No Data

4063 Shin-Etsu Chemical

- 5168.0

- +28.0+0.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nikkei Average Contribution Ranking (pre-close) ~ The Nikkei Average has risen for five consecutive days, with Fast Retailing contributing about 25 yen per share.

As of the close 24 days ago, the number of advancing and declining stocks in the Nikkei Average was 191 gainers, 34 losers, and 0 unchanged. The Nikkei Average has risen for five consecutive days. It closed the morning session at 40,192.85 yen, up 233.98 yen (+0.59%) from the previous day (with an estimated Volume of 0.9 billion 30 million Stocks). On the 23rd, the U.S. stock market continued to rise. The Dow Inc rose by 408.34 dollars to 44,565.07 dollars, and the Nasdaq increased by 44.34 points to close at 20,053.68. Employment-related indicators...

Shin-Etsu Chemical Completes 94 Billion Yen Share Buyback

ADR Japan stock ranking – mixed highs and lows, with Chicago being 30 yen higher than Osaka at 39,920 yen.

Japanese stocks represented by American Depositary Receipts (ADRs) saw an increase in comparison to the Tokyo Stock Exchange (calculated at 156.02 yen per dollar), including Orion Land <4661>, Sumitomo Mitsui Financial Group <8316>, Mitsubishi Corporation <8058>, Mizuho Financial Group <8411>, Daiichi Sankyo <4568>, Marubeni <8002>, and Mitsui & Co. <8031>, while Disco <6146>, Japan Post Bank <7182>, Nidec <6594>, SoftBank Group <9984>, Japan Post Holdings <6178>, and Tokyo Electron <8035> experienced declines.

The STAR for AI-related stocks continues, temporarily recovering to the 0.04 million yen range.

The Nikkei average rose for the fourth consecutive day, finishing the trade at 39,958.87 yen, up 312.62 yen (estimated Volume of 1.8 billion 70 million shares). In the previous day's USA market, the popularity of Artificial Intelligence (AI) related stocks continued, and the rise of technology stocks was noticeable, which led the Nikkei average to open higher. After the opening, there were moments when the increase narrowed, but the desire for Buy on dips was strong, and as the day progressed, the increase expanded, reaching as high as 40,036.07 yen, marking a return to the 0.04 million yen level for the first time in about two weeks since the 8th.

Stock News Premium = October to December financial results, Main Board peaks at the end of January - February focuses on Automobiles such as Toyota.

The financial results season for Japanese companies for the last year from October to December is starting. Following the preliminary announcements this week, the peak on the Tokyo Stock Exchange Main Board will be on the 31st of next week. In February, each company will announce their performance daily until the 14th, and this momentum is likely to influence the direction of the market. For the October to December (third quarter) financial results of firms listed on the Main Board, about 180 companies are scheduled for the 31st. February 7th will also be a crucial day with approximately 170 companies expected to disclose their results, and when combined with companies from the Standard and Growth markets, that day will be significant.

The Nikkei average is up by 337 yen, being mindful of psychological thresholds.

The Nikkei average is up by 337 yen (as of 1:50 PM). In terms of contribution to the Nikkei average, SoftBank Group <9984>, Advantest <6857>, and Fast Retailing <9983> are the top positive contributors, while Tokyo Electron <8035>, Lasertec <6920>, and Shin-Etsu Chemical <4063> are the top negative contributors. In the Sector, Nonferrous Metals, Other Products, Machinery, Pulp & Paper, and Services industries have the highest rate of increase, while Electricity & Gas, Pharmaceutical, and Food are among them.

