No Data

601088 China Shenhua Energy

- 39.22

- -0.16-0.41%

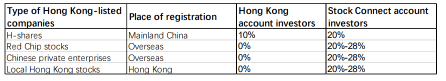

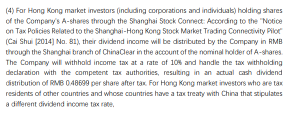

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

HK stocks are abnormal | Coal industrial concept(coal industry) stocks widen their decline in the afternoon. Coal companies are expected to reach the bottom in the third quarter, and winter coal prices may remain at a certain high level.

Coal industrial concept stocks widened their afternoon declines, with China Coal Energy (01898) falling by 4.22% to HKD 9.54; China Shenhua Energy (01088) fell by 2.9% to HKD 33.5; Yankuang Energy (01171) fell by 2.68% to HKD 10.18; Mongol Mining (00975) fell by 2.58% to HKD 9.06.

shanxi: It is expected that there will be limited room for the decline in winter coal prices, and the focus will be on stable high dividend stocks and metallurgical coal.

In the fourth quarter, the increase in coal supply is limited, with a seasonal decrease in hydro and new energy output. Overall, it is expected to maintain a relative balance between coal supply and demand under the game scenario.

Open Source Securities: Q3 performance improved on a quarter-on-quarter basis, coal dual logic four main line layout.

In the current slow economic recovery and low interest rate environment, funds pay more attention to the certainty of investment returns, with coal's high dividends and sustainability aligning with capital allocation preferences.

China Shenhua Energy Reports Q3 Results

The net profit of the top three coal giants declined overall in the first three quarters, with the leader Shenhua seeing a double increase in net profit in the third quarter compared to the previous quarter. | Interpretations

①Affected by the downward trend of coal prices, the performance of coal listed companies in the first three quarters generally declined, but with differentiated performance in Q3; ②Regarding the future trend of coal prices, the industry generally believes that there is hope for a recovery after hitting the bottom, but the magnitude of the increase is limited.

Citi: Maintains a 'buy' rating on China Shenhua Energy (01088) with a target price of HK$41.4.

China Shenhua Energy (01088) saw a 4% year-on-year drop in net profit in the first nine months, reaching 84% of both the market and the bank's full-year forecasts respectively.

Comments

Cars: $LI AUTO-W (02015.HK)$ $GEELY AUTO (00175.HK)$ $BYD COMPANY (01211.HK)$

Conventional Electricity: $CHINA RES POWER (00836.HK)$ $HUANENG POWER (00902.HK)$ $CKI HOLDINGS (01038.HK)$

Shipping: $COSCO SHIP HOLD (01919.HK)$ $OOIL (00316.HK)$

Coal: $CHINA SHENHUA (01088.HK)$ $YANKUANG ENERGY (01171.HK)$ $YANCOAL AUS (03668.HK)$

Home Appliances: $MIDEA GROUP (00300.HK)$ $HAIER SMARTHOME (06690.HK)$ $HISENSE HA (00921.HK)$

Investment: $CITIC SEC (06030.HK)$ $CHINA CINDA (01359.HK)$

���������...

There was HKD351.6 million, HKD326.1 million and HKD160.6 million Southbound Trading net outflow from $MEITUAN-W (03690.HK)$ , $CHINA SHENHUA (01088.HK)$ and $CHINA MOBILE (00941.HK)$ .

For $SH->HK Connect (GangGuTong.HK)$ , $TENCENT (00700.HK)$ was the most active stock with ...

Southbound trading has been crucial in stabilizing Hong Kong’s stock market amid geopolitical risks.

BOCI expects strong demand from Mainland investors for Hong Kong stocks to continue due to attractive valuations and high dividend yields.

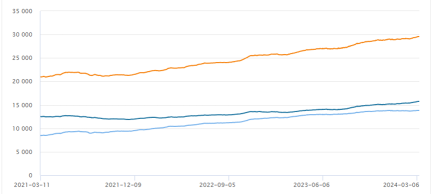

The volume of southbound trading is projected to grow from RMB289.4 billion in 2023 to RMB600 billion f...

Analysis

Price Target

No Data

No Data