No Data

06100 TONGDAO LIEPIN

- 2.550

- +0.100+4.08%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

miniso's third-quarter revenue increased by about 20% and tongdao liepin's profit in the first nine months increased by approximately 126% year-on-year|Selected announcements from Hong Kong stocks on November 29.

① miniso's revenue in the third quarter increased by about 20%, how has the overall performance been this year? ② tongdao liepin's profits increased by about 126% year-on-year in the first nine months, what factors drove this?

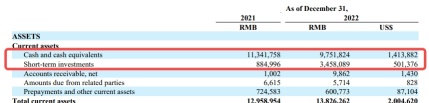

Tongdao Liepin Group Invests in Wealth Management Products

tongdao liepin (06100.HK) subscribed to a structured deposit product worth 0.1 billion yuan

Gelonghui announced on November 29 that Tongdao Liepin (06100.HK) subscribed to a principal of 100 million yuan in a structured deposit product (linked to exchange rates, three-tier range A) for the 2024551821129 period through its wholly-owned subsidiary Tongdao Elite (tianjin) Information Technology Co., Ltd. on November 29, 2024. The subscription was funded by the group's surplus cash reserves and the redemption principal from the structured deposit product purchased on October 31, 2024, from Xiamen International Banks.

Express News | Tongdao Liepin - Unit Subscribed for 2024551821129 Corporate Structured Deposit Product for RMB100.0 Mln

Profitability steadily improved, three major highlights driving the valuation repair of tongdao liepin (06100).

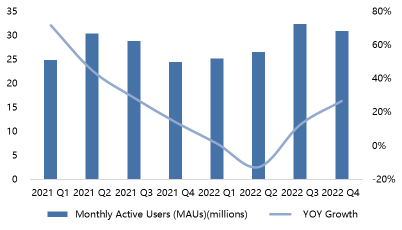

Tongdao Liepin released its Q3 performance for 2024, achieving revenue of 0.503 billion yuan and net income for shareholders of 0.046 billion yuan, a year-on-year increase of 43.6%. In the first three quarters, revenue reached 1.517 billion yuan and net income for shareholders amounted to 0.091 billion yuan, marking a year-on-year growth of 126.6% and a significant improvement in profitability.

Tongdao Liepin (06100.HK) reported a 136.6% year-on-year increase in net profit for the first three quarters, with continued growth in user activity, and AI applications assisting in market expansion.

As of September 30, 2024, Tongdao Liepin (06100.HK) announced that for the nine months ended on September 30, 2024, the main revenue came from providing talent acquisition and other human resource services to corporate clients and providing talent development services to individual users, totaling 1.51 billion yuan in revenue, with a gross profit of 1.177 billion yuan, and a net profit of 0.126 billion yuan, a year-on-year increase of 136.6%; the net profit attributable to equity shareholders of the company was 91.3 million yuan, a year-on-year increase of 126.6%. As of September 30, 2024, the registered individual users had reached 0.1034 billion.

Comments

Tongdao Liepin Group's (HKG:6100) 32% Share Price Plunge Could Signal Some Risk

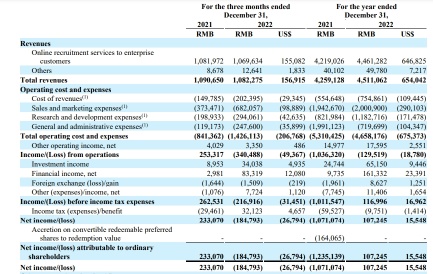

Tongdao Liepin Group's (HKG:6100) 32% Share Price Plunge Could Signal Some RiskKANZHUN's 22Q4 revenue was 1.0823 billion yuan, a slight decline of less than 1% year-on-year. The revenue in 2022 will be 4.511 billion yuan, YoY+5.9%, slightly exceeding market expectations, reflecting that the company still maintains a certain degree of competitivene...

Analysis

Price Target

No Data

No Data