No Data

09896 MNSO

- 47.200

- +2.250+5.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Guosen Securities: Maintains miniso (09896) "outperform the market" rating, single quarter gross margin hits a historical high.

Guosen predicts miniso (09896) parent net income for 2024-2026 to be 2.755/3.33/3.958 billion yuan.

Kaiyuan Securities: Miniso (09896) Q3 overseas direct-operated store expansion accelerates, driving the increase in gross margin. Maintain a 'buy' rating.

Open-source Securities expects miniso's net income for 2024-2026 to be 2.73/3.39/4.16 billion yuan.

Meituan Q3 financial report: Behind the steady growth of core business, how to promote ecological win-win.

Recently, Meituan released its performance report for the third quarter of 2024. The financial report shows that Meituan achieved revenue of 93.6 billion yuan in the third quarter, a year-on-year increase of 22.4%. Meituan's stock price has already achieved a cumulative increase of over 100% this year, demonstrating strong market confidence in Meituan's future development, and indirectly confirming the significant achievements Meituan has made in improving efficiency and optimizing its business structure. Meituan CEO Wang Xing stated: 'We will continue to meet user needs, support merchants' operations, care for and assist the development of delivery riders, and achieve win-win outcomes with our ecological partners.' Synergistic effects are strengthening, and core business remains stable.

