No Data

6857 Advantest

- 9447.0

- +352.0+3.87%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock ranking - Overall selling pressure with Yu-cho Bank and others, Chicago is down 100 yen compared to Osaka at 40,130 yen.

Japanese stocks of American Depositary Receipts (ADR), when compared to the Tokyo Stock Exchange (calculated at 157.91 yen per dollar), saw declines in stocks such as Japan Post Bank <7182>, Advantest <6857>, Disco <6146>, SMC <6273>, DAIKIN INDUSTRIES, LTD. Unsponsored ADR <6367>, Toyota Motor <7203>, and Honda Motor <7267>, indicating a general trend of selling. The settlement price of the Chicago Nikkei 225 Futures was 40,130 yen, which is 100 yen lower than the daytime rate in Osaka. The US stock market also experienced a decline, with Dow Inc down by 333.59 dollars to 42,9.

The New York market fell on the 27th [New York market - close]

[NYDow・Nasdaq・CME (table)] NYDOW; 42992.21; −333.59 Nasdaq; 19722.03; −298.33 CME225; 40130; −100 (compared to the Osaka exchange) [NY Market Data] The NY market on the 27th declined. The Dow average ended trading down $333.59 at $42,992.21, and Nasdaq finished down 298.33 points at $19,722.03. After the opening, it fell due to profit-taking ahead of the year-end.

The U.S. stock market fell, and profit-taking Sell in the tech sector intensified (27th).

"Chicago Nikkei Average Futures (CME)" (27th) MAR24 O 39,770 (denominated in USD) H 40,545 L 39,675 C 40,220 compared to the Osaka exchange -10 (evening comparison +80) Vol 5,568 MAR24 O 39,690 (denominated in yen) H 40,450 L 39,585 C 40,130 compared to the Osaka exchange -100 (evening comparison -10) Vol 23,075 "Overview of American Depositary Receipts (ADR)" (27th) In the ADR market, compared to the Tokyo Stock Exchange (1 USD = 157.91 JPY)

Recovery to 0.04 million yen level due to expectations for the New Year market.

The Nikkei average rose significantly for the third consecutive day. It ended at 40,281.16 yen, up 713.10 yen (with an estimated Volume of 2.1 billion 30 million shares), recovering to the 0.04 million yen level for the first time in about five and a half months since July 19. The yen rate weakened to around 158 yen to the dollar in the previous day's Overseas market, leading to early buying focused on export stocks such as Automobiles, and the Nikkei average started to rise. Just before the midday close, it recovered to the 0.04 million yen level for the first time in about two weeks. Afterwards, Semiconductor-related stocks and other high-value stocks continued to rise.

JP Movers | DeNA Rose 15.58%, Leading Nikkei 225 Components, Nissan Motor Topped Turnover List

Market sentiment was high today as Nikkei 225 components generally rose, with DeNA(2432.JP) being the top gainer today, rising 15.58% to close at 3115.0 yen. In addition, the top loser was Nissan Motor(7201.JP),falling 7.82% to end at 509.2 yen.

Today's flows: 12/27 Fast Retailing saw an inflow of JPY¥ 8.58 billion, Toyota Motor saw an outflow of JPY¥ 10.14 billion

On December 27th, the TSE Main Market saw an inflow of JPY¥ 850.32 billion and an outflow of JPY¥ 742.74 billion.$Fast Retailing(9983.JP)$, $Advantest(6857.JP)$ and $Disco(6146.JP)$ were net buyers

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$(4 Hour Chart) -[BULLISH↗ *]We stay slightly bullish as we expect price to push towards 6000 resistance level. A 4 hour candlestick closing above 6000 resistance level would open a push towards 6035 resistance level. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlesti...

