No Data

03333 EVERGRANDE

- 0.163

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

According to the Central Finger Research Institute: In November, the average transaction price of second-hand Residences in 100 cities fell by 0.57% month-on-month, while the Volume in Shenzhen doubled year-on-year.

Data monitoring shows that in November 2024, the average price of second-hand Residences in 100 cities is 14,278 yuan per square meter, a month-on-month decrease of 0.57%, narrowing the decline by 0.03 percentage points compared to October; a year-on-year decrease of 7.29%.

Keari Real Estate Research: In November, the Residence market transactions maintained a high level for the year.

In November, the supply scale grew month-on-month and year-on-year, with the supply volume in 100 typical cities at 15.07 million square meters, a year-on-year decrease of 26.3%, but a month-on-month increase of 43.4%.

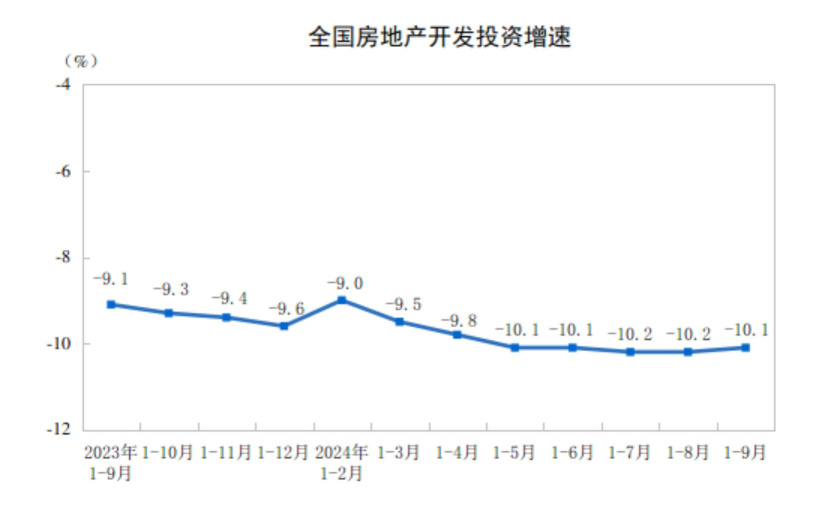

Statistics Bureau: From January to November, national Real Estate Development investment decreased by 10.4% year-on-year.

Today, the National Bureau of Statistics released data showing that from January to November, national Real Estate Development investment was 9363.4 billion yuan, a year-on-year decrease of 10.4%; among which, Residence investment was 7119 billion yuan, a decrease of 10.5%.

CITIC SEC: The policy framework continues in 2025, with increased policy support helping the Real Estate sector stabilize and rebound.

In the medium to long term, China's real estate market has a broad base of genuine demand, and the supply-side reform has basically been completed, providing a promising development prospect for high-quality Real Estate Development companies.

Hong Kong stocks move | Mainland real estate stocks opened higher across the board. The Political Bureau meeting emphasized to "stabilize the real estate market," and policies for both supply and demand in real estate are expected to increase.

Mainland real estate shares opened higher across the board. As of the time of writing, sunac (01918) rose 13.84% to HKD 3.29; ronshinechina (03301) rose 13.73% to HKD 0.58; radiance hldgs (09993) rose 12.65% to HKD 3.74.

Standard Chartered: It is expected that the Federal Reserve will cut interest rates by 125 basis points from the current period to the third quarter of next year. The housing market in Hong Kong is expected to stabilize in an L-shaped manner next year.

Although the usa's interest rate cut is slower than expected in both magnitude and speed, Hong Kong silver has reacted quite quickly to follow the usa's interest rate cut, hence it is expected that the real estate market will stabilize in an L-shaped manner next year.

