No Data

399006 Chinext Price Index

- 2149.75

- -14.72-0.68%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Sungrow Power Supply: The growth rate of performance continues to slow in the first three quarters. Plans to issue GDR for fundraising to expand production capacity|Interpretations

①The dual leading sungrow power supply in energy storage and power inverter no longer maintains high growth momentum, with revenue growth but profit declining in Q3 this year; ②The company plans to issue GDR to raise 47.8 billion yuan and indicates that the existing production capacity is far from enough to meet the future broad market demand, urgently needing to prepare for production capacity construction.

Goldman Sachs firmly calls for the rise of Chinese stocks: expected to rise within 2-3 months after the US election!

①Goldman Sachs strategists' latest forecast predicts that Chinese stocks will rise within two to three months after the US presidential election; ②The firm believes that China's economic stimulus measures have created the so-called "policy put options" to protect investors in the Chinese stock market from the impact of declines.

USA election enters countdown, these markets have become "safe havens"

①In the final stage of the usa election, investors are selling the yen in droves and instead investing in cash, india, china markets, and some assets denominated in Singapore dollars; ②Pictet Asset Management said: "We actually think china is a good place to hide."

Delayed hospital purchases, sluggish non-rigid medical demand, and other factors dragged down shenzhen mindray bio-medical electronics' Q3 net income by 9.31% | Financial report watch

Due to factors such as delayed hospital procurement, tight hospital construction funds, and sluggish non-rigid medical demand, in the third quarter, Shenzhen Mindray Bio-Medical Electronics' net income decreased by 9.31% year-on-year, while total revenue increased by 1.43% year-on-year. In the second interim profit distribution in 2024, Shenzhen Mindray Bio-Medical Electronics will distribute 16.50 yuan for every 10 shares.

The central bank has once again introduced a new liquidity management tool, suitable for the habits of overseas investors, which can better hedge the concentrated maturity of MLF by the end of the year.

1. This is also a new tool launched by the central bank after temporary reverse repurchase and bond trading since the beginning of this year; 2. The term of buy-back repurchase does not exceed 1 year, which can further enrich the liquidity management tools and better hedge the concentrated maturity of MLF before the end of the year; 3. Overseas investors are more accustomed to the buy-back repurchase commonly used internationally.

Nvidia and Zhongji Innolight are entering the game! The high-speed rate optical module shipments are driving the doubling of demand for optical chips. Which domestic manufacturers can get a piece of the pie?

①AI drives the demand for high-speed optical modules, leading to a shortage of optical chips, prompting international major factories to announce price hikes; ②The demand for optical chips is expected to continue rising, with various parties such as Guangdong, Wuxi, and nvidia recently announcing investments or support for the development of optical chips; ③Currently, the high-speed optical chip market is still mainly dominated by foreign manufacturers, with domestic 100G EML optical chips still not being shipped in large quantities.

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

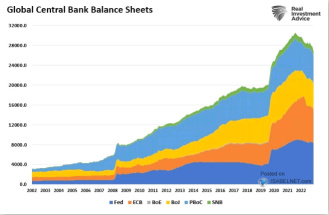

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

New energy-related stocks are among the best performers.

$SSE Composite Index (800146.HK)$ $CSI 300 Index (800122.HK)$ $SSE Composite Index (000001.SH)$ $CSI 300 Index (000300.SH)$ $Chinext Price Index (399006.SZ)$ $Shenzhen Component Index (399001.SZ)$ $Petrochina (601857.SH)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.