No Data

399006 Chinext Price Index

- 2104.73

- +37.45+1.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Eoptolink Technology Inc. had an 80% increase in profits in Q4 last year compared to the previous quarter, but the details behind the investigation of the actual controller remain unclear.| Interpretations

① The demand for high-speed products is rapidly increasing, and Eoptolink Technology Inc. expects the net profit attributable to shareholders to grow over 300% year-on-year last year, with a quarter-on-quarter net profit increase of 47.76%-79.77% in Q4. ② Just a month ago, the actual controller, Gao Guangrong, was investigated by the Securities Regulatory Commission for allegedly violating restrictive regulations by transferring Stocks and other actions, and the details behind this remain unclear.

Will the A-share spring offensive be advanced? What are the main investment themes? The strategies from the top ten brokerages are here.

Summary of the latest viewpoints on the top ten brokerages' strategies + overview of bullish sectors.

Chinese Shares End Higher Amid Positive Sentiment -- Market Talk

The investigation authorities will legally initiate an investigation into the import of American chips, and the process of Semiconductors localization is expected to accelerate.

On January 16, during a press conference, the Ministry of Commerce stated that American companies' low stock price exports of related mature process chip products to China will be reviewed by the investigating authorities in accordance with relevant Chinese laws and regulations, following WTO rules, and an investigation will be initiated in accordance with the law. Research reports from Minsheng Securities point out that the urgent need for self-controllable demand in the core links of Semiconductors, and domestic manufacturers that continue to make breakthroughs in advanced manufacturing will usher in significant development opportunities.

Cailian Press Autos Morning Report [January 16]

① The Ministry of Commerce: This week, detailed implementation rules for new purchase subsidies for mobile phones and other digital products will be issued successively; ② Guangdong: The production of New energy Fund vehicles will grow by 43% in 2024, accounting for a quarter of the national total; ③ Chongqing Changan Automobile: It will enter the Europe market in 2025;

Premium rate of 200%, valuation increased fivefold. Eve Energy Co., Ltd. intends to acquire employee-held subsidiary equity for 0.579 billion yuan | Quick announcement read.

① Eve Energy Co.,Ltd. (300014.SZ) plans to acquire part of the equity of its subsidiaries held by the employee stock ownership platform for 0.579 billion yuan; ② A report by Caixin found that the employees spent 0.193 billion yuan to acquire this part of the equity that year, with a premium rate of 200%, but the valuation of the equity subsidiaries has increased fivefold compared to that year.

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

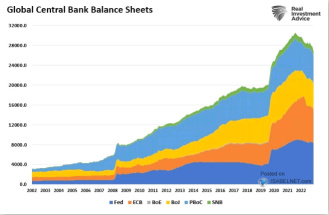

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

New energy-related stocks are among the best performers.

$SSE Composite Index (800146.HK)$ $CSI 300 Index (800122.HK)$ $SSE Composite Index (000001.SH)$ $CSI 300 Index (000300.SH)$ $Chinext Price Index (399006.SZ)$ $Shenzhen Component Index (399001.SZ)$ $Petrochina (601857.SH)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.