Comments

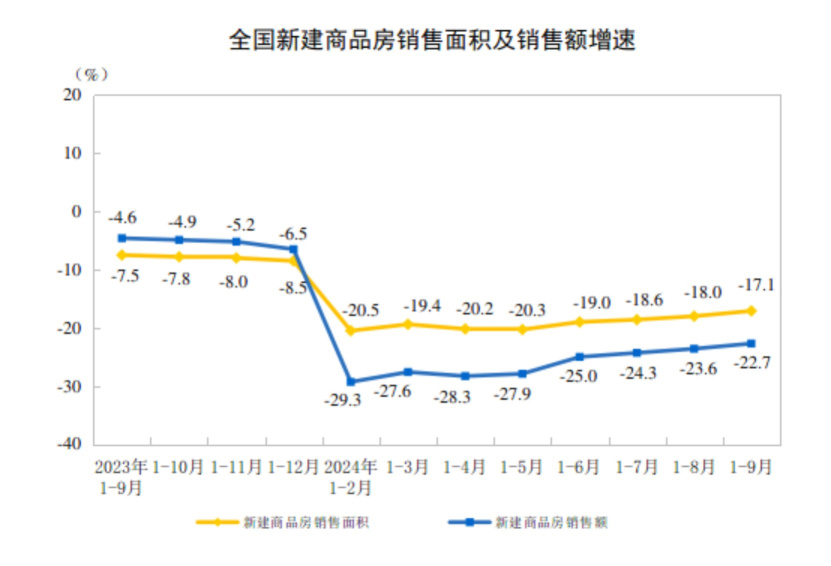

2⃣Residential housing sales areas decline narrowed to -17.1% y/y at 703 million square meters, and the total sales down by 22.7% y/y to 6.89 trillion yuan. (narrowed)

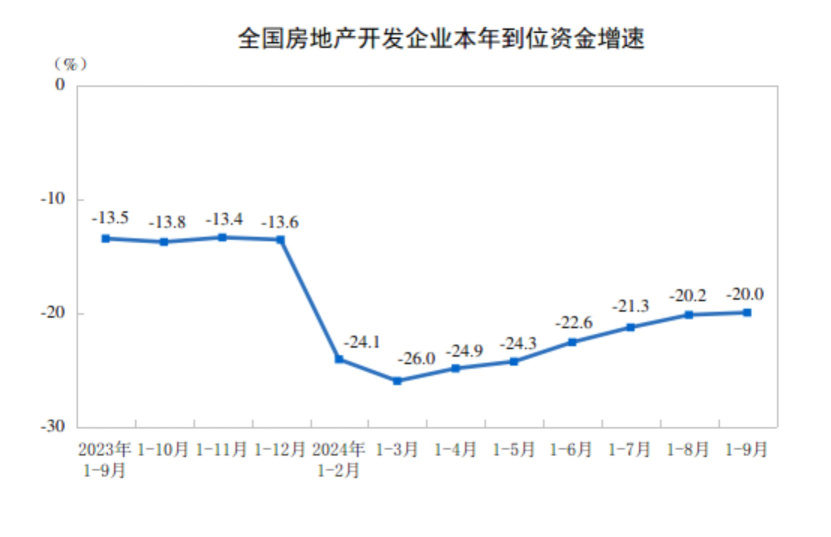

3⃣Developing funds in place down 20.0% y/y(narrowed) to 7.89 trillion yuan.

4️⃣Sentiment 92.41

$LONGFOR GROUP (00960.HK)$ $CG SERVICES (06098.HK)$ $AGILE GROUP (03383.HK)$ $EVERGRANDE (03333.HK)$

ALL CHINA SEPT NEW HOME PRICES -0.7% M/M (AUG -0.7%), -5.8% Y/Y (AUG -5.3%). STABILIZED M/M, WITH Y/Y DECLINES WIDENING.

HOME PRICES FELL M/M IN 66 OF 70 CITIES VS. 67 IN AUG, FELL Y/Y IN 68 CITIES, VS 68 IN AUG.

$CG SERVICES (06098.HK)$ $LONGFOR GROUP (00960.HK)$ $EVERGRANDE (03333.HK)$ $AGILE GROUP (03383.HK)$

2) Increase in credit for "white-listed" projects to 4 trillion yuan by year-en...

$NASDAQ Golden Dragon China (.HXC.US)$ $LONGFOR GROUP (00960.HK)$ $EVERGRANDE (03333.HK)$ $CG SERVICES (06098.HK)$