No Data

03188 ChinaAMC CSI 300 Index ETF

- 43.300

- -0.320-0.73%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

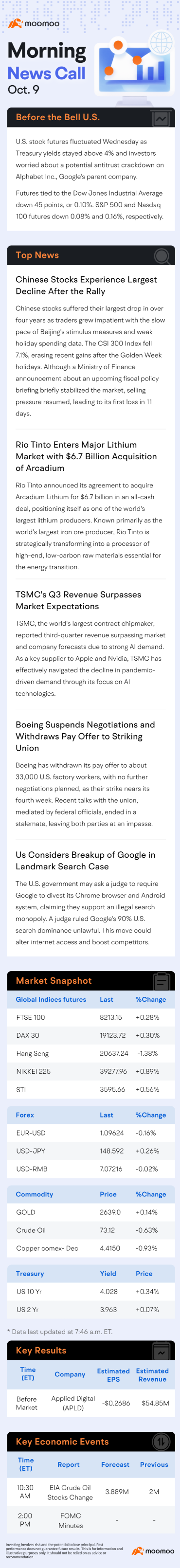

Hong Kong stock morning news | Trump sends signals about tariff exemptions; Xiaomi plans to raise approximately 42.5 billion Hong Kong dollars through a placement.

① Trump has stated that he will announce additional tariffs on Autos, timber, and chips; there may be exemptions for tariffs on multiple countries. ② Trump again calls for the Federal Reserve to lower interest rates; Federal Reserve's Bostic stated that the inflation rate will not return to 2% before early 2027. ③ The three major U.S. stock indices collectively rose, while China Concept Stocks remained lukewarm. ④ The central bank's MLF operation was adjusted to multiple price level bidding, marking a net injection after eight months.

The Chinese market is booming! Three bullish factors have led to a fundamental shift in the views of global investors.

① The Chinese market has recently attracted a large number of overseas investors due to DeepSeek and government stimulus measures, driving market activity; ② Data shows that the total issuance amount of stocks by Chinese companies in the first quarter reached 16.8 billion USD, a year-on-year increase of 118%; ③ Investment bankers point out that favorable policies, innovation, and appropriate valuations will continue to attract overseas investors, and the global perspective on the Chinese market has undergone a fundamental change.

Foreign investors are optimistic about China Stocks: there is definitely still room for growth!

On March 24, the Milken Institute Global Investors Conference was held in Hong Kong, where several investors believed that Stocks in China have more room for growth; Oliver Weisberg, CEO of Blue Pool Capital, stated that foreign investors have increased their investments in Hong Kong, and the Hong Kong stock market is expected to return to its rightful position.

Express News | Jack Ma-backed, Ant Group Co., utilized semiconductors manufactured in China to create methods for training AI models, resulting in a 20% reduction in costs, according to sources (Bloomberg)

Brokerage Morning Meeting Highlights: Focus on low positions + resilience in the economic outlook during the consolidation period.

At today's Brokerage morning meeting, HTSC believes that the solidifying period should focus on low positions and resilient market directions; Everbright stated that downstream demand for organic silicon is steadily increasing, and the supply-demand pattern in the Industry is expected to improve; GTJA proposed that the enthusiasm for the Spring Sugar Hotel Exhibition has decreased, and the sales of Baijiu after the festival are stable.

Hong Kong Stock Morning Report|Our country will implement comprehensive measures to expand consumption. Most China Concept Stocks are down.

1. The country will implement comprehensive measures to expand consumption; the new policy on consumer loans allows for the personal consumption loan self-payment cap to be increased from 0.3 million yuan to 0.5 million yuan in stages. 2. Trump and the U.S. Secretary of Defense made speeches stating that Russia and Ukraine will soon achieve a complete ceasefire. 3. The three major U.S. stock indices rose last Friday, while most China Concept Stocks declined. 4. Speculative traders have shifted to Put the dollar for the first time since Trump's victory.

Comments

Firstly, you might be asking yourself is it too late to invest? The answer is ...