No Data

03172 Samsung Asia Pacific ex NZ Metaverse Theme ETF

- 17.150

- -0.030-0.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

A year-on-year increase of 32%! Global electric vehicle sales have set historical highs for three consecutive months, with China accounting for 70% of the market.

The performance of the China market is impressive, with sales in November growing by 50% year-on-year to reach 1.27 million vehicles, accounting for about 70% of Global total sales. Overall Auto sales in China for November increased by 16.6% compared to the previous year, marking the highest growth rate since January this year. BYD is expected to exceed the annual Global sales target and surpass Ford and Honda.

Who might be the supplier for the Xiaomi YU7?

Xiaomi Autos is once again making waves in the automotive circle! The first SUV model, YU7, has been officially announced, and is expected to be launched in mid-2025. Xiaomi is ambitious and has raised its annual sales target to 120,000 units after completing a delivery volume of 100,000 units ahead of schedule. In a Research Report released on the 12th, UBS Group predicts that with the addition of the new model YU7 and the enhancement of production capacity, total sales of Xiaomi Autos in 2025 are expected to double to 260,000 units. The supply chain for the YU7 is gradually coming to light. UBS Group believes that companies such as Topband, FUYAO GLASS, Minth, Huayang, NEXTEER, and Keboda Technology are likely to become partners of Xiaomi, providing components for the YU7.

The Nikkei Average has risen for three consecutive days, showing strong movement with stable financial stocks.

On the 10th, the U.S. Stocks market fell further. The Dow Inc average decreased by 154.10 points, closing at 44,247.83 dollars, while the Nasdaq ended down 49.45 points at 19,687.24. With a lack of materials, buying and selling fluctuated after the opening, resulting in mixed outcomes. The Dow was pressured by selling due to caution at high prices, leading to a soft trend throughout the day. The Nasdaq was briefly boosted by Alphabet's rise, but selling due to concerns over high interest rates, along with drops in Oracle Corp and Semiconductors company NVIDIA, contributed to its decline.

Continuing to fluctuate within the range of 39,000 to 39,500 yen.

The Nikkei average continued to rise, closing at 39,367.58 yen, up 207.08 yen (estimated volume of 1.7 billion shares). As the yen weakened to 151 yen per dollar, buying was led by export-related stocks, and the Nikkei average rose to 39,465.14 yen shortly after the opening. However, just before the psychological barrier of 39,500 yen, selling by those waiting for a rebound and profit-taking was evident, leading to some softening, with the index struggling to maintain its level, dipping to 39,171.69 yen towards the end of the morning session. In the afternoon session, semiconductor-related stocks...

Lei Jun wants to dethrone the Model Y.

There is still a need to overcome the capacity challenges.

Active and newly listed stocks during the morning session.

*Learning situation <2301> 2006 +231 results exceeded expectations in the previous period, with a forecast of double-digit operating profit growth for this period. *Topcon <7732> 1928 +171.5 reported to have entered the bidding process for privatization. *Nippon Paint Holdings <4612> 1093 +63 SMBC Nikko Securities has raised its target stock price. *Nippon Sheet Glass <5202> 349 +20 it is reported that they aim to release automotive glass materials from leftover materials by 2026. *Saizeriya <7581> 5820 +280 middle.

Comments

$BIDU-SW (09888.HK)$ $Baidu (BIDU.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Samsung Electronics Co., Ltd. (SSNLF.US)$ $Samsung Asia Pacific ex NZ Metaverse Theme ETF (03172.HK)$

https://youtu.be/IZmx4FOatrU?si=HQWLoO0muj6e6xrg If own NVTS, great. If you don’t own. Maybe it’s time to built a position. Samsung $Samsung Asia Pacific ex NZ Metaverse Theme ETF (03172.HK)$ $Samsung Electronics Co., Ltd. (SSNLF.US)$ already sign a deal to use the Gan Technology to built fast chargers for there products like phones, earbuds, tablets etc. Will we see others use this technology? I think so!

$Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Meta Platforms (META.US)$ $NVIDIA (NVDA.US)$

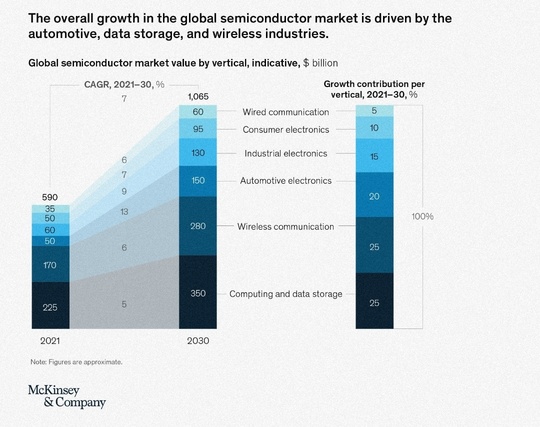

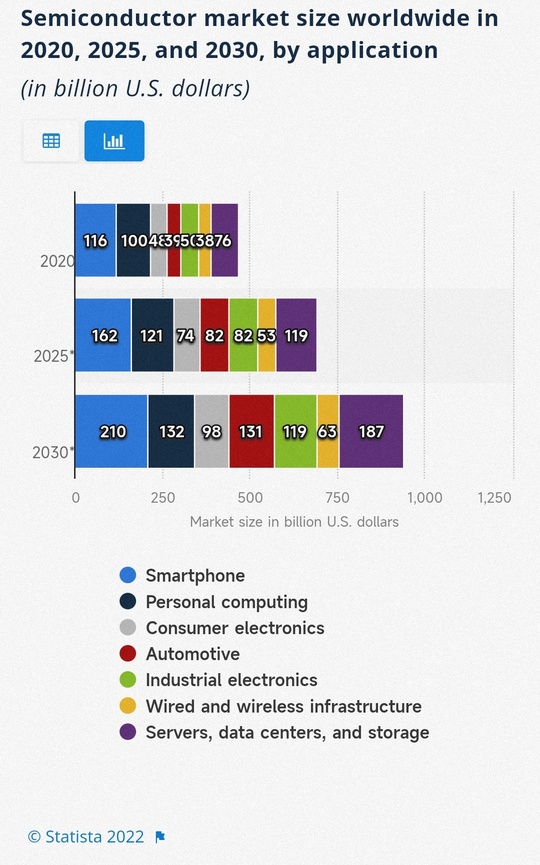

The amount of semiconductors and chips which are used for personal computing is not as significant as before and its proportion and margins could decrease, the decline might not affect the market as much as proclaimed by the article.