No Data

300207 Sunwoda Electronic

- 23.40

- +0.35+1.52%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Impressive Earnings May Not Tell The Whole Story For Sunwoda ElectronicLtd (SZSE:300207)

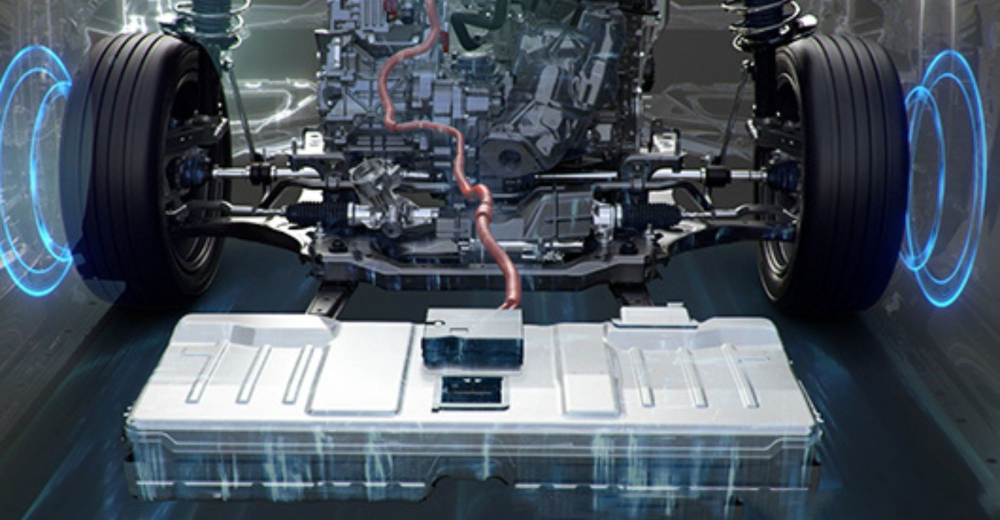

Sunwoda Electronic (300207.SZ): has the ability to research and produce batteries for low-altitude drones.

Gelonghui November 5th | sunwoda electronic (300207.SZ) stated on the investor interaction platform that the company has the capability to research and develop and produce batteries for low-altitude aircraft, and is actively connecting with related manufacturers.

Sunwoda Electronic (300207.SZ): It is expected to complete the production of laboratory samples of solid state batteries with energy density greater than 700Wh/kg by 2027.

Gelonghui November 5th | Sunwoda (300207.SZ) stated on the investor interaction platform that Sunwoda has further increased the energy density of solid state batteries to 500Wh/kg by using lithium metal as the negative electrode, and there are already laboratory prototype samples. It is expected to complete the production of laboratory samples of all solid-state batteries with energy density greater than 700Wh/kg by 2027.

Sunwoda Electronic (300207.SZ): repurchased 0.7% of the shares.

Gelonghui November 1st, Sunwoda Electronic (300207.SZ) announced that, as of October 31, 2024, the company repurchased 12,948,360 shares through a repurchase special securities account for centralized bidding trading, accounting for 0.70% of the company's current total share capital of 1,862,217,256 shares. The repurchased shares will be cancelled and the company's registered capital will be correspondingly reduced. The highest fill price was 18.27 yuan per share, the lowest fill price was 13.73 yuan per share, and the total amount of the trades was 199,934,497.20 yuan (excluding transaction costs).

Sunwoda: Report for the third quarter of 2024

Sunwoda Electronic (300207.SZ): Net income for the first three quarters was 1.212 billion yuan, a year-on-year increase of 50.84%.

On October 29, Gelonhui announced the third quarter report for 2024. In the first three quarters of 2024, the company achieved revenue of 38.279 billion yuan, an 11.54% year-on-year increase; net income attributable to shareholders of the listed company was 1.212 billion yuan, a 50.84% year-on-year increase; net income after deducting non-recurring gains and losses was 1.163 billion yuan, a 90.78% year-on-year increase; basic earnings per share were 0.66 yuan per share.

Comments

Sunwoda ElectronicLtd (SZSE:300207) Could Be Struggling To Allocate Capital

Sunwoda ElectronicLtd (SZSE:300207) Could Be Struggling To Allocate CapitalMeituan began to invest in automobile transportation in 2018. After 2019, intelligent hardware, automobile transportation, advanced manufacturing and ot...

$Sunwoda Electronic (300207.SZ)$

$GEELY AUTO (00175.HK)$

Analysis

Price Target

No Data

No Data