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

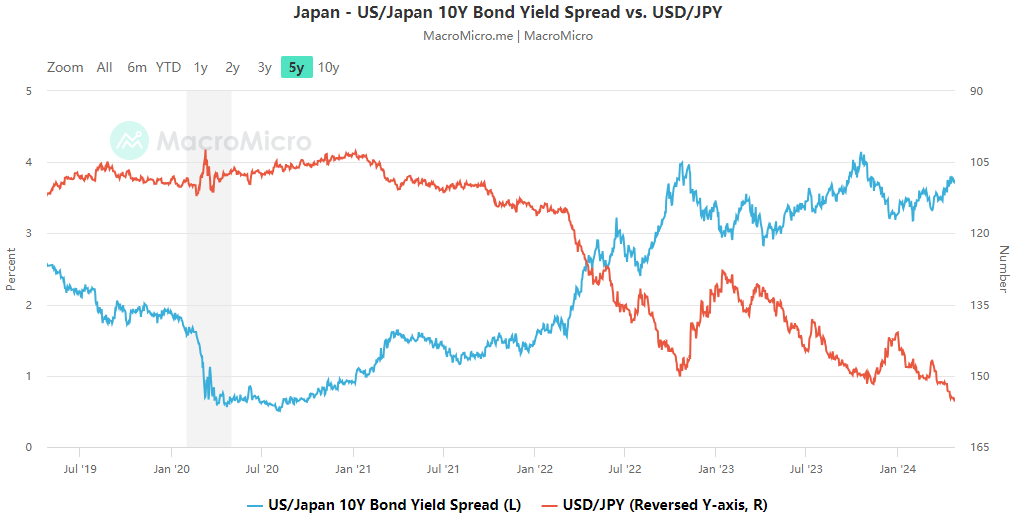

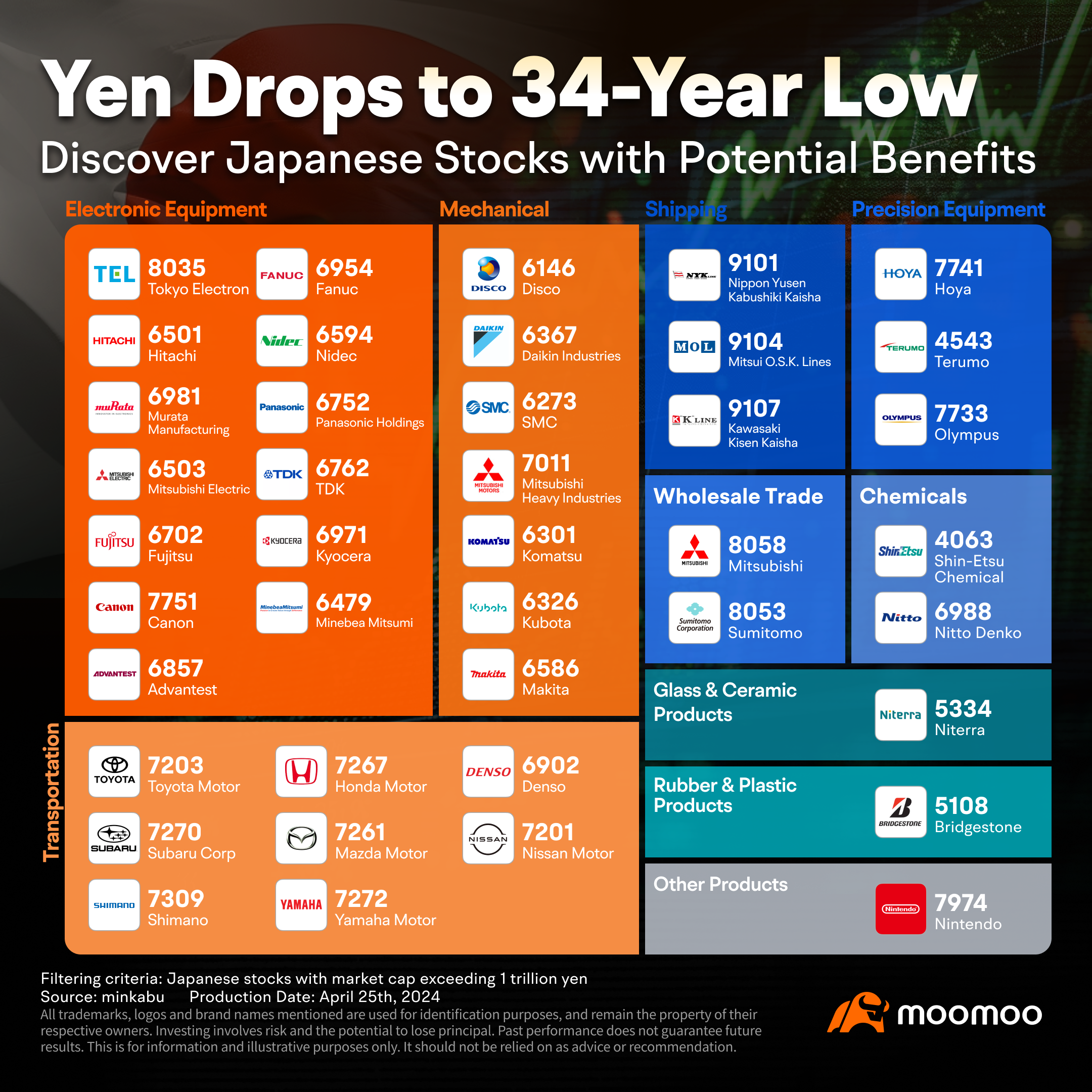

