No Data

03153 CSOP Nikkei 225 Index ETF

- 79.000

- -0.620-0.78%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

From semiconductors to software, bright and dark sides due to tariff risks.

In the high-tech stock sector in the past month, there has been a significant shift in trends. It has been reported that there is a decline in the popularity of semiconductors, and instead, software is attracting attention. In the USA, concerns revolve around the high valuations and the risk of trade wars under the upcoming Trump administration, leading to an outflow of money from semiconductor stocks. It is reported that software stocks are riding high on the tailwind of artificial intelligence (AI). <6702> Fujitsu

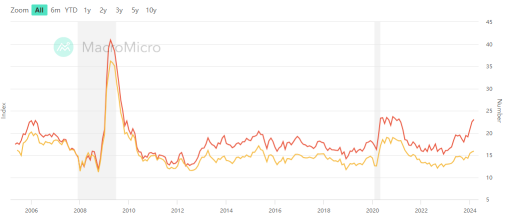

Risk aversion stance due to caution about Trump's tariff policy.

The Nikkei average fell after 3 business days. It ended trading at a decrease of 338.14 yen to 38,442.00 yen (with an approximate volume of 1.9 billion shares traded). Amid reports of additional tariffs on China by the upcoming US President Trump, risk aversion intensified. The Nikkei average sharply declined right after the opening, approaching the psychological milestone of 38,000 yen in the mid-morning session at 38,020.08 yen. Subsequently, due to buying back movements against the steep decline, the losses narrowed by the closing bell. Tokyo Stock Exchange Pla

Limited buying aimed at a one-step rise from 39,000 yen.

The Nikkei Average continued to rise significantly. It closed the trading at 38,780.14 yen, up 496.29 yen (volume approximately 2.74 billion shares), with buying leading across a wide range of stocks against the backdrop of positive economic indicators and the previous week's strong performance in US stocks. The Nikkei Average extended its gains to 39,053.64 yen around the midpoint of the morning session, recovering the key level of 39,000 yen for the first time in 6 trading days since the 15th. However, achieving the psychological milestone may lead to a sense of accomplishment in the short term, with subsequent selling on the sidelines waiting for a pullback.

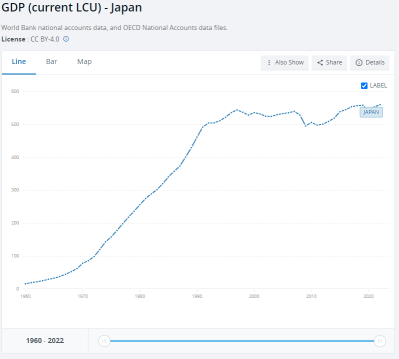

Is Japan's Nikkei 225 Still a Bargain?

Japan's Coincident Index Rises, Leading Indicators Revised Down

Nissho, Nichias etc (additional) Rating

Upgraded - bullish Code Stock Name Brokerage Firm Previous Change After -------------------------------------------------------------- <4967> Kobayashi Pharmaceutical Mizuho "hold" "buy" <6481> THK City "2" "1" <7186> Concordia JPM "Neutral" "OverW" <7202> Isuzu Mizuho "hold" "buy" Downgraded - bearish Code Stock Name Brokerage Firm Previous Change After -----

Comments

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...