No Data

600115 China Eastern Airlines Corporation

- 4.31

- -0.02-0.46%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hong Kong stocks are experiencing fluctuations | The Aviation/airlines Industry continues its recent upward trend with Bullish Signals emerging continuously. Airlines' profitability is expected to continue to recover.

The Aviation/airlines Industry continues to rise; as of the time of writing, MEILAN AIRPORT (00357) is up 3.06%, at 9.42 Hong Kong dollars; China Southern Airlines (01055) is up 2.15%, at 4.27 Hong Kong dollars; Air China Limited (00753) is up 2.06%, at 5.45 Hong Kong dollars.

Airlines: 2025 Positive Outlook Overshadowed By Supply Disruption

The Aviation Sector has risen over 10% in three Trading days: a turning point in supply and demand is emerging, could a prosperity cycle begin in 2025?

In fact, based on historical experience, the 'recovery' of performance and valuation in the Aviation/airlines Industry this time is not unfounded.

Multiple bullish factors are driving the recovery of the aviation industry, with Air China Limited rising nearly 8%.

① The aviation/airlines industry has strengthened recently. What news has driven this trend? ② Why is air china limited leading the rise?

Hong Kong stocks are moving differently | The aviation/airlines industry continues to rise as domestic air traffic demand maintains a recovery trend. Under a low base, the sector is expected to see compensatory growth in 2025.

Aviation/airlines industry continues to trend upwards, as of the time of publication, Air China Limited (00753) rose by 4.27%, to 5.13 Hong Kong dollars; China Southern Airlines (01055) rose by 2.03%, to 4.03 Hong Kong dollars; China Eastern Airlines (00670) rose by 1.95%, to 2.62 Hong Kong dollars; Beijing Capital International Airport (00694) rose by 1.42%, to 2.86 Hong Kong dollars.

Hong Kong stock concept tracking | The Spring Festival travel rush in 2025 is expected to become a test of the aviation cycle, and the aviation sector is likely to welcome a profit release cycle (including concept stocks).

The pricing strategy of the aviation industry may face a turning point in 2025, and the performance elasticity of the major airlines is significant.

Comments

$TENCENT (00700.HK)$ incremented 0.3% to $359.2 after China approved 75 imported online games, including Rainbow Six Siege agented by TENCENT.

As for other tech stocks, $BABA-W (09988.HK)$ closed the half-day flat ...

DBS: China Eastern Airlines Corp Ltd – Buy Target Price HK$2.80; RMB4.40 - Alpha Edge Investing

$China Eastern Airlines Corporation (600115.SH)$ $CHINA EAST AIR (00670.HK)$

DBS: Fly with CX as Chinese carriers continue to miss the mark – Regional Aviation: Airlines - Alpha Edge Investing

$China Eastern Airlines Corporation (600115.SH)$ $Air China Limited (601111.SH)$ $China Southern Airlines (600029.SH)$ $CATHAY PAC AIR (00293.HK)$

UOB KH has a buy rating with tp of HKD6.32. They have sell ratings on China South Air and China East Air with tp of HKD3.68 and HKD2.35 respectively.

Based on their respective preliminary earnings guidance, all three major Chinese airlines were still loss-making in 2Q23, missing their expectations of a turnaround in 2Q23. Excluding one-offs and forex losses (seen by all three airlines), CSA and Air China wer...

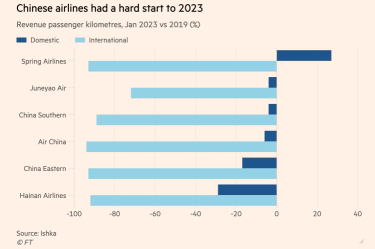

On January 6, the CAAC claimed that it would increase the proportion of international aviation, cargo aviation, regional aviation, and general aviation in the civil aviation business, accelerate the construction of a new pattern of opening up civil aviation to the outside world and strive for an overall recovery to the pre-epidemic level of 75%.

Just past ...

No Data