No Data

268A Rigaku Holdings

- 1109

- -51-4.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Stocks that moved the previous day part1 QPS Research Institute, BTM, Last One Mile, etc.

Stock Name <Code> Closing Price on the 29th ⇒ Previous Day Comparison Tokyo Gas <9531> 4510 +68 ROE exceeds 8%. Reportedly, Azu Planning Design <3490> 2315 +45 sold 2 pieces of real estate for sale and repaid borrowed funds of 0.72 billion yen. Vision <9416> 1439 +40 The area offering "Global WiFi" 5G has expanded to 50 countries and regions, an increase of 8 countries. QPS Research Institute <5595> 1570 +29 selected for JAXA's open call for proposals for the Space Strategy Fund Project. BTM <524

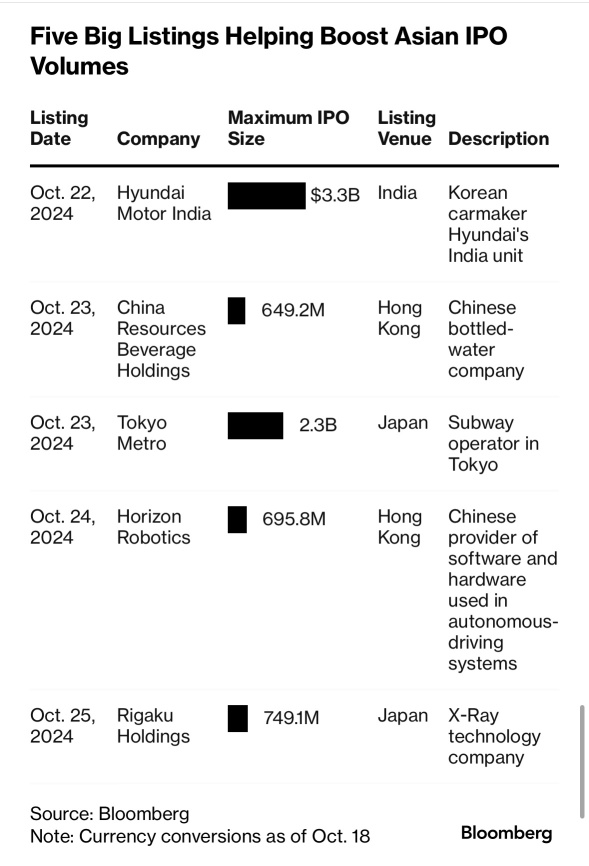

Express News | [Amendment Report] Mr. Akira Shimura reported a decrease in shareholding percentage of Rigaku Holdings (268A.JP) shares to 12.09%.

List of Conversion Stocks (Part 1) [List of Parabolic Signal Conversion Stocks]

List of stocks for buying conversion Market Code Security Name Closing Price SAR Tokyo Main Board <1899> Fukuda Construction 5330 5200 <1945> Tokyo Enesis 10381008 <1946> Toenec 940904 <1982> Hibiya Construction 38803610 <2002> Nisshin Flour G 18451799 <2053> Chubu Fodder 13351287 <2220> Kameda Confectionery 41904095 <2229>

Rigaku etc [stocks with intriguing characteristics based on volume changes]

Closing prices for stocks and their changes in volume: * <7746> Okamoto Glass 167,504,451,900 * <9331> Caster 105,415,045,400 * <7782> Shincia 54,551,493,00 * <268A> Rigaku 116,061,283,8300 * <2375> Gig Works 30,877,186,00 * <7163> Sumishin SBI Net silver 340,550,064,357,00 * <9235> Sellable Internet Advertising 152,222,125,500 * <9424> Japan Communications 14,377,975.

Casio Computer, Rigaku ◆ Today's Fisco hot stocks ◆

Casino Kei <6952> announced a revision of the financial estimates for the fiscal year ending March 2025. The revenue was revised downward from 275 billion yen to 262 billion yen, and operating profit from 16 billion yen to 14 billion yen. Following a ransomware (ransom-demanding virus) unauthorized access on October 5th, the servers were disconnected from the internal network, resulting in an impact. It is expected that the impact of sales opportunity loss due to unauthorized access will push down revenue by approximately 13 billion yen in the October to December 2024 period, and operating profit by approximately 4 billion yen.

Rigaku - Aiming for a rebound from the bottom zone.

Amidst the continued adjustment since peaking at 1265 yen on October 31st, there has been a rebound movement at present. Furthermore, in the adjustment since entering November, it has generally been within the range set at the time of listing, and the deterioration of supply and demand is expected to be limited. With a rebound from the bottom range, a potential resurgence is likely to be recognized. In addition, it is observed that bullish coverage has started at US-based securities, which may be considered as significant news.

Analysis

Price Target

No Data

No Data