No Data

399006 Chinext Price Index

- 2215.13

- -11.59-0.52%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Investing heavily in China occupies an important position! Bank of America’s main strategy for 2025: "BIG".

Recently, a wave of asset allocation characterized by "the East rising and the West falling" has been triggered in the Global market; many people in Wall Street institutions have expressed their views on the current decline of the US stock market, as well as the increasing popularity of US Treasury bonds, Gold, and Central European Assets; Michael Hartnett, the Chief Analyst of Bank of America, who was once dubbed the "most accurate Analyst on Wall Street," recently shared his perspective.

Brokerage morning meeting highlights: The special plan to promote consumption has been implemented, bullish on the opportunity for consumer revaluation.

At today's Brokerage morning meeting, HTSC stated that the special plan to promote Consumer spending is being implemented, and they are Bullish about the opportunities in Consumer reevaluation; GTJA believes that Consumer expectations are Diffusing, highlighting the growth value of Snack Food; China Securities Co.,Ltd. pointed out the importance of focusing on the direction of first-quarter report prosperity, with "AI+" remaining the core main line in the medium term.

Decrease in revenue but increase in profits! Contemporary Amperex Technology will generate over 50 billion in 2024|Interpretations

① In 2024, Contemporary Amperex Technology's performance will see a decrease in revenue but an increase in profit, with a Net income reaching 50.7 billion yuan; ② The Battery Business remains the largest source of revenue for Contemporary Amperex Technology; ③ The inventory impairment reserve of Contemporary Amperex Technology has significantly increased compared to the previous year.

The "King Ning" is heading towards a new battlefield.

Reconstruct the Global Industry Chain.

New themes are gradually emerging as market styles shift between high and low, but the strength of the Technology mainline's recovery remains crucial.

Yesterday, the market continued to adjust, and all three major Indexes fell, returning to a consolidation structure in the short term.

Brokerage morning meeting highlights: It is recommended to pay attention to companies in the humanoid robot industry that have the capability for low stock price bulk supply of components.

In today's Brokerage morning meeting, China Securities Co.,Ltd. suggested focusing on companies in the humanoid robot Industry that have the capacity for low stock price mass supply of components; Tianfeng stated that the wind turbine Sector will undergo a value reassessment; Galaxy Securities believes that the peak season de-stocking turning point in the non-ferrous Industry is emerging, and the spring market is expected to unfold.

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

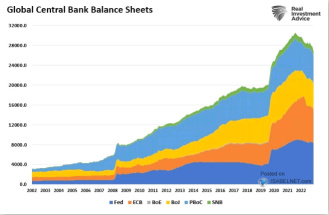

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

New energy-related stocks are among the best performers.

$SSE Composite Index (800146.HK)$ $CSI 300 Index (800122.HK)$ $SSE Composite Index (000001.SH)$ $CSI 300 Index (000300.SH)$ $Chinext Price Index (399006.SZ)$ $Shenzhen Component Index (399001.SZ)$ $Petrochina (601857.SH)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.