No Data

03188 ChinaAMC CSI 300 Index ETF

- 41.400

- -0.160-0.38%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

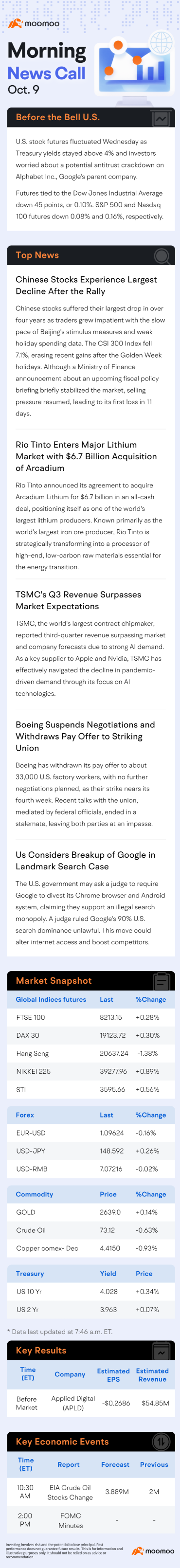

Hong Kong stock morning report on January 8: The Ministry of Industry and Information Technology is conducting a trial for 10G optical networks; Mixue Ice City has obtained registration from the China Securities Regulatory Commission for its Hong Kong IPO

① The State Council: Venture Capital Funds should focus on developing new quality productive forces. ② Ministry of Industry and Information Technology: Launching pilot projects for 10-gigabit optical networks. ③ Apple's spring "budget version" iPhone new model will start mass production in mid-January 2025. ④ Mi Xue Bing Cheng's Hong Kong IPO has been filed with the China Securities Regulatory Commission.

Selected announcement | POLY PROPERTY's contract sales for 2024 reached 54.2 billion yuan; WUXI BIO plans to sell its Ireland vaccine factory for 0.5 billion USD.

In 2024, Poly Real Estate's contracted sales exceeded 54 billion yuan; TRULY INT'L's annual operating net profit increased by over 10% year-on-year.

The ranking of Global automotive companies by Market Cap has undergone a "huge change": 21 Chinese automotive companies have made it into the TOP 50, with Xiaomi and BYD ranked third and fourth respectively.

①Tesla and Toyota still rank first and second; ②BYD, which previously held the third-largest position in the Global automotive market with a Market Cap of 107.84 billion USD, was surpassed by Xiaomi, which officially entered the Autos market in 2024 and was still outside the top 10 midway through the year; ③Chongqing Sokon Industry Group Stock, which is deeply tied to Huawei, ranks fourth among Chinese automotive companies after Xiaomi, BYD, and SAIC Group.

Kweichow Moutai's 2024 performance has "initially submitted": annual growth exceeds 15%, and Moutai's base liquor has reduced production for the first time.

Response cycle.

Hong Kong stock market morning report on January 3: GTJA's merger application with HAITONG SEC will be discussed next week. Institutions expect that Hong Kong stock IPO fundraising could reach 160 billion Hong Kong dollars in 2025.

① PwC predicts that Hong Kong stock IPO fundraising could reach 160 billion Hong Kong dollars in 2025. ② GTJA's merger application with HAITONG SEC will be discussed next week. ③ Alibaba's buyback plan still has a remaining quota of 20.7 billion US dollars. ④ Last November, Hong Kong's retail sales volume decreased by 8.3% year-on-year.

Moutai liquor production cuts? Individuals close to Kweichow Moutai: last year's production remained within a normal and orderly Range | Quick read announcement.

In 2024, Kweichow Moutai plans to produce approximately 0.0563 million tons of Moutai liquor, a decrease of 1.58% year-on-year. Last year, increased marketing investments in the Moutai series of liquors and the higher proportion led to a decline in the company's overall net margin, which may have fallen below 50% last year, reaching the lowest level since 2018. Amid soft stock prices, Kweichow Moutai officially initiated a buyback, with nearly 0.3 billion yuan repurchased on the first day.

Comments

Firstly, you might be asking yourself is it too late to invest? The answer is ...