No Data

03188 ChinaAMC CSI 300 Index ETF

- 43.120

- -0.900-2.04%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

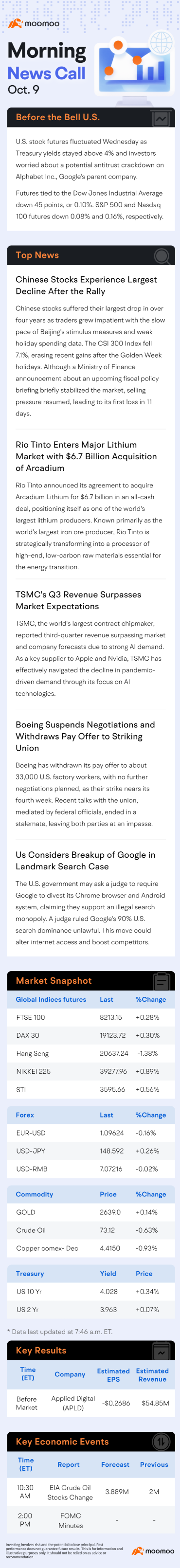

3 listed insurance companies flex their muscles! The China Life, New China Life, and Ping An collectively distribute a mid-term dividend of 17.252 billion yuan, with the highest dividend yield reaching 15.2%.

① Ping An Insurance distributed cash dividends of 9.914 billion yuan, accounting for 13.29% of the mid-term attributable net income; ② New China Life Insurance distributed cash dividends of 1.685 billion yuan, accounting for 15.2% of the mid-term attributable net income; ③ New China Life Insurance distributed cash dividends of 5.653 billion yuan, accounting for 14.77% of the mid-term attributable net income.

Goldman Sachs A-shares 2025 Heavyweight Strategy Outlook: Domestic funds will grasp pricing power! Overweight A-shares before H, industry focus on consumer stocks!

Goldman Sachs believes that compared to Hong Kong stocks, A-shares are more sensitive to policy easing and personal investment capital flows. The first quarter of next year will be a better time to allocate to Hong Kong stocks. In terms of sectors, analysts recommend that investors pay attention to themes such as consumer, emerging markets exporters, specific new technologies, and shareholder return strategies.

Taking the lead independently, with foreign investment closely following; range-extended hybrid technology sweeping the global market.

①On November 20 local time, Stellantis Group announced the launch of the STLA Frame vehicle platform. ② Stellantis Group introduced that vehicles equipped with this platform will first be equipped with innovative powertrains, including pure electric and extended-range, and in the future can also be equipped with internal combustion engines, hybrid power, and hydrogen energy power systems.

Is the lithium battery industry chain about to bottom out? Insiders predict that prices are expected to rebound next year, with industry leaders emphasizing global layout | Exclusive coverage of the High Work Lithium Battery Annual Conference.

① At the 2024 High-tech Lithium Battery Annual Conference held yesterday, Zhang Xiaofei, chairman of High-tech Lithium Battery, predicted that the first quarter of next year will be the lowest price point, and in the second quarter of next year, the prices of battery raw materials will begin to rise; ② The future industry will face a more severe competitive landscape and capacity thresholds, and the solution offered by leading enterprises is to expand overseas.

gtja: How will the Hong Kong stock market perform after the usa election?

After Trump takes office as president of the usa in 2025, China-US trade may continue to negotiate. Unlike 2018, the Hong Kong stock market has currently priced in, and compared horizontally, the valuation level of the Hong Kong stock is at a low point.

Last week, overseas funds accelerated inflow into Hong Kong stocks. Institutions stated that a "policy window" may be approaching in the near future.

①How much does external liquidity affect the Hong Kong stock market? ②What are the current hold positions strategies for Hong Kong stocks?

Comments

Firstly, you might be asking yourself is it too late to invest? The answer is ...