No Data

03160 ChinaAMC MSCI Japan Hedged to USD ETF

- 21.360

- -0.140-0.65%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The resilience of Semiconductors-related stocks provides support.

The Nikkei average fell, closing at 39,981.06 yen, down 102.24 yen (with an estimated Volume of 1.8 billion and 50 million shares) in Trade. Influenced by the drop in tech stocks in the previous day's USA market, selling started initially, and shortly after the beginning of Trade, it dropped to 39,705.81 yen. However, after the selling subsided, Semiconductors stocks rebounded, and the exchange rate temporarily shifted to a weaker yen at around 158 yen per dollar, leading to a subsequent slow-down in the decline. Additionally, USA stock Futures remained stable.

Advante, Ryohin Keikaku ETC (additional) Rating

Upgraded - Bullish Code Stock Name Securities Company Previous Change After ------------------------------------------------------------ <6506> Yaskawa Electric Morgan S "Underweight" "Equal Weight" <7167> Mebuki FG JPM "Neutral" "Overweight" Downgraded - Bearish Code Stock Name Securities Company Previous Change After ----------------------------------------

Kyocera Corporation Sponsored ADR, Toyota, ETC [List of stock-related materials from the newspaper]

*Kyocera Corporation Sponsored ADR <6971> will start mass production of a new electronic mirror next year, providing clear imagery from rear automotive cameras (Nikkankogyo 1st page) - ○ *Toyota <7203> Woven City will open this autumn, with Chairman Toyoda saying, 'Welcome companions from around the world' (Nikkankogyo 1st page) - ○ *Sony Group Corp <6758> Sony-Honda Mobility has begun accepting reservations for a new EV at 14 million yen, with deliveries expected next mid-year (Nikkankogyo 1st page) - ○ *Panasonic HD <6752> PanaEnergy is expanding its power supply for DC aimed at North America, expecting revenue of 250 billion yen by fiscal 2030 (Nikkankogyo 1st page) - ○

Assessing the resilience of high-tech stocks after the sell-off.

[Stocks Opening Comment] On the 8th, the Japanese stock market is likely to be influenced by profit-taking actions following the significant rise the previous day. On the 7th, the USA market saw the Dow Jones Industrial Average drop by 178 points, and the Nasdaq fell by 375 points. The JOLTS job openings number for November 2024 and the ISM non-manufacturing index for December exceeded expectations, leading to increased inflation concerns and speculation about a slowdown in the Federal Reserve's rate cut pace, which weighed on the market, causing an increase in long-term interest rates in the USA. Chicago Nikkei

Against the backdrop of rising US high-tech stocks, a recovery to the milestone of 0.04 million yen.

The Nikkei Average significantly rebounded, ending the trade at 40,083.30 yen, a rise of 776.25 yen (estimated Volume of 1.9 billion 60 million shares), recovering the significant level of 0.04 million yen for the first time in three trading days since December 27 of last year. In the previous day's USA market, semiconductor stocks, particularly major players like NVIDIA and Micron Technology Inc, were primarily bought. Following this trend, high-tech stocks with substantial index impacts led the way, pushing the Nikkei Average up to 40,288.80 yen before the midday break.

Japan Steel, Shizuoka FG, ETC (additional) Rating

Downgrade - Bearish Code Stock Name Securities Company Previous Change After----------------------------------------------------------------<4626> Taiyo HD Morgan Stanley "Overweight" "Equal Weight" Target Price Change Code Stock Name Securities Company Previous Change After----------------------------------------------------------------<

Comments

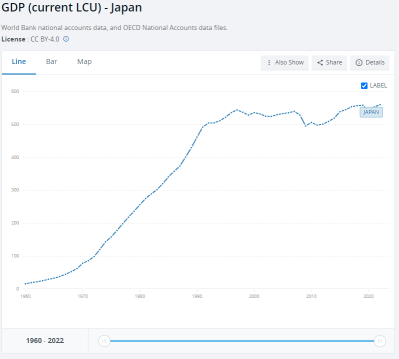

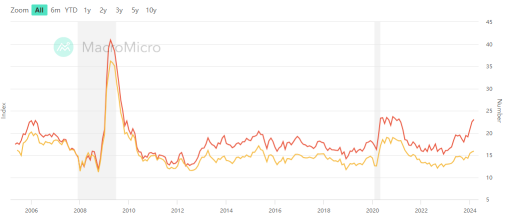

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...