No Data

03150 Global X Japan Global Leaders ETF

- 61.320

- +0.140+0.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Insights Into Sony Group's Upcoming Earnings

Profit-taking dominant near 0.04 million yen, but Trump trade continues.

The Nikkei Average fell. It ended trading at 39,381.41 yen, down 99.26 yen (with an estimated volume of 2.750 billion shares). In the U.S. market on the 6th, former President Trump, the Republican candidate, won the presidential election held on the 5th and the Republican Party secured a majority in the Senate in the federal congressional elections. Expectations are rising for Trump to push ahead with tax cuts and deregulation promised, leading to major stock indexes hitting record highs across the board. Following this trend, the Tokyo market opened with buying ahead, and the Nikkei Average stock price reached the opening price.

Daikin Industries - significant increase, positive impact leading to upward revision of full-year performance.

Sharp rise. The company announced its second quarter results the previous day, with operating profit for July-September reaching 131.2 billion yen, a 11.3% increase from the same period last year. This marks a turnaround from the profit decline in the first quarter to a double-digit increase. The full-year financial estimates have also been revised upward from the previous 425 billion yen to 428 billion yen, representing a 9.1% increase from the previous year. As the full-year consensus was previously below the company's plan, there seems to be a strong positive reaction. The main reason for the upward revision appears to be the yen depreciation in exchange rates.

Mitsubishi Heavy Industries, Yamazaki Baking, etc. (additional) Rating

Downgrade - Bearish Code Securities Company Formerly Changed After -------------------------------------- <2413> M3 IWAI Cosmo "B+" "B" <4549> Eiken Chemicals Mizuho "Buy" "Hold" Target Stock Price Change Code Stock Name Securities Company Formerly Changed After ----------------------------------------

SBI Securities (morning closing) Toyota Motor selling more, Disco buying more.

Sell Code Stock Name Trading Value (6146) Disco 47,225,555,880 (7011) Mitsubishi Heavy Industries 30,760,963,992 (6920) Laser Tech 28,041,555,350 (6857) Advantest 25,298,566,835 (7013) IHI 25,080,538,440 (1570) NEXT FUNDS Nikkei 225 Leveraged Exchange Traded Fund 2

November 7th [Today's Investment Strategy]

[FISCO Selected Stock] [Material Stock] Maiko <6787> 5600 yen (11/6) Engaged in printed circuit boards. The financial estimates for the fiscal year ending in March 2025 have been revised upward. Operating profit is expected to be 19 billion yen (an increase of 62.9% from the previous period). It has been raised by about 18% from the previous estimate. The sales of high value-added build-up boards have expanded significantly, in addition to improvements in productivity, cost reduction, and the impact of exchange rates, resulting in an upward revision. The year-end dividend is set at 40 yen. The previous estimate was 36 yen, and the year-end dividend for the previous period

Comments

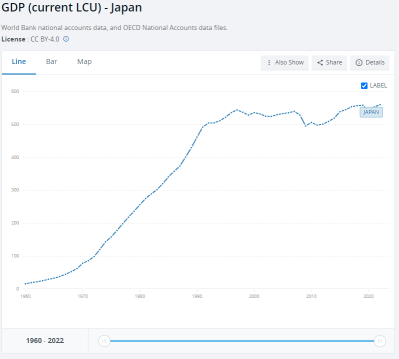

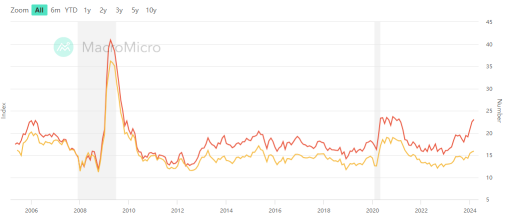

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...