No Data

399006 Chinext Price Index

- 2175.57

- -90.29-3.98%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Goldman Sachs A-shares 2025 Heavyweight Strategy Outlook: Domestic funds will grasp pricing power! Overweight A-shares before H, industry focus on consumer stocks!

Goldman Sachs believes that compared to Hong Kong stocks, A-shares are more sensitive to policy easing and personal investment capital flows. The first quarter of next year will be a better time to allocate to Hong Kong stocks. In terms of sectors, analysts recommend that investors pay attention to themes such as consumer, emerging markets exporters, specific new technologies, and shareholder return strategies.

The native hongmong system has expanded to the tablet sector, and the huawei hongmong ecosystem is expected to experience accelerated development.

On the morning of November 21, following the release of smartphones, Huawei's terminal announced on its official social platform that a tablet equipped with the native Hongmeng OS will soon debut at the Mate brand event. This marks Huawei's first expansion of the native Hongmeng OS to the tablet track.

Is the lithium battery industry chain about to bottom out? Insiders predict that prices are expected to rebound next year, with industry leaders emphasizing global layout | Exclusive coverage of the High Work Lithium Battery Annual Conference.

① At the 2024 High-tech Lithium Battery Annual Conference held yesterday, Zhang Xiaofei, chairman of High-tech Lithium Battery, predicted that the first quarter of next year will be the lowest price point, and in the second quarter of next year, the prices of battery raw materials will begin to rise; ② The future industry will face a more severe competitive landscape and capacity thresholds, and the solution offered by leading enterprises is to expand overseas.

A-shares and Hong Kong stocks are up, with the gem rising more than 1%, led by photovoltaics, chips, and non-ferrous metals.

PV concept stocks in A-shares rose at the beginning of the market, Suzhou Good-Ark Electronics hit the limit up, Sungrow Power Supply, Deli Technology rose more than 6%, Ginlong Technologies, Suzhou Maxwell Technologies, and Orise Technology quickly followed the upward trend.

Schroder: China is actively promoting economic growth in conjunction with the usa's moderate interest rate cut outlook, improving investment prospects in asia.

Schroders' Chief Investment Officer of Diversified Assets, She Kangru, stated that looking ahead, Schroders remains optimistic about the overall fundamentals of the Asian bonds market, especially after the bond index has undergone adjustments with lower quality companies being excluded, particularly high-yield real estate firms.

China Securities Co., Ltd.: A-shares should be accumulated when the price drops, avoiding micro-trading speculation.

In October, M2 and other financial data were better than expected, and expectations for interest rate cuts and reserve requirement ratio reductions remain. Liquidity is expected to remain ample; signs of improvement in the fundamentals have emerged, and a continued gradual recovery is anticipated. Moreover, there are still expectations for incremental policies, although there is a time lag between the implementation of policies and the confirmation of fundamentals, while the market often leads the fundamentals.

Comments

$Shenzhen Component Index (399001.SZ)$ CLOSED UP 1.09%, AT 10470.91

$CSI 300 Index (000300.SH)$ CLOSED UP 0.25%, AT 3935.2

$Chinext Price Index (399006.SZ)$ CLOSED UP 0.69%, AT 2210.34.

THE HONG KONG STOCK MARKET CLOSED LOWER ON MONDAY, $Hang Seng Index (800000.HK)$ FELL BY 1.57% AND TECH WAS DOWN BY 2.37%.

CHIPMAKERS AND PHARMACEUTICAL FACTORIES ARE DOWN, $SMIC (00981.HK)$ DROPPED 2.15% AND CHINA TRADITI...

$Hang Seng Index (800000.HK)$ $Hang Seng China Enterprises Index (800100.HK)$ $Hang Seng TECH Index (800700.HK)$ $Hang Seng China Affiliated Corporations Index (800151.HK)$ $SSE Composite Index (000001.SH)$ $Shenzhen Component Index (399001.SZ)$ $Chinext Price Index (399006.SZ)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $NASDAQ Golden Dragon China (.HXC.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $China Concept Stocks (LIST2517.US)$

���������...

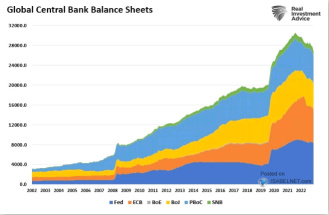

Liquidity is What Moves Markets

Investors worldwide pay very close attention to the Fed whenever they speak. They are searching for any inkling of a clue into future policy decisions. Ultimately, they are looking for the one thing that moves markets, and that would be liquidity.

Will they decrease interest rates? Will they add assets to their balance sheet? Will the Federal Reserve pump liquidity into the ...

$SSE Composite Index (800146.HK)$ down 1.2%, $CSI 300 Index (800122.HK)$ down 1.18%.

$SSE Composite Index (000001.SH)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$ $BABA-W (09988.HK)$ $TENCENT (00700.HK)$ $BYD Company Limited (002594.SZ)$ $BYD COMPANY (01211.HK)$

New energy-related stocks are among the best performers.

$SSE Composite Index (800146.HK)$ $CSI 300 Index (800122.HK)$ $SSE Composite Index (000001.SH)$ $CSI 300 Index (000300.SH)$ $Chinext Price Index (399006.SZ)$ $Shenzhen Component Index (399001.SZ)$ $Petrochina (601857.SH)$

if people believe the fed, then I have a 2008 story for you.

if people believe the fed, then I have a 2008 story for you.