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

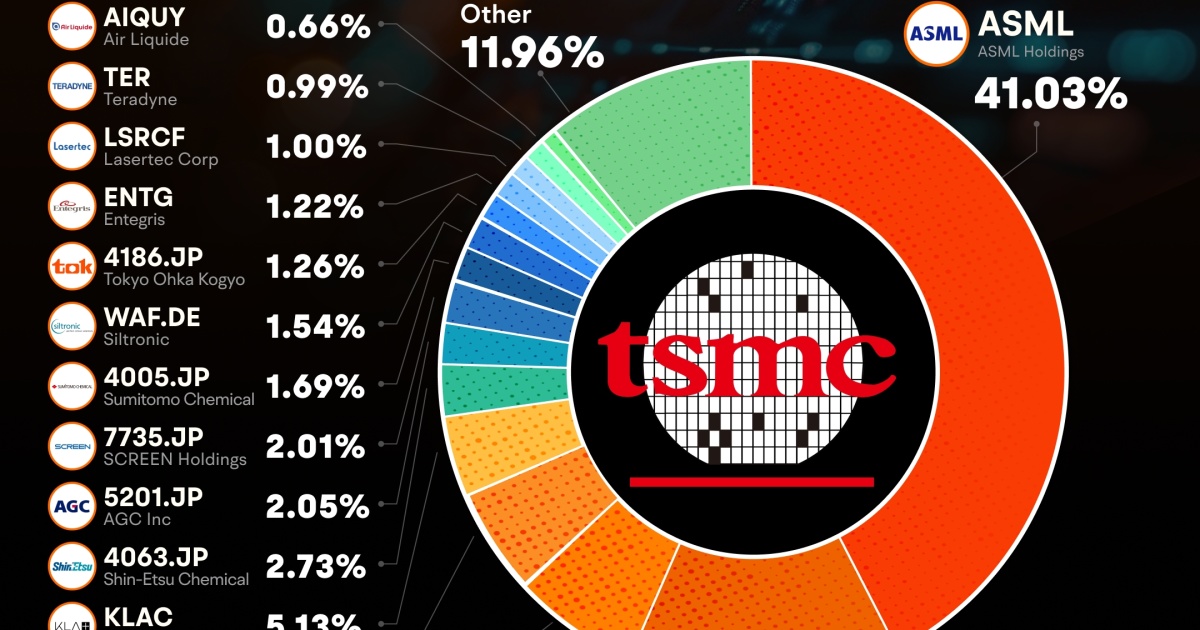

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...