No Data

09696 TIANQI LITHIUM

- 24.150

- -0.150-0.62%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Should You Think About Buying Tianqi Lithium Corporation (SZSE:002466) Now?

Wanlian Securities: The industrialization of Solid State Battery is accelerating, and the future market space is vast.

The industrialization of Solid State Battery is accelerating, with material systems iterating, which is expected to drive the upgrade of the lithium battery Industry Chain.

Lithium stocks are under pressure, GANFENGLITHIUM (01772) fell by 4.65%, and Institutions indicate that lithium prices may be difficult to maintain recent highs.

Jingu Financial News | Lithium stocks are under pressure, as of the time of publication, GANFENGLITHIUM (01772) is down 4.65% and Tianqi Lithium Corporation (09696) is down 3.21%. In terms of news, Daiwa Capital Markets stated in a research report to clients that the Global lithium supply is expected to grow by 12-28% from 2025 to 2026 due to increased production in key regions such as Argentina, Australia, and Africa. However, the team warned that due to oversupply, lithium prices may still face pressure. Currently, China's LCE (lithium carbonate

Hong Kong stocks are moving differently | Lithium stocks fell in early trading, Rio Tinto expanded its production capacity in Argentina, and Institutions expect lithium prices to fluctuate at the bottom Range next year.

Lithium stocks dropped in morning trading. As of the time of this report, GANFENGLITHIUM (01772) fell by 4.2%, trading at 21.65 Hong Kong dollars; Tianqi Lithium Corporation (09696) fell by 3.21%, trading at 25.65 Hong Kong dollars.

haitong sec: The average price of lithium carbonate has slightly decreased, and the demand for the lithium battery industry chain will gradually increase with the development of electric vehicles.

In the future, as the raw material costs of the lithium battery industry chain continue to decrease, combined with policy support and the ongoing increase in end-user demand, the sales of electric vehicles are expected to continue growing, and the demand for the lithium battery industry chain will gradually rise.

Soochow: The supply and demand reversal in the lithium battery industry is imminent, and a bullish outlook is strong.

Soochow Securities stated that the demand in the lithium battery industry has exceeded expectations, with a non-weak season from November to December. The demand for 2025 has been revised up to over 30% growth, and the current valuation is at the profit bottom. Industry leaders are showcasing significant technological innovation and cost advantages, with profitability set to recover first. A supply-demand reversal is imminent, and there is strong bullish sentiment.

Comments

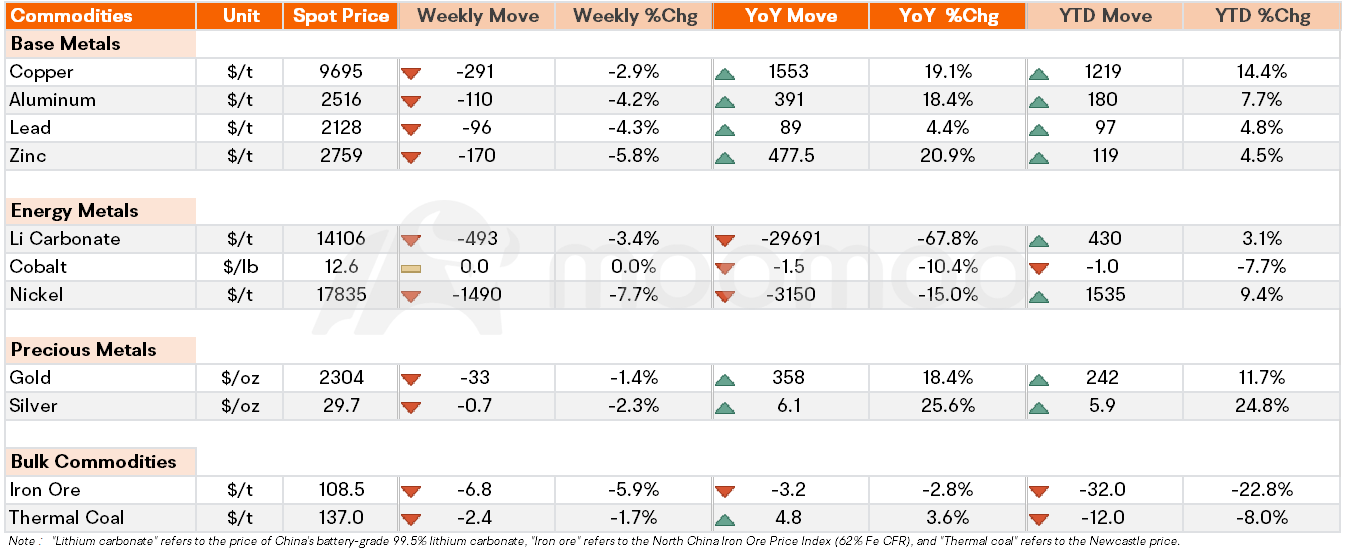

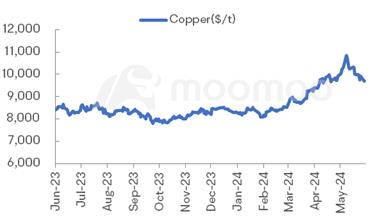

•Base metals: Copper price drops to five-week low due to strong dollar

•Energy metals: Nickel price falls by 7.7% on a weekly basis

•Precious metals: Gold price sinks to 1-month low

•Bulk commodity: Iron ore price hits seven-week low

Spot Price Snapshot

Key Price Moves

$Copper Futures(MAR5) (HGmain.US)$ prices in...

For resource stocks, $CHALCO (02600.HK)$ declined 3.6%, while $GANFENGLITHIUM (01772.HK)$ and $TIANQI LITHIUM (09696.HK)$ crumple...