No Data

09626 BILIBILI-W

- 154.200

- -7.500-4.64%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Shares of US-listed Chinese Stocks Are Trading Lower Due to Stimulus Concerns and Disappointing Economic Data. The Biden Administration Plans to Raise Tariffs on Solar Wafers, Polysilicon and Some Tungsten Products.

Express News | Shares of US-listed Chinese Stocks Are Trading Lower Due to Stimulus Concerns and Disappointing Economic Data. The Biden Administration Plans to Raise Tariffs on Solar Wafers, Polysilicon and Some Tungsten Products

The Nasdaq fell to 0.02 million points, Adobe plummeted more than 13%, the China concept Index rose against the trend, and Bitcoin dropped below 0.1 million dollars.

In November, USA PPI inflation exceeded expectations, with the market betting on a pause in interest rate cuts in January next year. The Dow has fallen for six consecutive days, with NVIDIA experiencing the largest drop of 2.5%. Tesla, Meta, Google, and Amazon have moved away from their highs, uranium mining stocks have declined, but Apple reached a new high. Broadcom rose nearly 5% in after-hours trading, and Chinese stocks Baidu and PDD Holdings increased by over 1%. Bond yields in Europe and the USA have risen significantly, and after the European Central Bank cut interest rates, the euro fell to a one-week low, before rebounding. The dollar reached a two-week high, while the offshore yuan once rose over 200 points, breaking through 7.26 yuan. Commodities generally fell, with spot gold down over 2% and spot silver down over 4% during the session.

China to Lift Fiscal Spending to Boost Economy

Bilibili-W (09626.HK) spent 0.8431 million USD on December 11 to repurchase 0.0423 million shares.

Gelonghui announced on December 12 that Bilibili-W (09626.HK) stated that on December 11, 2024, the company spent 0.8431 million USD to repurchase 0.0423 million shares, with a repurchase price per share of 19.79-19.99 USD.

The NASDAQ broke through 0.02 million points for the first time, Tesla led a group of tech giants to a new high, and Bitcoin climbed to 0.1 million dollars

The Dow and Apple fell, the Nasdaq rose nearly 2%, Tesla and Google rose nearly 6%, while Meta, Amazon, and Netflix all reached new highs. NVIDIA rose over 3%, Broadcom rose nearly 7%, Super Micro Computer once dropped over 8%, the decline of Chinese concepts narrowed, and Fangdd Network turned to rise over 11%. The U.S. November CPI confirms interest rate cut bets for next week, with a pause on rate cuts expected in January next year. The dollar and U.S. Treasury yields rebounded in a V-shape, while spot Gold reached its highest level in five weeks. The yen plunged below 152, while the offshore yuan once dropped over 300 points, falling below 7.29 yuan. After a significant interest rate cut by the Bank of Canada, the Canadian dollar and Canadian bond yields turned to rise, and oil prices increased by about 2%.

Comments

Cut LPR by 35bps to 3.1%

Cut interbank rates 8bps to 1.744%

Approved $1.4T in additional debt

Approved $1.4T in local govt debt swap

Approved $838B in additional local govt debt issuance

Cut rates on $5.3T of outstanding mortgages

Reduced the downpayment on new and 2nd hand home purchases from 25% to 15%

Approved tens of billions in loans to financial institutions and listed firms for share buybacks

Yes, they have been working to stimulate ...

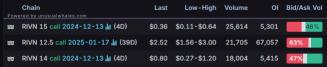

1. $Rivian Automotive (RIVN.US)$ shares surged 11% in Monday's trading, with the most traded calls are contracts of $15 strike price that expire on Dec. 13. The total volume reaches 25,614 with the open interest of 5,301.

Benchmark analyst Mickey Legg initiated coverage on the stock with a Buy rating and $18 price target. Legg believes Rivian can attract more custo...

Business Data

No Data