No Data

09896 MNSO

- 44.950

- -0.800-1.75%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

[Brokerage Focus] Huaan maintains a 'buy' rating for Miniso (09896), pointing out that the performance of the overall net income is somewhat dragged down by the overseas direct sales market.

King's Finance News | Huaan Securities issued a research report, miniso (09896) Q3 revenue of 4.52 billion yuan, yoy +19.3%, basically in line. Adjusted net income of 0.69 billion yuan (yoy +6.9%), slightly lower than expected by 3.4%; in the third quarter, there were 135 new miniso stores in China on a quarter-on-quarter basis, higher than the consensus expectation of 107 stores; overseas business in the third quarter was 1.81 billion yuan (yoy +40%), slightly higher than the consensus expectation of 1.4%; the revenue of overseas direct sales market in the third quarter increased by 55.4% year-on-year, maintaining a high growth rate; agency market increased by 26.5% year-on-year, growth rate

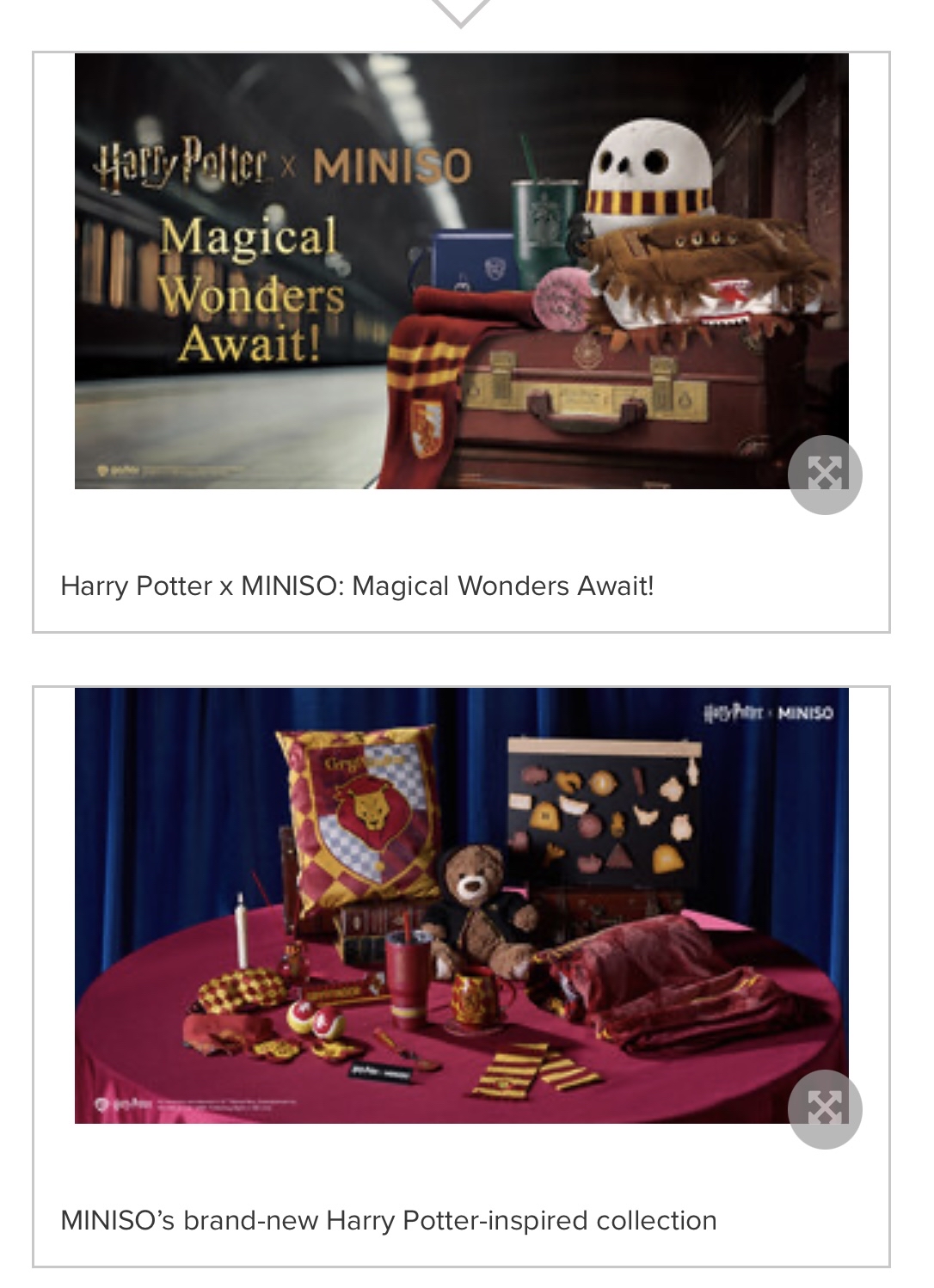

[Brokerage Focus] Huayuan Securities initially rated miniso (09896) with a "shareholding" rating, indicating that its IP global strategy and efforts in the anime sector will enhance product capabilities.

Golden Finance News | Huayuan Securities Research points out that in Q3 2024, miniso (09896) achieved revenue of 4.523 billion yuan, an increase of 19.3% year-on-year; achieved net income attributable to shareholders of 0.642 billion yuan, an increase of 4.8% year-on-year; and achieved adjusted net income of 0.686 billion yuan, an increase of 6.9% year-on-year. Golden Finance News | In the first three quarters of 2024, the company achieved revenue of 12.281 billion yuan, an increase of 22.8% year-on-year; achieved net income attributable to shareholders of 1.812 billion yuan, an increase of 12.0% year-on-year; and achieved adjusted net income of 1.928 billion yuan, an increase of 13.7%, excluding net exchange loss and

Top Gap Ups and Downs on Monday: TSLA, NET, STLA and More

Nasdaq, S&P hit new highs, French stock and bond yields fluctuate and rise, Euro once fell more than 1%, Dollar rose.

On the first trading day of December, Cyber Monday shopping amounts will break records, with the Nasdaq and Chinese concept stocks rising about 1%, and the chip index leading with a 2.6% increase, while the Dow fell from its peak. Tesla soared over 4% during the day, intel rose nearly 6% before turning negative, super micro computer surged nearly 29%, and Xpeng autos climbed over 5%, but Li Auto dropped nearly 4%. The French government faces a vote of no confidence, causing French stocks to briefly fall over 1%, and the spread between French and German government bond yields approached the widest in twelve years. US henry hub natural gas fell over 4%, the indian rupee hit a new low, and the offshore yuan dropped over 400 points, falling below 7.29 yuan.

US stocks closed: Chinese concept stock index 'three consecutive rises,' technology giants prop up NASDAQ, S&P to reach new highs.

① Technology giants continue to rise, with the S&P and Nasdaq hitting new highs; ② Musk's high salary once again rejected by a judge; ③ Super micro computer announces no inappropriate behavior found; ④ Intel CEO suddenly retires, reportedly forced out by the board of directors.

12 Consumer Discretionary Stocks Moving In Monday's Pre-Market Session

Analysis

Price Target

No Data

No Data