No Data

3436 SUMCO

- 1203.0

- -41.0-3.30%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Stocks that moved the previous day part1 QPS Research Institute, BTM, Last One Mile, etc.

Stock Name <Code> Closing Price on the 29th ⇒ Previous Day Comparison Tokyo Gas <9531> 4510 +68 ROE exceeds 8%. Reportedly, Azu Planning Design <3490> 2315 +45 sold 2 pieces of real estate for sale and repaid borrowed funds of 0.72 billion yen. Vision <9416> 1439 +40 The area offering "Global WiFi" 5G has expanded to 50 countries and regions, an increase of 8 countries. QPS Research Institute <5595> 1570 +29 selected for JAXA's open call for proposals for the Space Strategy Fund Project. BTM <524

Active and newly listed stocks during the morning session.

*World <3612> 2158 +228 Mitsubishi Corporation to fully subsidiary a subsidiary company. *Goodcome Asset <3475> 867 +81 Evaluated for upward revision of earnings forecast and increased dividends. *Jus Spirits <2222> 2087 +144 Newly recommended for buying by Goldman Sachs Securities. *Noritz Steel Machinery <7744> 4605 +280 Performance forecast heading towards another upward revision. *Toho Titanium <5727> 1032 +46 Reported that Japanese-made titanium is gaining momentum.

The Nikkei average fell, as the progress of yen appreciation triggered concerns, briefly falling below the 38,000 yen level.

The Nikkei average declined. It closed the morning trading at 38,193.01 yen, down 156.05 yen (-0.41%) from the previous day, with an estimated volume of 7,050 million shares. The US market was closed for the Thanksgiving holiday. In the currency market, trading of major currencies remained subdued. The dollar-yen pair struggled to rise, being bought up to 151.77 yen at one point, then falling to 151.41 yen before closing the trading at 151.50 yen. Despite the closure of the US market, the exchange rate experienced a stronger yen and a weaker dollar with the dollar trading at the 150-yen level.

List of stocks that moved the previous day part 1: KOKUSAI, T&DHD, Sanrio, etc.

Announcement of the medium-term management plan for the fiscal years 2025-2027. A plan to conduct a total of 35 billion yen in share buybacks over the entire period.

Today's flows: 11/28 Nissan Chemical saw an inflow of JPY¥ 2.8 billion, Advantest saw an outflow of JPY¥ 8.9 billion

On November 28th, the TSE Main Market saw an inflow of JPY¥ 770.19 billion and an outflow of JPY¥ 777.94 billion.$Nissan Chemical(4021.JP)$, $SUMCO(3436.JP)$ and $Sony Group(6758.JP)$ were net

Nikkei average contribution ranking (pre-closing) ~ Nikkei average rebounds for the first time in three days, with To-Electric pushing up about 141 yen per share.

As of the close on the 28th, the number of advancing and declining stocks in the Nikkei average was 151 up, 72 down, and 2 unchanged. The Nikkei average rebounded for the first time in three days, closing at 38,295.13 yen, up 160.16 yen (+0.42%) from the previous day, with a trading volume estimate of 0.8 billion 40 million shares. On the 27th, the U.S. stock market fell. The dow inc ended down 138.25 dollars at 44,722.06 dollars, while the nasdaq closed down 115.10 points at 19,060.48.

Comments

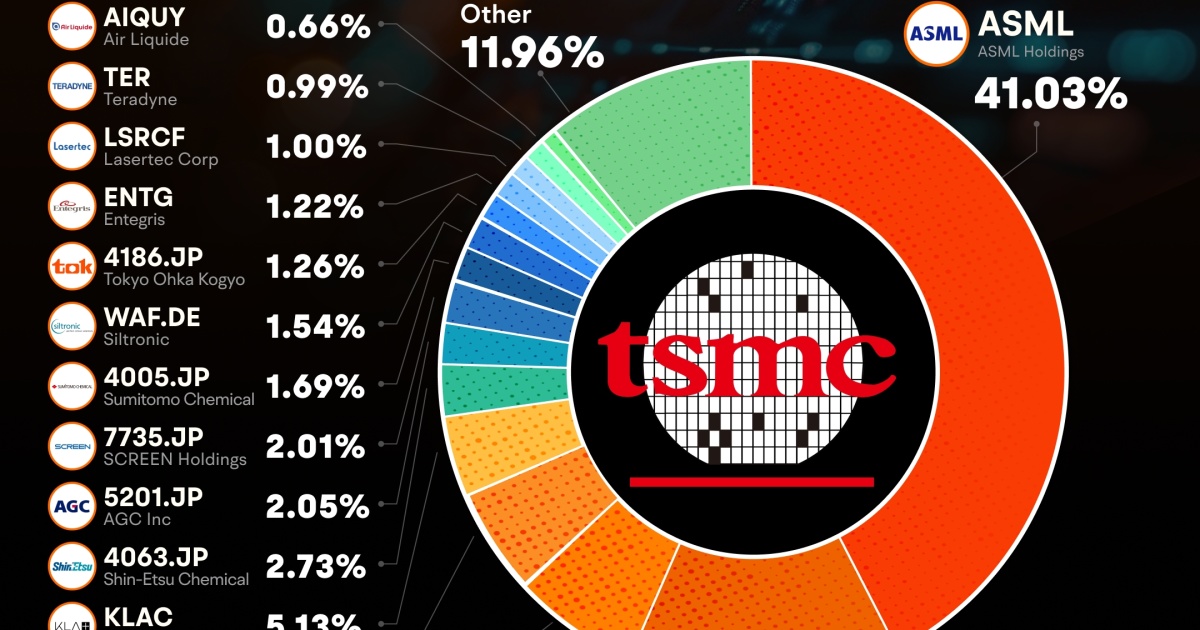

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...

Analysis

Price Target

No Data

No Data