No Data

3436 SUMCO

- 1180.0

- -31.0-2.56%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nikkei average contribution ranking (before closing) - the Nikkei average has significantly risen for four consecutive days, with Advantest contributing approximately 91 yen.

As of the close on the 12th, the number of rising and falling stocks in the Nikkei average was 180 stocks up, 42 stocks down, and 3 stocks unchanged. The Nikkei average rose significantly for the fourth consecutive day. It finished the morning session at 39,881.10 yen, up 508.87 yen (+1.29%) from the previous day (with an estimated Volume of 0.9 billion 90 million shares). The U.S. stock market on the 11th was mixed. The Dow Inc was down 99.27 dollars at 44,148.56 dollars, while the Nasdaq closed up 347.65 points at 20,034.89.

Yokan HD, Casio, ETC (additional) Rating

Upgraded - Bullish Code Stock Name Brokerage Firm Previous After ------------------------------------------------------------- <3291> Iida GHD Morgan Stanley "Underweight" "Equal Weight" <9021> JR West Japan SMBC Nikko "3" "2" <9502> Chubu Electric Mizuho "Hold" "Buy" Downgraded - Bearish Code Stock Name Brokerage Firm Previous After ------------------------

Three points to watch in the latter half of the session - the recovery of the Nikkei to the 40,000 yen level, driven by the rise in U.S. tech stocks.

In the afternoon trading on the 12th, three points should be noted: • The Nikkei average rose significantly for four consecutive days, temporarily recovering to the 40,000 yen level influenced by the rise in U.S. tech stocks. • The dollar-yen exchange rate showed signs of resistance to falling, maintaining high U.S. interest rates. • The top contributor to price increases was Advantest <6857> and the second was Fast Retailing <9983>. ■ The Nikkei average rose significantly for four consecutive days, temporarily recovering to the 40,000 yen level, driven by the rise in U.S. tech stocks. The Nikkei average rose significantly for four consecutive days, rising by 508.87 yen (+1.29%) compared to the previous day.

The Nikkei average rose significantly for the fourth consecutive day, temporarily recovering to the 40,000 yen level, fueled by the rise in U.S. tech stocks.

The Nikkei average rose significantly for the fourth consecutive day, closing the morning session at 39,881.10 yen, up 508.87 yen (+1.29%) from the previous day (estimated volume of 0.9 billion 90 million stocks). The U.S. stock market on the 11th showed mixed results. The Dow Inc closed down 99.27 dollars at 44,148.56 dollars, while the Nasdaq ended up 347.65 points at 20,034.89. The consumer price index (CPI) for November remained within expectations, raising hopes for an additional interest rate cut at the Federal Open Market Committee (FOMC) in December.

The Nikkei Average has risen for three consecutive days, showing strong movement with stable financial stocks.

On the 10th, the U.S. Stocks market fell further. The Dow Inc average decreased by 154.10 points, closing at 44,247.83 dollars, while the Nasdaq ended down 49.45 points at 19,687.24. With a lack of materials, buying and selling fluctuated after the opening, resulting in mixed outcomes. The Dow was pressured by selling due to caution at high prices, leading to a soft trend throughout the day. The Nasdaq was briefly boosted by Alphabet's rise, but selling due to concerns over high interest rates, along with drops in Oracle Corp and Semiconductors company NVIDIA, contributed to its decline.

The Nikkei Average slightly rebounded, but was weighed down by semiconductor weakness after a round of buying.

Last weekend, on the 6th, the Dow Jones Industrial Average in the US market closed at 44,642.52, down 123.19 dollars, while the Nasdaq ended the session at 19,859.77, up 159.05 points. Expectations for further rate cuts at the December Federal Open Market Committee (FOMC) meeting increased after the employment statistics, leading to an initial rise in trading. However, as several Federal Reserve Board (FRB) officials expressed caution about rate cuts, speculation grew about a slowdown in the pace of rate cuts, causing the market to struggle. The Dow remained subdued throughout the day.

Comments

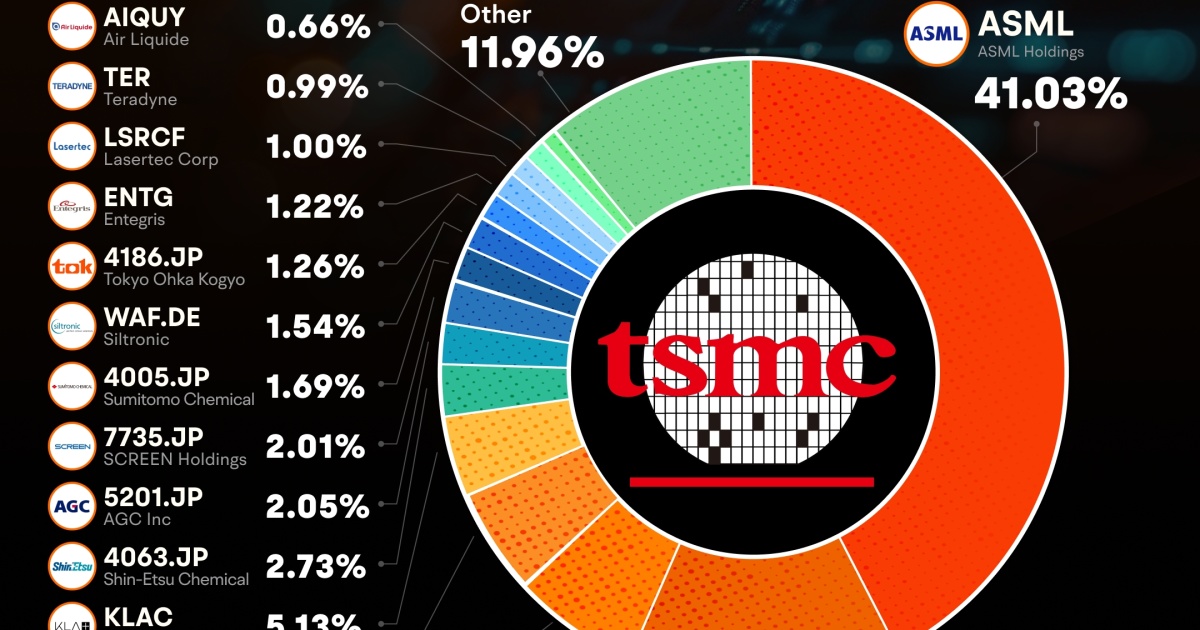

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...

No Data