No Data

4063 Shin-Etsu Chemical

- 5265.0

- -155.0-2.86%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock rankings – mixed highs and lows, Chicago is up 100 yen compared to Osaka at 39,570 yen.

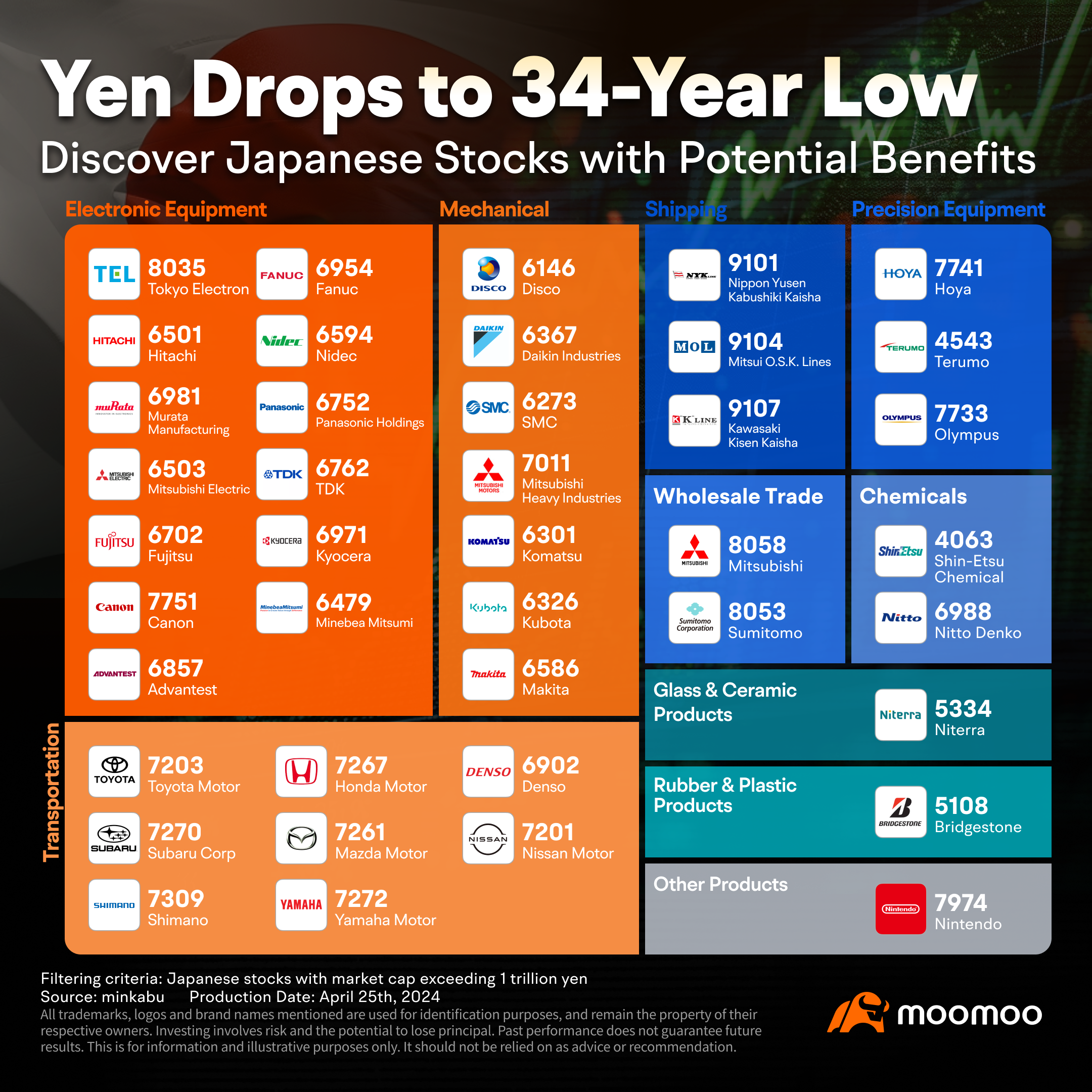

ADR Japan stock ranking - mixed highs and lows, Chicago is up 100 yen compared to Osaka at 39,570 yen - Japanese stocks of ADR (American Depositary Receipt) compared to the Tokyo Stock Exchange (based on 1 dollar = 153.66 yen), such as SoftBank Group <9984>, Mitsui Sumitomo FG <8316>, Mizuho FG <8411>, Mitsubishi Corporation <8058>, HOYA <7741> rose, while Japan Post Bank <7182>, MS&AD Insurance HD <8725>, Nidec <6594>, Japan Post <6178>.

Profit-taking Sell is prevailing in response to the consecutive rise.

The Nikkei Stock Average fell for the first time in five days, finishing the trade at 39,470.44 yen, down 378.70 yen (estimated Volume 1.9 billion 90 million shares). In the previous day's US market, major stock price indices declined, and after recovering the significant 0.04 million yen mark the day before, profit-taking Sell orders were prioritized due to short-term overheating. Although there were some moments where prices slightly recovered due to Buy orders on dips, the failure to stay above the SQ value (39,434.85 yen) invited selling pressure, and there were instances where it dropped to 39,247.41 yen towards the end of the morning session.

Against the backdrop of rising U.S. tech stocks and a weaker yen, it temporarily recovered to the 0.04 million yen level.

The Nikkei average rose significantly for the fourth consecutive day, closing at 39,849.14 yen, up 476.91 yen (Volume approximately 1.9 billion 30 million shares). Since the previous day's USA market was driven by buying in technology stocks, buying started off strongly, and in the mid-morning session, it rose to 40,091.55 yen, recovering the important level of 0.04 million yen for the first time since October 15. Additionally, the yen exchange rate depreciated to 152 yen to the dollar, which was also favorable for export-related stocks.

