No Data

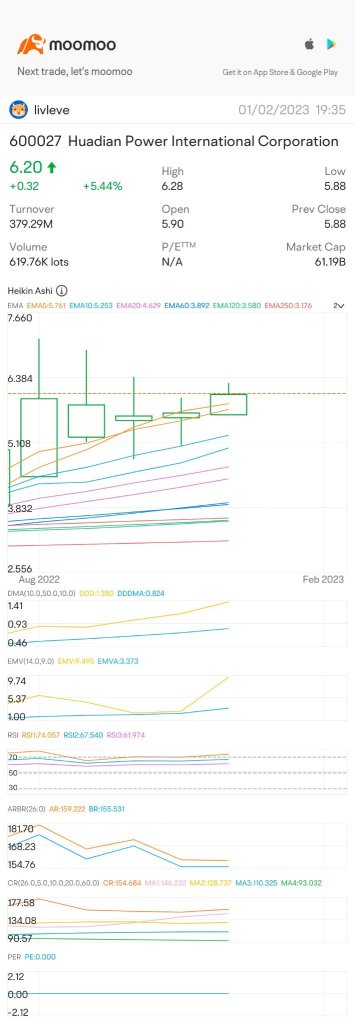

600027 Huadian Power International Corporation

- 5.72

- +0.02+0.35%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Huadian Power Strengthens Investment Ties With New Partnerships

Private Companies Are Huadian Power International Corporation Limited's (HKG:1071) Biggest Owners and Were Hit After Market Cap Dropped HK$1.6b

Cinda Securities: Provincial electrical utilities spot market turning positive, highlighting the value of coal-fired power generation.

In the situation of tight supply and demand for electrical utilities, the peak value of coal-fired power generation is highlighted; with the continuous promotion of electricity market reform, electricity prices are expected to increase slightly and steadily.

Huadian Power's Q3 Profit Inches Up; Shares Rise 5%

Stock market anomaly | Huadian Power International Corporation (01071) rose more than 5%, intending to acquire high-quality thermal power assets and issue A-shares to raise matching funds.

Huadian Power International Corporation (01071) rose more than 5%, as of the deadline, up 5.11%, closing at 3.91 Hong Kong dollars, with a turnover of 35.6865 million Hong Kong dollars.

In the first three quarters, the net income of huadian power (01071) increased by 14.63% year-on-year.

Jingwucailiao | Huadian International Electric Power (01071) announced its performance for the third quarter of 2024. During the period, the net income attributable to shareholders of the listed company was 1.933 billion yuan (RMB, the same below), an increase of 0.87% year-on-year; basic earnings per share were 0.16 yuan. Operating income during the period was 31.63 billion yuan, an increase of 1.13% year-on-year. For the previous three quarters, the net income attributable to shareholders of the listed company was 5.156 billion yuan, an increase of 14.63% year-on-year; basic earnings per share were 0.43 yuan. Operating income during the period was 84.811 billion yuan, a decrease of 6.52% year-on-year.

Comments

Investors Could Be Concerned With Huadian Power International's (HKG:1071) Returns On Capital

Investors Could Be Concerned With Huadian Power International's (HKG:1071) Returns On CapitalAnalysis

Price Target

No Data

No Data