No Data

06862 HAIDILAO

- 14.020

- -0.220-1.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

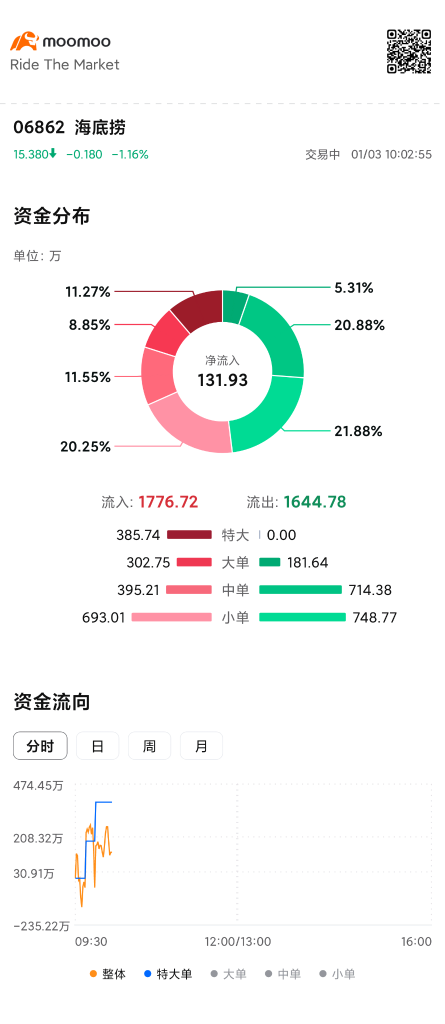

Capital Trend

No Data

News

[Brokerage Focus] CITIC SEC believes that the likelihood of further intensification of the Dining price war is relatively low.

Golden Owl Financial News | CITIC SEC stated that under a low base, the growth rate of dining retail began to rebound since October 2024, increasing from about 3% to about 4%, while the number of dining stores remains in a downward trend on the supply side. From the data of listed companies, price pressure has eased and customer flow shows signs of stabilizing. The same-store sales decline in 24Q4 is expected to stabilize overall, while HAIDILAO shows a decline due to a high base but remains relatively stable compared to the first and second half of the year. Leading companies in segmented tracks have taken the lead in adjusting prices, which the company believes reflects a certain degree of stabilization in overall competition, while the marginal impact of the low stock price strategy in stimulating customer flow has weakened, possibly intensifying the price war further.

Jefferies Adjusts Haidilao International Holding's Price Target to HK$14.20 From HK$14, Keeps at Hold

Nomura Adjusts Haidilao International's Price Target to HK$16.30 From HK$15.10, Keeps at Buy

Haidilao Could Post Solid 2H Profit Growth -- Market Talk

[Brokerage Focus] Jianyin International cuts HAIDILAO (06862) Target Price by 5.6%, expects a low single-digit decline in same-store sales in the second half of last year.

Jinwu Financial News | Jiayin International's research report indicates that considering the sluggish customer traffic, the sales growth forecast for HAIDILAO (06862) in the second half of 2024 has been revised down from an increase of 15% to a decline of 3%. Supported by a large customer flow during the summer vacation, sales achieved a single-digit growth, but the growth momentum slowed down afterwards, turning negative by mid-October and continuing until early December. It is expected that same-store sales (SSS) in the second half of 2024 will experience a low single-digit decline year-on-year, as customer traffic is expected to decrease by about 8%. In addition, the firm also expects the turnover rate of HAIDILAO to drop from 4.3 times in the second half of 2023 to 2024.

Hong Kong stocks show unusual movement | Dining stocks warmed up in the morning as multiple regions started a new round of Consumer voucher distribution. The Dining Sector benefits directly and has considerable recovery elasticity.

Dining stocks warmed up in the morning session. As of the time of writing, JIUMAOJIU (09922) is up 3.99%, priced at 2.87 Hong Kong dollars; HAILENSI (09869) is up 3.03%, priced at 2.04 Hong Kong dollars; DPC DASH (01405) is up 2.89%, priced at 74.7 Hong Kong dollars; HAIDILAO (06862) is up 2.14%, priced at 14.3 Hong Kong dollars.

Comments

103725026 : Sell it now.

103725026 : Already bought it.