No Data

03153 CSOP Nikkei 225 Index ETF

- 81.780

- -1.220-1.47%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

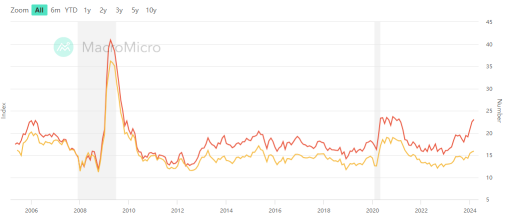

Trade Overview

Capital Trend

No Data

News

Profit-taking Sell is prevailing in response to the consecutive rise.

The Nikkei Stock Average fell for the first time in five days, finishing the trade at 39,470.44 yen, down 378.70 yen (estimated Volume 1.9 billion 90 million shares). In the previous day's US market, major stock price indices declined, and after recovering the significant 0.04 million yen mark the day before, profit-taking Sell orders were prioritized due to short-term overheating. Although there were some moments where prices slightly recovered due to Buy orders on dips, the failure to stay above the SQ value (39,434.85 yen) invited selling pressure, and there were instances where it dropped to 39,247.41 yen towards the end of the morning session.

The Nikkei average fell for the first time in five days, with a slight sense of accomplishment following the previous day's reach into the 40,000 yen range.

On the 12th, the US stock market fell. The Dow Inc average decreased by 234.44 dollars to 43,914.12 dollars, and the Nasdaq ended trading down 132.05 points at 19,902.84. Concerns over an unexpected acceleration in the November Producer Price Index (PPI) led to a decline after the opening. The Dow was pressured by selling due to unexpectedly weak employment-related indicators and the decline of managed healthcare company UnitedHealth, resulting in further declines. The Nasdaq fell amidst concerns over rising long-term interest rates. Towards the end, stocks.

NTT, Construction companies ETC [List of stock materials from newspapers]

*NTT <9432> commercialization of energy-saving Server, utilizing IOWN, suppressed to one-eighth (Nikkankogyo front page) - ○ *Mitsubishi Chem G <4188> revival of subsidiary president position, Mitsubish Chem will be concurrently held by Mr. Chikumoto, Tanabe Mitsubishi will have Mr. Tsujimura as president (Nikkankogyo page 3) - ○ *Lib Work <1431> and Teijin, strategic partnership, developing wooden Residences with few pillars and walls (Nikkankogyo page 3) - ○ *JDI <6740> collaborating with a US startup to develop high-resolution Thermal Sensor (Nikkankogyo page 3) - ○ *Seibu HD <9024> red P

A stance of buying on dips with an awareness of year-end highs.

[Stocks Opening Comment] The Japanese stock market on the 13th started with a slight Sell, but it seems to develop into a market where firmness is recognized. In the U.S. market on the 12th, the Dow Jones Industrial Average fell by 234 points, and the Nasdaq decreased by 132 points. The wholesale price index (PPI) for November exceeded market Financial Estimates. Since the previous day’s consumer price index (CPI) matched expectations, concerns about inflation reignited, leading to a prevailing Sell. However, the U.S. Federal Open Market Committee (FOMC)

Against the backdrop of rising U.S. tech stocks and a weaker yen, it temporarily recovered to the 0.04 million yen level.

The Nikkei average rose significantly for the fourth consecutive day, closing at 39,849.14 yen, up 476.91 yen (Volume approximately 1.9 billion 30 million shares). Since the previous day's USA market was driven by buying in technology stocks, buying started off strongly, and in the mid-morning session, it rose to 40,091.55 yen, recovering the important level of 0.04 million yen for the first time since October 15. Additionally, the yen exchange rate depreciated to 152 yen to the dollar, which was also favorable for export-related stocks.

Yokan HD, Casio, ETC (additional) Rating

Upgraded - Bullish Code Stock Name Brokerage Firm Previous After ------------------------------------------------------------- <3291> Iida GHD Morgan Stanley "Underweight" "Equal Weight" <9021> JR West Japan SMBC Nikko "3" "2" <9502> Chubu Electric Mizuho "Hold" "Buy" Downgraded - Bearish Code Stock Name Brokerage Firm Previous After ------------------------

Comments

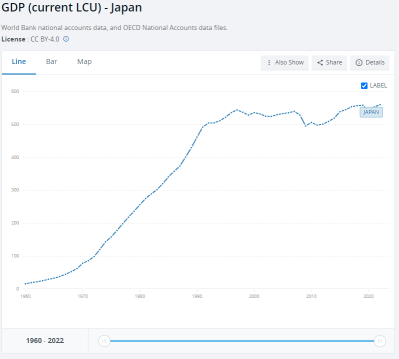

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...