No Data

601336 New China Life Insurance

- 50.97

- -0.33-0.64%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Guolian: Stricter regulations in 2025 are expected to encourage leading insurance companies to expand their advantages.

With the implementation of the "reporting and operating as one" policy in the individual insurance channel, the continued decrease in product reservation rates, and the active adjustment of product structure by insurance companies, the NBV Margin is expected to further improve by 2025, thereby supporting the positive growth of NBV.

New China Life Insurance Unveils Board Structure

New China Life Insurance (01336.HK: Gong Xingfeng's qualifications to serve as Director, President, and Chief Financial Officer of the company have been approved.

On December 24, Gelonghui reported that New China Life Insurance (01336.HK) announced that it recently received the National Financial Supervisory Administration's ("Financial Regulatory Authority") approvals regarding the qualification of Gong Xingfeng as a Director of New China Life Insurance Co., Ltd. (No. Jin Fu [2024] 819), the approval of Gong Xingfeng as General Manager (No. Jin Fu [2024] 843), and the approval of Gong Xingfeng as Financial Officer (No. Jin Fu [2024] 825), and the Financial Regulatory Authority has approved Gong Xingfeng.

Rescue or 'bottom fishing'? Four insurance companies have acquired 15 Wanda Assets this year.

New China Life Insurance (601336.SH) has taken over another Wanda Assets. According to Tianyancha information, Wanda Plazas in Chifeng and Jinjiang have already occurred...

After long-term bonds fell below 2%, insurance funds shifted towards equity assets, with high dividend and high ROE being the top choices.

Recently, the yield on 30-year government bonds has fallen below 2.0%. Guosen believes that the central tendency of long-term bond rates continues to decline, and the pressure on investment income from insurance funds is further increasing. Since the beginning of this year, companies represented by Great Wall Life, China Pacific Insurance, and Ruizhong Life have been increasing their stakes in high-quality listed companies, mainly concentrated in industries such as utilities, transportation, and Banks, which have high dividend yields and relatively stable ROE levels.

A Closer Look At New China Life Insurance Company Ltd.'s (SHSE:601336) Impressive ROE

Comments

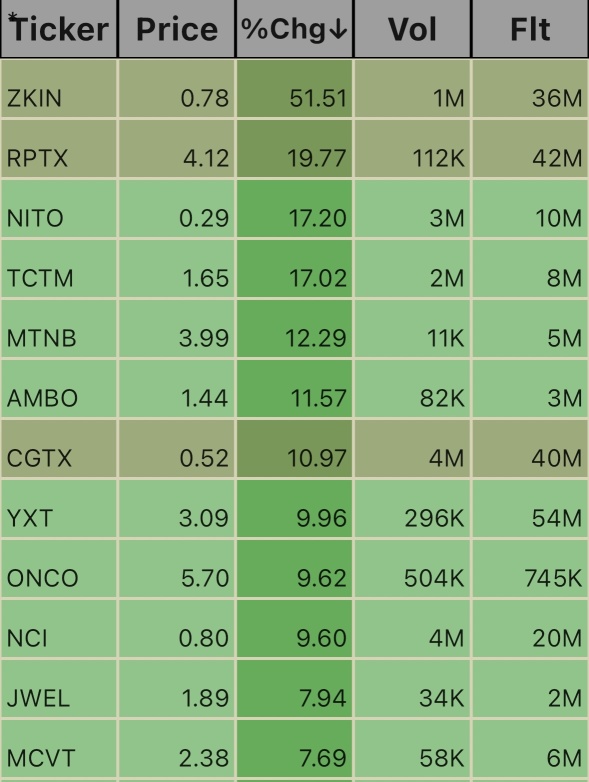

📊⚡️📊

No Data