No Data

3436 SUMCO

- 1493.0

- +4.0+0.27%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

JP Movers | Konica Minolta Rose 7.29%, Leading Nikkei 225 Components, Disco Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with Konica Minolta(4902.JP) being the top gainer today, rising 7.29% to close at 602.1 yen. In addition, the top loser was Sumitomo Pharma(4506.JP),falling 6.32% to end at 593.0 yen.

Nikkei average falls, with strong caution towards the election, no active buying.

The Nikkei Average fell. It ended the morning session at 37,771.79 yen, down 371.50 yen (-0.97%) from the previous day, with an estimated trading volume of 708 million shares. The U.S. stock market on the 24th was mixed. The Dow Jones Industrial Average closed at 42,374.36, down 140.59 points, while the Nasdaq closed at 18,415.49, up 138.83 points. Initial jobless claims came in below financial estimates, easing concerns about the labor market, leading to a solid start after the opening bell. Nasdaq saw strength in electric car manufacturers like Tesla.

Nikkei Average Contribution Ranking (pre-closing) - The Nikkei Average rebounded slightly after 4 days, with Toshiba Electronics pushing up by approximately 42 yen in one stock.

On the 24th, at the closing time of the Nikkei average constituent stocks, there were 71 stocks that rose, 153 stocks that fell, and 1 stock that remained unchanged. The Nikkei average rebounded for the first time in four days. It closed the morning session at 38,154.25 yen, up 49.39 yen (+0.13%) from the previous day, with an estimated volume of 0.860 billion shares traded. The U.S. stock market on the 23rd saw a decline. The Dow Jones Industrial Average closed at 42,514.95, down 409.94 points, while the Nasdaq finished trading at 18,276.65, down 296.47 points.

Three points to focus on in the afternoon session ~ The awareness of being oversold leads to a buying back scenario.

In the afternoon trade on the 24th, we want to focus on the following three points: - The Nikkei Average rebounded for the first time in 4 days, with a conscious buy-back development due to a sense of overselling. - The dollar-yen rate is weak due to the decline in US interest rates. - The top contributors to the price increase are Toshiba Corporation <8035> in first place, followed by Advantest <6857>. ■ The Nikkei Average rebounded for the first time in 4 days, with a conscious buy-back development. The Nikkei Average rebounded for the first time in 4 days, up 49.39 yen from the previous day (+0.13%) to 38,154.25 yen (volume approx. 0.8 billion yen).

The Nikkei average rebounds for the first time in four days, as the oversold sentiment is recognized and leads to buying back.

The Nikkei average rebounded for the first time in 4 days, closing the morning trade at 38,154.25 yen, up 49.39 yen (+0.13%) from the previous day's closing price (with an estimated volume of approximately 806 million shares). The U.S. stock market on the 23rd experienced a decline, with the Dow Jones down 409.94 points at $42,514.95, and the Nasdaq down 296.47 points at 18,276.65 by the close of trading. The decline of the fast food chain, mcdonald's, weighed heavily, leading to a drop after the opening. The rise in long-term interest rates also weakened the high-tech sector.

List of converted stocks (Part 2) [List of converted stocks for Parabolic Signal]

Sell conversion stock list Market Code Stock name Closing price SAR Tokyo Main Board <1518> Mitsui Matsushima HD 4885 5200 <1605> INPEX 2032 2215 <1663> K&O Energy 3355 3635 <1926> Wright Koji 2268 2330 <1930> Hokuriku Electric 1202 1234 <2292> SFoods 2801 2856 <2613> Jio

Comments

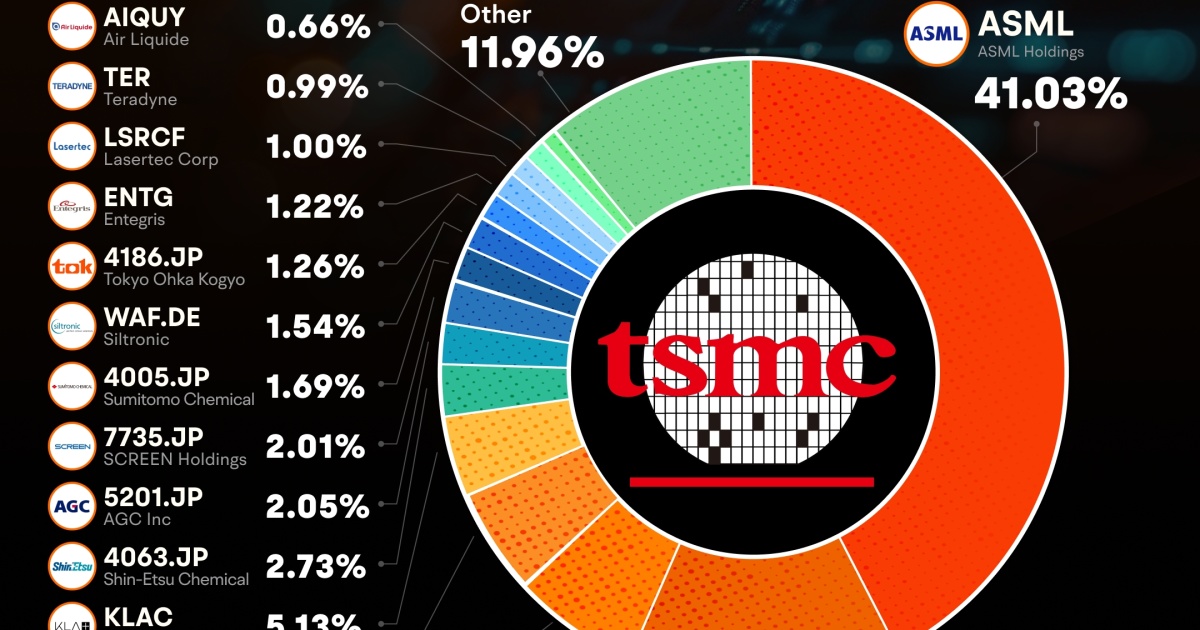

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...

Analysis

Price Target

No Data

No Data