No Data

399006 Chinext Price Index

- 2008.44

- -19.91-0.98%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

A-share midday review: Chinext Price Index fell by 2.77%, over 4,800 stocks in the red, Consumer Electronics Concept had the largest decline.

Major A-share indices all dropped in the morning session. By the lunch break, the Shanghai Composite Index fell 1.46% to 3182.48 points, the Shenzhen Component Index dropped 2.38%, the Chinext Price Index declined 2.77%, and the Northbound 50 Index decreased by 2.20%. The All Market had a half-day trading volume of 713.9 billion yuan, an increase of 103.2 billion yuan compared to the previous day, with over 4,800 stocks in the red. On the market, influenced by positive policy news, some Retirement Concept stocks performed strongly, with Everjoy Health Group and Dahu Aquaculture hitting the daily limit. Some port and Marine Transportation stocks also rose, with COSCO SHIP ENGY up over 7%, and China Merchants Energy Shipping and Xiamen Port Development rising over 4%. The Consumer Electronics concept dropped overall, with Guoguang Electric and Yidao Information seeing declines.

Chengfei injection completed, Zhonghang Electronic Measuring Instruments plans to change its name to Zhonghang Chengfei丨Quick Read Announcement.

① Investors have long awaited the integration of Chengfei into Zhonghang Electronic Measuring Instruments, which has finally been completed; ② Zhonghang Electronic Measuring Instruments intends to be renamed as Zhonghang Chengfei.

Analysts predict that ByteDance's AI computing power expenditure will exceed 100 billion yuan by 2025, and the dawn of domestic computing power demand is approaching.

① Recently, ByteDance released a procurement sourcing announcement for the design framework of its self-built Datacenter substation. ② Zheshang Securities stated that the dawn of domestic computing power demand has arrived, and ByteDance has made huge investments in AI, with capital expenditures reaching 80 billion yuan in 2024.

The "flying" pigs! Wens Foodstuff Group expects its revenue to surpass 100 billion yuan for the first time in 2024, with profits nearing 10 billion yuan | Quick announcement.

① Wens Foodstuff Group expects to achieve revenue exceeding 100 billion yuan and a net income of 9 billion-9.5 billion yuan in 2024; ② Analysts believe that the company's performance meets expectations but does not exceed them, which is considered normal; ③ In contrast to the impressive performance, Wens Foodstuff Group's stock price has dropped a cumulative 16.66% throughout the year 2024.

There has been a pullback, is it time to get on board?

Opportunities come from falls.

China Shares Lower, Weighed by Retail Stocks -- Market Talk

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

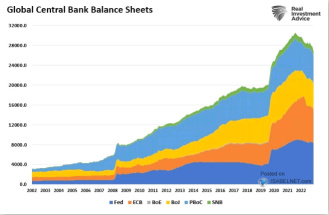

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

New energy-related stocks are among the best performers.

$SSE Composite Index (800146.HK)$ $CSI 300 Index (800122.HK)$ $SSE Composite Index (000001.SH)$ $CSI 300 Index (000300.SH)$ $Chinext Price Index (399006.SZ)$ $Shenzhen Component Index (399001.SZ)$ $Petrochina (601857.SH)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.