No Data

688363 Bloomage Biotechnology Corporation Limited

- 49.83

- -1.05-2.06%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Guo Xueping, the Deputy General Manager and core technical staff of Bloomage Biotechnology Corporation Limited (688363.SH), has retired and left his position.

Bloomage Biotechnology Corporation Limited (688363.SH) announces that the company's Director, Deputy General Manager, and core technical staff member, Dr. Guo Xueping, due to reaching...

At CN¥53.24, Is Bloomage BioTechnology Corporation Limited (SHSE:688363) Worth Looking At Closely?

Bloomage Biotechnology Corporation Limited (688363.SH): Actively introducing AI and machine learning technologies.

On December 25, Gu Longhui reported that Bloomage Biotechnology Corporation Limited (688363.SH) stated on the interactive platform that the company is actively introducing AI and machine learning technology, combined with high-throughput screening technology, to achieve efficient operation in synthetic biology for strain design, construction and trait screening, data analysis, biological system modeling, and downstream process development optimization, thereby improving project development conversion efficiency and product quality. In addition, using the AI design prediction platform, mechanism research and target prediction are conducted, and combined with efficient, reliable, and diverse cell models, skin models, and other application mechanism research platforms, for the design and development of new bioactive substances and efficacy verification.

Bloomage BioTechnology Corporation Limited's (SHSE:688363) Market Cap Surged CN¥2.2b Last Week, Private Equity Firms Who Have a Lot Riding on the Company Were Rewarded

Does Bloomage BioTechnology (SHSE:688363) Have A Healthy Balance Sheet?

Bloomage Biotechnology Corporation Limited (688363.SH): China Life Insurance and Chengda collectively shareholding 1.00% of the company's shares.

On November 11, Geruihui: bloomage biotechnology corporation limited (688363.SH) announced that as of November 11, 2024, Guoshou Chengda reduced its holdings of the company's shares by 4,634,782 shares through centralized auction trading, and reduced its holdings of the company's shares by 182,000 shares through bulk trading, totaling a reduction of 4,816,782 shares, accounting for 1.00% of the total shares of the company. After this equity change, Guoshou Chengda holds 29,616,504 shares of the company, accounting for 6.15% of the total shares of the company.

Comments

Bloomage BioTechnology Corporation Limited's (SHSE:688363) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

Bloomage BioTechnology Corporation Limited's (SHSE:688363) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?1. In the past three years, China's medical beauty industry has undergone earth-shaking changes, and non-surgical products occupy the mainstream

2. The brand is a marketing tool and a social contract for the legal entity to face society. Last year, it began to issue documents on supervising medical aesthetics, focusing on doctors' qualifications, marketing, and the capabilities of three types of ...

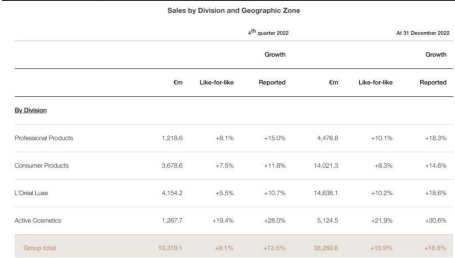

$L'OREAL (LRLCF.US)$ $Estee Lauder (EL.US)$ $Shiseido (ADR) (SSDOY.US)$

①China's overall performance is poor, with only L'Oreal's positive growth, behind the reflection of organizational efficiency and brand matrix perfection differences.

②Effective skincare continues to overgrow, perfume demand explodes, and wash care upgrade is ready to take ...

1. Epidemic + consumption off-season

National Bureau of Statistics January-November total cosmetics retail sales of 365.2 billion yuan, down 3.1% year-on-year, August-November is a continuous negative growth.

Two landmark events in the year's first half, the ebb of beauty collection stores and the cold of 618, foreshadowed the standard pressure at...

No Data