No Data

4661 Oriental Land

- 3488.0

- -50.0-1.41%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nikkei Average Contribution Ranking (Before the break) ~ The Nikkei Average slightly rebounded, with two stocks, TDK and Tokyo Electron, pushing it up by approximately 47 yen.

As of the close two days ago, the number of advancing and declining stocks in the Nikkei average was 144 gaining stocks, 78 losing stocks, and 3 unchanged stocks. The Nikkei average had a slight rebound, finishing the morning session at 38,220.01 yen, up 11.98 yen (volume approximately 0.7 billion 73.93 million shares). Last Friday, November 29, the Dow Inc. in the USA closed up 188.59 dollars at 44,910.65 dollars, and the Nasdaq closed up 157.69 points at 19,218.17 points. After the presidential election, the confidence index for small and medium-sized enterprises has improved.

Japanese stock buybacks this week (11/25~11/29)

――――11/25――――$Baudroie(4413.JP)$ will buy back up to 640.6K shares, 4% of its outstanding shares (excluding its own shares), for an amount of JPY¥ 3.5 billion.――――11/26――――$Oriental Land(4661.JP)$

ADR Japanese stock rankings - Selling pressure predominant on SoftBank Group etc, Chicago down 290 yen compared to Osaka at 37,810 yen.

In comparison to the Tokyo Stock Exchange (converted at 1 dollar to 151.07 yen), Japanese stocks of American Depositary Receipts (ADR) such as Japan Post Bank <7182>, Japan Post <6178>, SoftBank Group <9984>, Renesas <6723>, Nidec <6594>, Advantest <6857>, and Mitsubishi Corporation <8058> have declined, indicating overall selling pressure. The clearing price of Chicago Nikkei 225 Futures is 37,810 yen, down 290 yen compared to daytime trading in Osaka. The US stock market has fallen back. The Dow Inc. average decreased by 138.25 dollars to 44,722.

Stocks that moved the previous day part 1 Rain Wind Sun, Dai Do Group HD, SHIFT etc.

Stock name <Code> 27th closing price ⇒ Compared to the previous day Advantest <6857> 8506 -328 fell below the 25-day line the previous day and closed out sell orders| Monster Lab <5255> 117 -2KDDI Technology joined in the development of AI solutions for retail store promotion but temporary popularity did not continue| Pixel CZ <2743> 79 +16Concluded a purchase agreement for GPU servers equipped with NVIDIA's H100. GNI <2160> 2953 +145 consolidated

Oriental Land Completes Share Repurchase

Sanrio, DyDo, People, Dreams, Technology etc.

<9072> Nikon HD 1950 +14 rebounds after cutting back. Announced the issuance of 22 billion yen of Euro-denominated convertible bonds due in 2031. The conversion price is 2090 yen, with an increase rate of 7.95% compared to the previous day's closing price, and an expected ratio of 8.45% of potential shares. On the other hand, to mitigate short-term impacts on supply and demand, a 7 billion yen share buyback in off-hours trading was also announced. Positive reactions are dominant as it is expected to lead to improved capital efficiency. It should be noted that the funds raised through the CB will be used for share buyback.

Comments

Do you find it

Yes?

No worries!

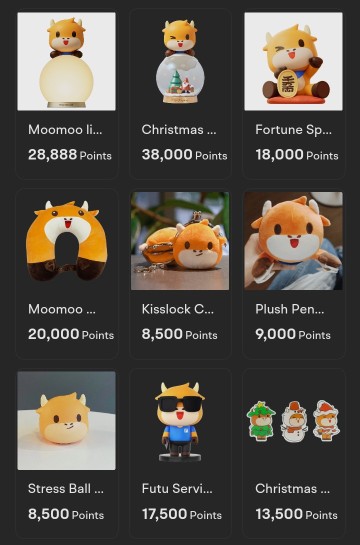

Why not try these methods to get rewards bigger

To get rewards bigger than the yield coupon, Mooers may exchange 400 coins for 1000 MooMoo points.

Let's assume Mooers managed to collect 4000 coins. This would mean that Mooers could exchange f...

Analysis

Price Target

No Data

No Data

Cui Nyonya Kueh : simi up down game ?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh :

Mars Mooo OP Cui Nyonya Kueh :

Cui Nyonya Kueh : chey![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Mars Mooo OP Cui Nyonya Kueh :

View more comments...