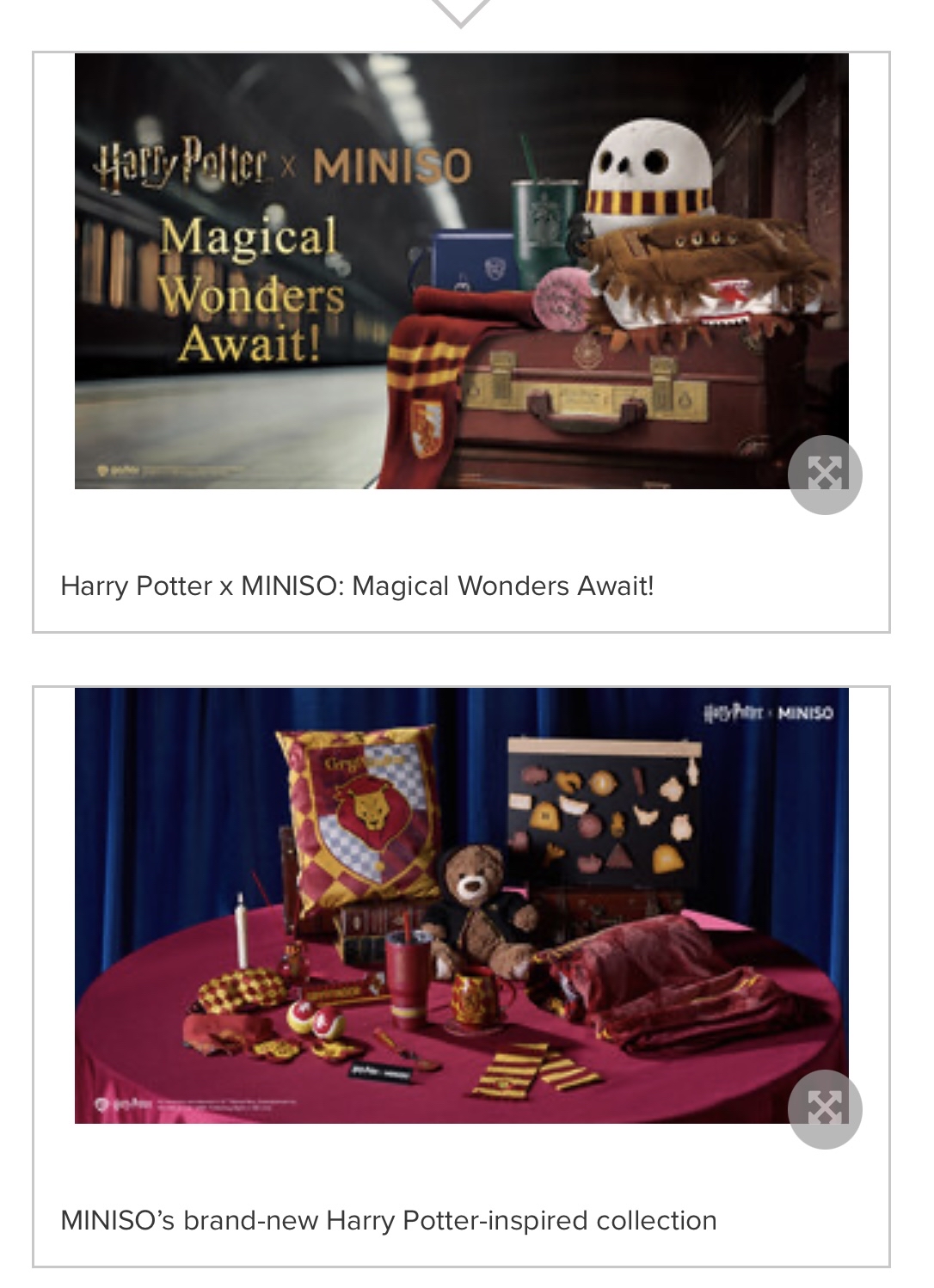

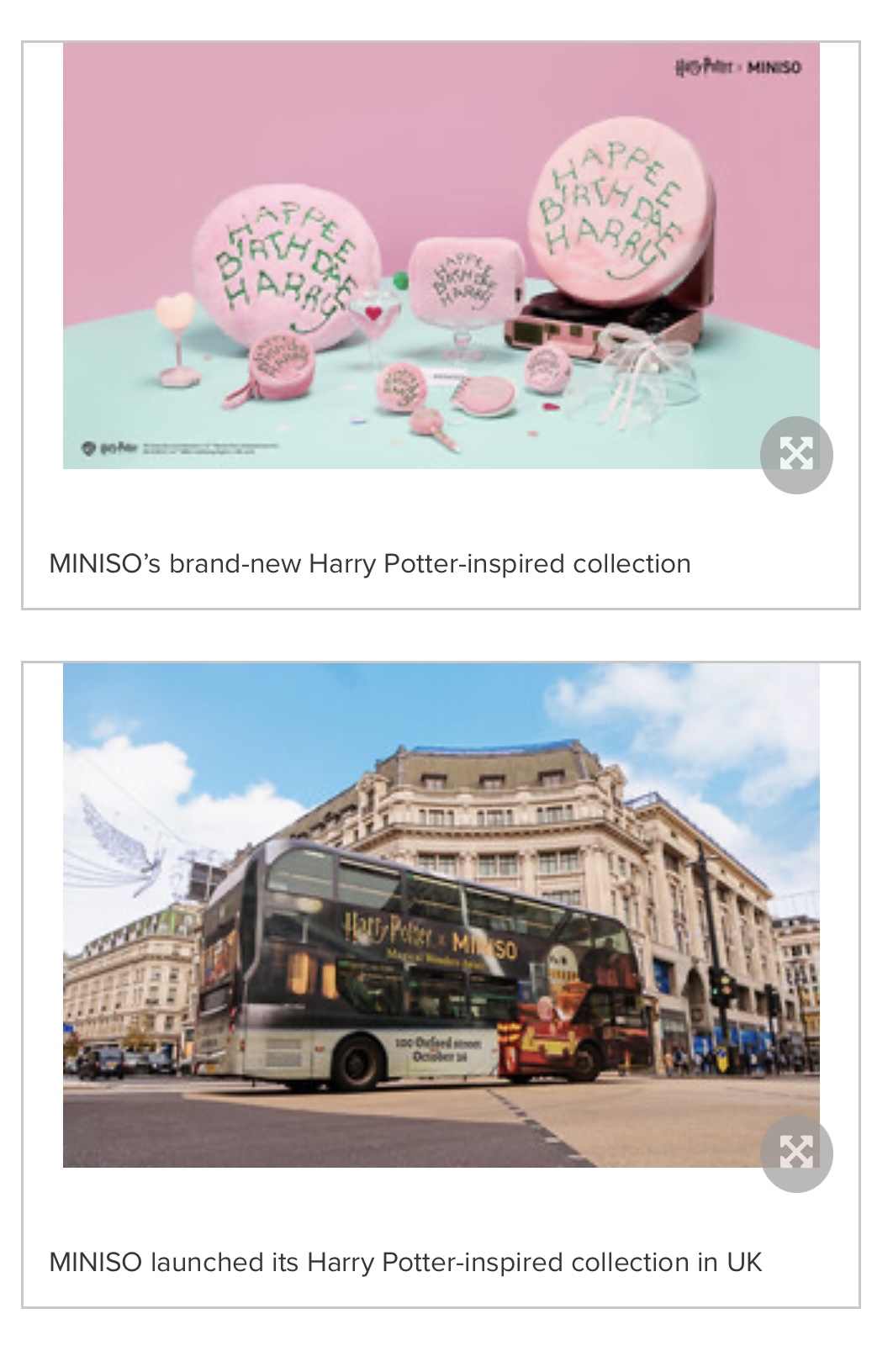

[Brokerage Focus] Guosen maintains the "Outperforming the Market" rating for Miniso (09896), indicating that it possesses strong channel capabilities and supply chain advantages.

Jingu News | Guosen Securities issued a research report, miniso (09896) achieved revenue of 12.28 billion in the first three quarters, yoy +22.8%. Net income adjusted for deductions was 1.93 billion yoy +13.7%, and the adjusted net profit margin was 15.7% yoy-1.3pct. Due to the high base effect of the explosive IP Barbie company's revenue in the same period last year, the revenue growth rate in Q3 slowed slightly, while the accelerated expansion of self-operated stores by the company led to a slight decrease in profit margin. Looking at Q4, overall revenue is expected to grow by 25-30% year-on-year, with overseas achieving a year-on-year growth rate of 45-50%; domestic revenue is expected to grow year-on-year.

0.5 billion "Aesthetic Culture" ignites the millet economy: saving offline business districts and supporting a trillion yuan market | Frontline

① Relevant data shows that in recent years, the number of pan-2D users in china has rapidly grown, and it is expected that by 2026, this number will further increase to 0.52 billion people. ② In recent years, many traditional retail locations have been poorly managed and have actively aligned with the consumption preferences of young people, introducing a large number of trendy toys and related merchandise. ③ The core of the guzi economy revolves around developing commodities that satisfy the emotional value of consumers based on intellectual property.

The Nasdaq index reached a new high, French stocks rose, the south korea etf narrowed after a 7% drop, and the offshore yuan briefly fell below 7.31 yuan.

South Korean President Yoon Suk-yeol abruptly declared a state of emergency, boosting safe-haven assets such as U.S. Treasury bonds, Japanese yen, and gold, while cryptos on the South Korean exchange plunged. The South Korean parliament quickly passed a resolution to lift the state of emergency, with the Ministry of Finance and the central bank actively working on market rescue measures. After a 2.7% drop to a two-year low, the won’s decline was cut in half, South Korean etfs fell by 1.6%, and the yield on 10-year U.S. Treasury bonds turned to increase after hitting a new low in over a month. France is set to vote on dissolving the government as early as Wednesday, with French stocks following European markets upward, although they had previously declined during the day. The Dow Jones, small cap stocks, and semiconductor indices fell, while the China concept index once rose by 1.9%. The yuan hit a new low in a year during the day, and U.S. oil rose nearly 3% testing the $70 mark.