No Data

3436 SUMCO

- 1206.5

- -2.0-0.17%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average rose by 125 yen, continuing to increase, but the selling while waiting for a rebound made it difficult to rise further = 21st afternoon session.

On the 21st, the Nikkei average stock price rose by 125.48 yen to 39,027.98 yen compared to the previous day, and the TOPIX (Tokyo Stock Price Index) also increased by 2.23 points to 2,713.50 points, continuing its upward trend. The Nikkei average recovered to the 39,000 yen level for the first time in six trading days since the 10th (39,190.40 yen) based on the closing price. Following the rise in U.S. stock price index Futures in Extended hours trading, buying came ahead from the morning. At 9:03 AM, the Nikkei average reached 39,238.21 yen, up 335.71 yen.

The Nikkei Average increased by about 250 yen, with intermittent buying in the stock index Futures expanding the increase = 16 days before the market close.

On the morning of the 16th, the Nikkei average stock price is fluctuating around 38,700 yen, up by about 250 yen compared to the previous day. Following intermittent buying in the stock index futures, by 9:30 AM, it reached 38,932.54 yen, an increase of 487.96 yen. On the 15th local time, the U.S. stock market saw the Dow Inc rise for three consecutive days, and the Nasdaq Composite Index rebounded for the first time in six days. The SOX (Philadelphia Semiconductors) Index also rose, leading to preemptive buying of Japanese stocks.

The Nikkei Average fell for five consecutive days, after a round of buying there was a hesitation among buyers, resulting in a consolidation.

On the 14th, the USA market was mixed. The Dow Inc average closed up $221.16 at $42,518.28, while the Nasdaq fell 43.71 points to 19,044.39 at the end of Trade. The Producer Price Index (PPI) was below expectations, reigniting Buy expectations, and it rose after the opening. However, it struggled afterwards due to caution ahead of Bank earnings and the Consumer Price Index (CPI) announcement. The rise in interest rates and the Biden administration's export restrictions on AI Semiconductors to China weighed down on firms like NVIDIA and other Semiconductors.

Nikkei Average Contribution Ranking (Pre-close) ~ The Nikkei Average rebounded for the first time in five days, with FANUC CORP contributing about 41 yen.

As of the market close on 15 days ago, the number of advancing and declining stocks in the Nikkei average was 146 stocks up, 79 stocks down, and 0 stocks unchanged. The Nikkei average rebounded for the first time in five days, finishing the morning trading session at 38,628.61 yen, up 154.31 yen (+0.40%) from the previous day (Volume approximately 0.7 billion 90 million shares). The US market on the 14th was mixed. The Dow Inc rose by 221.16 dollars to 42,518.28 dollars, while the Nasdaq closed down by 43.71 points at 19,044.39.

Three points to pay attention to in the latter half of the market - financial stocks supported by the observation of a January interest rate hike.

In the afternoon trading on the 15th, attention should be focused on the following three points. ・The Nikkei average rebounded for the first time in five days, with financial stocks supported by expectations of a rate hike in January. ・The dollar-yen exchange rate remains weak, anticipating U.S. interest rates. ・The top contributor to the price increase is FANUC CORP <6954>, and the second place goes to Fast Retailing <9983>. ■The Nikkei average rebounded for the first time in five days, supported by financial stocks anticipating a rate hike in January. The Nikkei average rebounded for the first time in five days, up 154.31 yen (+0.40%) from the previous day at 38,628.61 yen (Volume estimated).

The Nikkei Average rebounded for the first time in five days, supported by financial stocks, influenced by expectations of a rate hike in January.

The Nikkei average rebounded for the first time in five days, closing the morning session at 38,628.61 yen, up 154.31 yen (+0.40%) from the previous day, with an estimated Volume of 0.7 billion 90 million shares. The US market on the 14th was mixed. The Dow Inc rose by 221.16 dollars to 42,518.28 dollars, while the Nasdaq fell by 43.71 points to 19,044.39. The Producer Price Index (PPI) fell below Financial Estimates, reviving buying on expectations of rate cuts after the market opened, followed by the banking results and consumer goods.

Comments

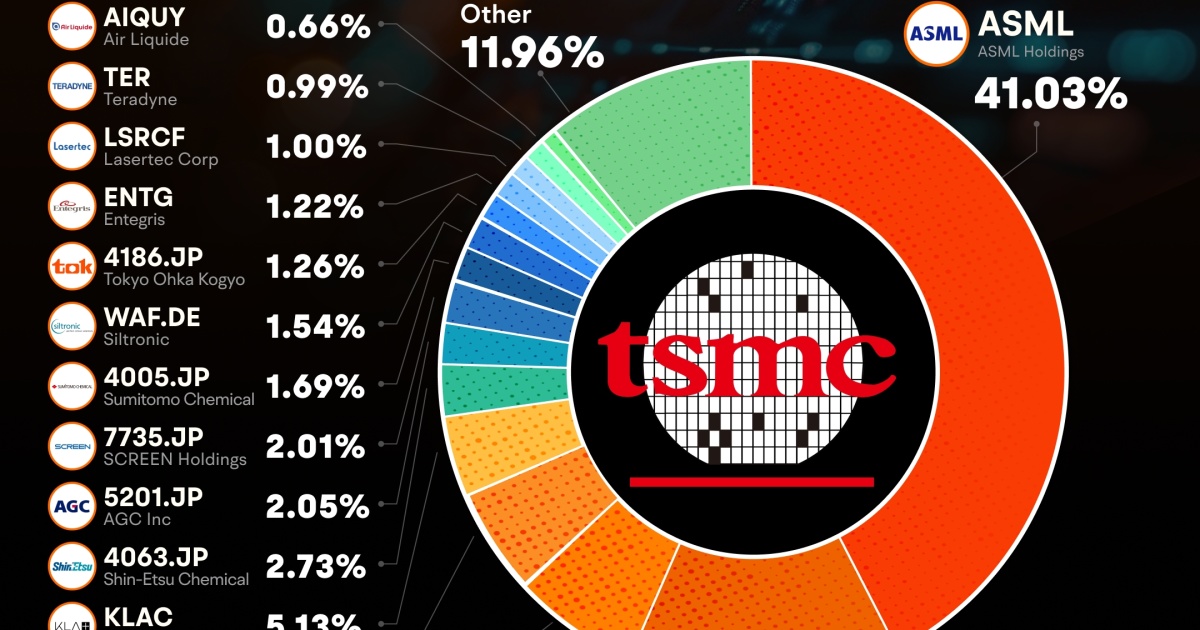

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...