No Data

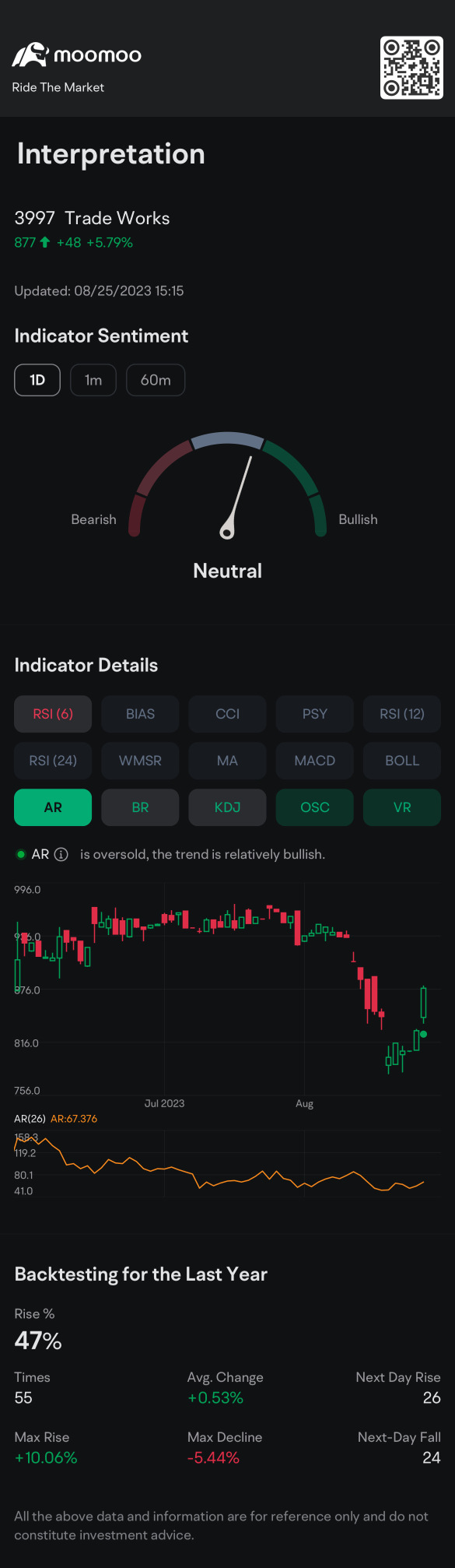

3997 Trade Works

- 1178

- -5-0.42%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Stocks that moved the previous day part1 Strike, Nichias, PKSHA Technology, etc.

Stock Name <Code> 21st Closing Price ⇒ Previous Day Comparison Strike <6196> 4655 +170 Domestic securities recommend buying. Nichias <5393> 5660 +200 Domestic securities raise investment judgment and target stock price. Hamai-san <6131> 890 -222 forecast downward revision for fiscal year ending March 2025. Trade Works <3997> 1270 +20 Introducing a shareholder benefit system. Secure <4264> 1872 +32 Continues to provide AI-based detection and notification platform.

Active and newly established stocks in the afternoon session.

*Strike <6196> 4655 +170 domestic securities are recommended for buying. *Nichias <5393> 5660 +200 domestic securities raise investment rating and target stock price. *Hamai Sanki <6131> 890 -22 The performance forecast for the fiscal year ending March 2025 has been revised downward. *Trade Works <3997> 1270 +20 introduces a shareholder benefit system. *Secure <4264> 1872 +32 continues to offer detection and notification platform based on AI, "Secure AI."

Toyo Securities, Satiwayn, MRO, etc.

<2914> JT 4094 -156 sharply continues to fall. It is reported that the company, along with American company Philip Morris and British American company, has been presented with a settlement proposal of approximately 3.5 trillion yen in a lawsuit regarding tobacco health risks in Canada. Details such as the distribution of the burden among the three companies are still undecided. While the clearing of the risk factor related to the lawsuit can be seen as positive, there seems to be a prevailing view that the settlement burden may exceed expectations. <8614>

Three points to focus on in the afternoon session - buying interest shifts to a corner of the semiconductor sector.

In the afternoon of the 21st, in the following three points of the trading session, attention should be paid: ・ The Nikkei Average continues to rise, with buying interest focusing on the semiconductor sector ・ The dollar-yen is weak, keeping an eye on US interest rates ・ Top contributors to the gains are Advantest <6857> in first place, followed by Tohoku Elec <8035> ■ The Nikkei Average continues to rise, with buying interest focusing on the semiconductor sector. The Nikkei Average continues to rise. It closed the morning session at 39,110.95 yen, up 129.20 yen (with approx. 0.7 billion 87.05 million shares in volume). The Dow Jones in the US market last weekend was up 36.

The Nikkei average continues to rise, with buying interest heading towards the semiconductor sector.

The Nikkei Average continues to rise. It ended the morning session with a gain of 129.20 yen at 39,110.95 yen (volume approx. 0.7 billion 87.05 million shares). The Dow Jones Industrial Average in the US market last weekend closed at 43,275.91, up 36.86 points, while the Nasdaq ended trading at 18,489.55, up 115.94 points. With profit-taking selling near record highs and a retreat in optimistic economic views, the Dow moved weakly. Nasdaq involved Apple (AAPL) and semiconductor Nvidia (NVDA) for mobile devices.

Hot stocks digest (morning): 31, Tradeworks, rakuten, etc

Tsugami <6101>: 1461 yen (0 yen) in a stalemate. It announced an upward revision of the first half performance and dividend financial estimates last weekend. Operating profit is being raised from the previous estimate of 8 billion yen to 9.9 billion yen, an increase of 66.6% compared to the same period last year, indicating that stronger than expected orders are being maintained. The interim dividend is also being raised from the previous plan of 24 yen to 27 yen. Regarding the full-year forecast and year-end dividends, they are planning to announce them in the future. While the dividend increase is positive, the operating profit for the first quarter was 5.79 billion.

Analysis

Price Target

No Data

No Data