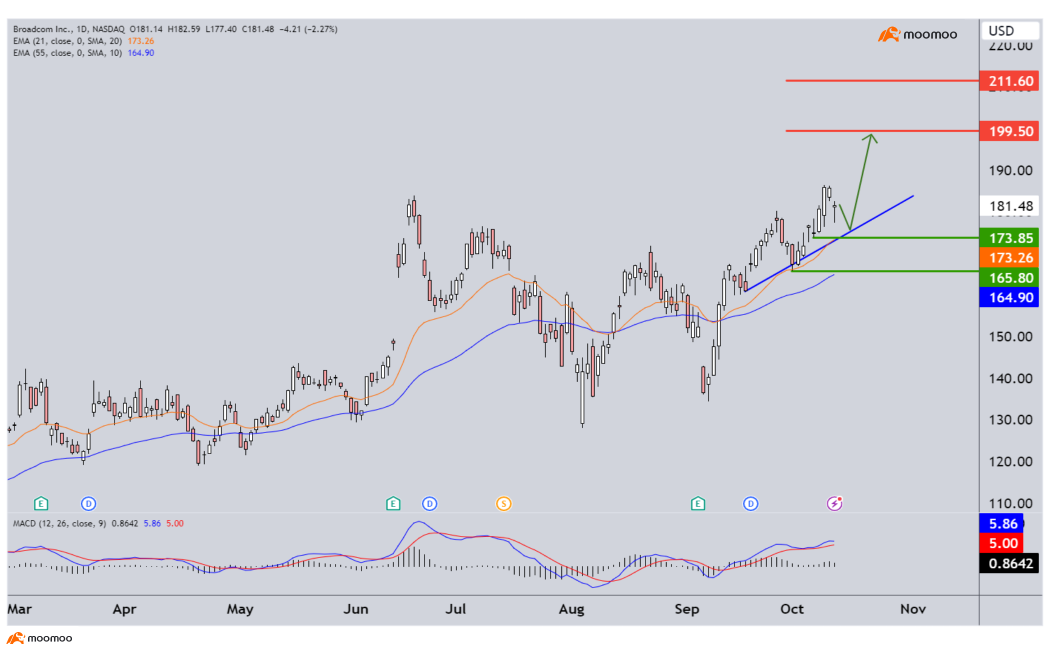

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]View remains unchanged. We maintain our bullish directional bias as long as price is holding above 5680 support level. Price is still expected to push higher towards 5945 resistance. Technical indicators are also advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below ...

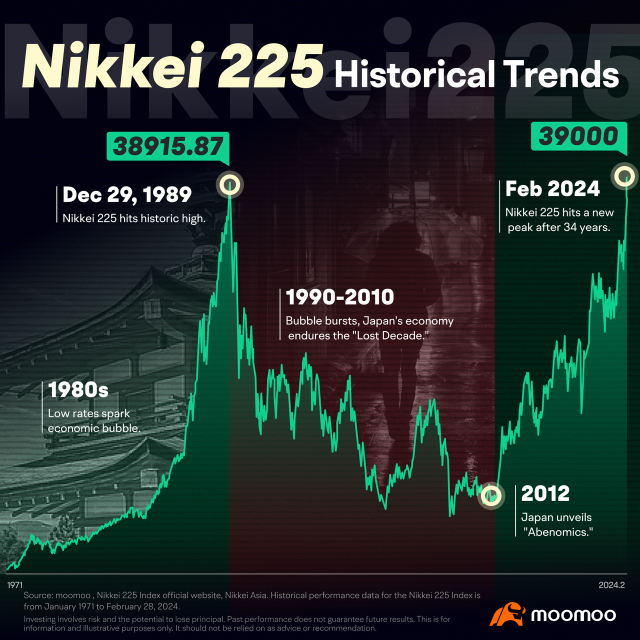

Later, when I had learned more about the Japanese market was from the group mates' chat about "When will Moomoo be listed on the Japanese stock market? The Japanese stock market has been doing well lately."