The Nikkei Average is up by 567 yen, with interest in the U.S. PPI, ETC.

The Nikkei average is up 567 yen (as of 14:50). In terms of contribution to the Nikkei average, Advantest <6857>, Fast Retailing <9983>, and Recruit Holdings <6098> are among the top positive contributors, while 7 & i Holdings <3382>, Shin-Etsu Chemical <4063>, and Konami Group <9766> are among the top negative contributors. In the Sector, services, Oil & Coal Products, electric and gas industries, Electric Appliances, and Precision Instruments have the highest rates of increase, while Iron & Steel has decreased.

Yokan HD, Casio, ETC (additional) Rating

Upgraded - Bullish Code Stock Name Brokerage Firm Previous After ------------------------------------------------------------- <3291> Iida GHD Morgan Stanley "Underweight" "Equal Weight" <9021> JR West Japan SMBC Nikko "3" "2" <9502> Chubu Electric Mizuho "Hold" "Buy" Downgraded - Bearish Code Stock Name Brokerage Firm Previous After ------------------------

Today's flows: 12/11 Mitsubishi Heavy Industries saw an inflow of JPY¥ 8.72 billion, Disco saw an outflow of JPY¥ 12.49 billion

On December 11th, the TSE Main Market saw an inflow of JPY¥ 677.06 billion and an outflow of JPY¥ 707.73 billion.$Mitsubishi Heavy Industries(7011.JP)$, $Kawasaki Heavy Industries(7012.JP)$ and $

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

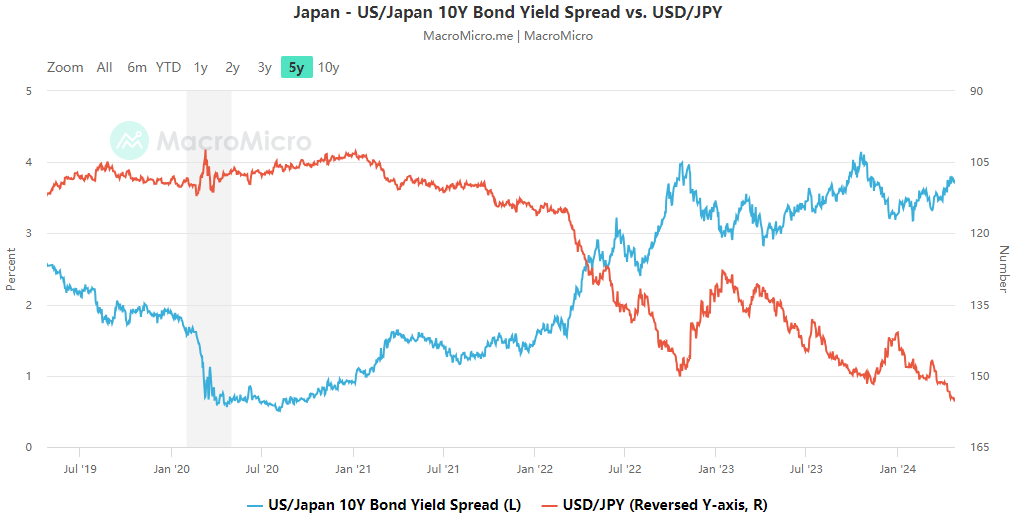

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

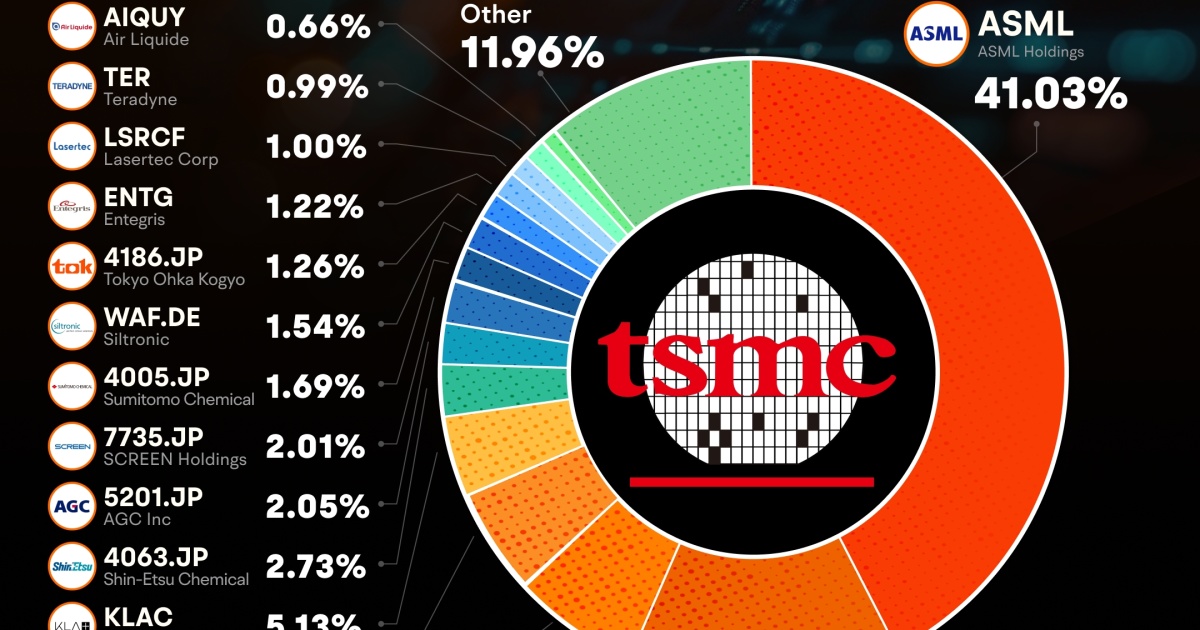

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...

No Data