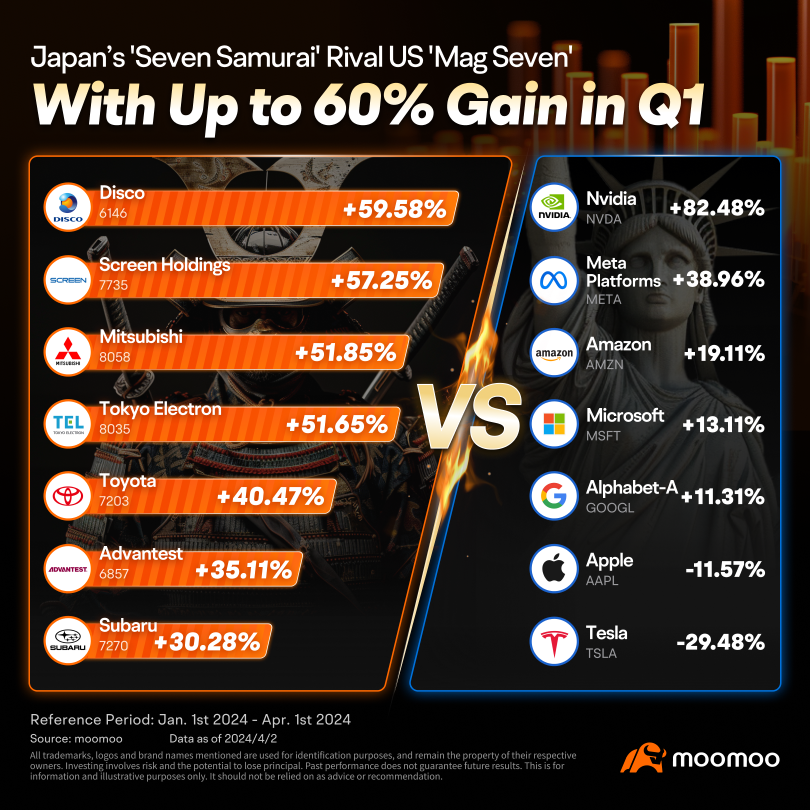

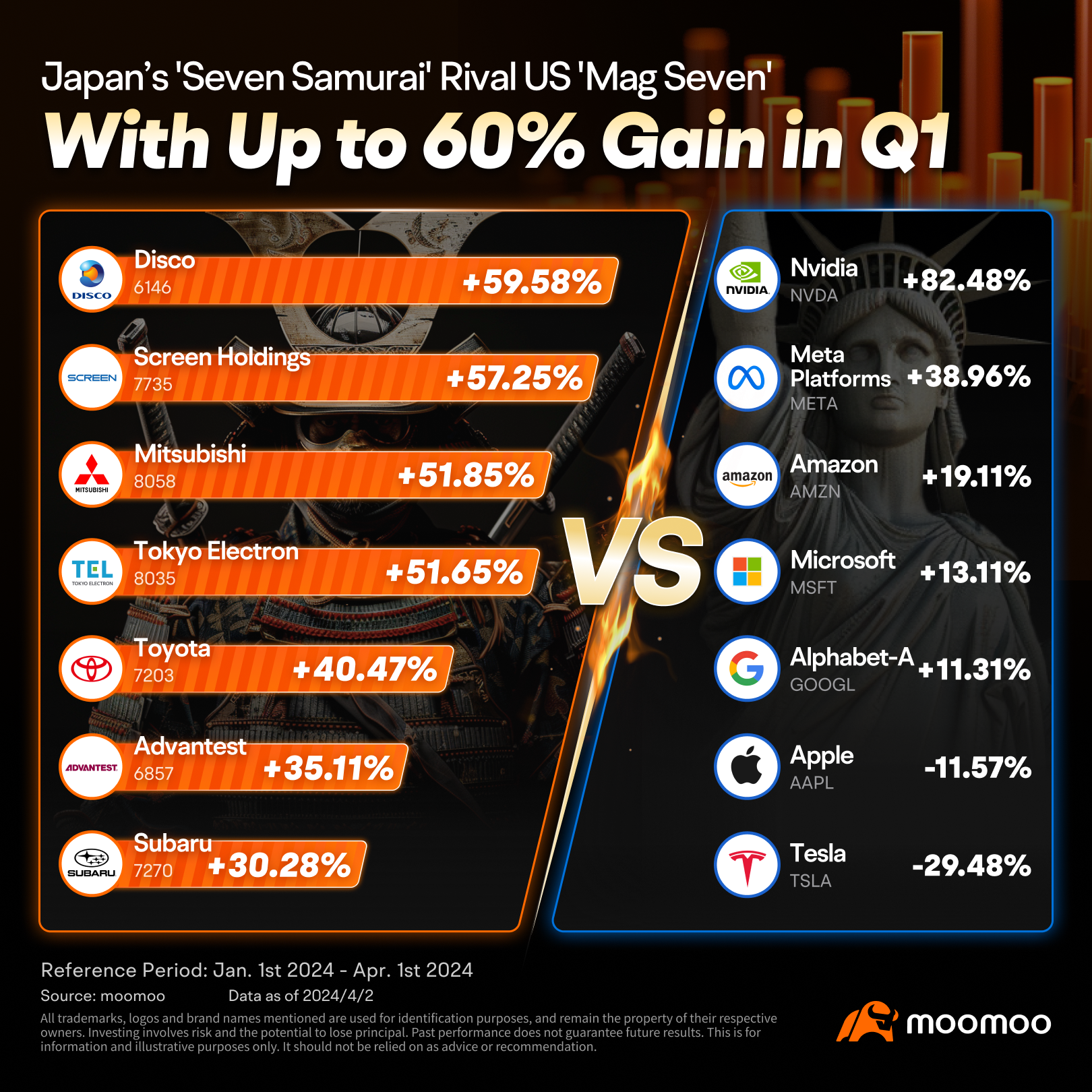

The Japanese stock market's record-breaking run has brought the "Seven Samurai" stocks into the spotlight for global investors. Coined by Bruce Kirk, a Goldman Sachs Japan strategist, the term draws...

No Data

Cui Nyonya Kueh :

Musang Siguntang : ???