No Data

6902 Denso

- 2166.5

- 0.00.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

Today's flows: 11/28 Nissan Chemical saw an inflow of JPY¥ 2.8 billion, Advantest saw an outflow of JPY¥ 8.9 billion

On November 28th, the TSE Main Market saw an inflow of JPY¥ 770.19 billion and an outflow of JPY¥ 777.94 billion.$Nissan Chemical(4021.JP)$, $SUMCO(3436.JP)$ and $Sony Group(6758.JP)$ were net

Obayashi Corporation, Kajima, etc. (additional) Rating

Upgrade - bullish Code Stock Name Brokerage Firm Previous Change After ------------------------------------------------------ <1803> Shimizu Corporation Nomura "Neutral" "Buy" Downgrade - bearish Code Stock Name Brokerage Firm Previous Change After ------------------------------------------------------ <1801> Taisei Corporation Nomura "Buy" "Neutral"

List of converted stocks (Part 2) [List of converted stocks for Parabolic Signal]

○List of stocks to sell market Code Stock name Closing price SAR Tokyo main board <1813> Fudo Tetra 2054 2230 <1852> Asanuma Group 652671 <1871> PS 10251085 <1925> Daiwa House 46614754 <1934> Your Tech 14551543 <1969> Takasago Heat 59476340 <2130> Members 11351210 <2148> ITM 1

Nikkei Stock Average Contribution Ranking (Closing) - Nikkei Average rebounds for the first time in 3 days, with First Retailing and Toshiba Elevator pushing up about 95 yen in two stocks.

At the closing on the 22nd, the Nikkei Average component stocks had 148 stocks up, 74 down, and 3 unchanged. The US stock market rose on the 21st. The Dow Jones Industrial Average closed at 43,870.35, up 461.88 points, while the Nasdaq finished at 18,972.42, up 6.28 points. Geopolitical risks eased and the market rose after the opening. Chicago Fed President Goolsbee indicated that next year's interest rates are likely to be 'below current levels,' prompting buying interest in lower interest rates.

Today's flows: 11/22 Mitsubishi UFJ Financial Group saw an inflow of JPY¥ 6.82 billion, Seven & i Holdings saw an outflow of JPY¥ 5.18 billion

On November 22nd, the TSE Main Market saw an inflow of JPY¥ 701.58 billion and an outflow of JPY¥ 692.74 billion.$Mitsubishi UFJ Financial Group(8306.JP)$, $Disco(6146.JP)$ and $Fast Retailing(9983.

ADR Japanese stock rankings - overall buying dominance including Orient Land, Chicago at 38,230 yen, 190 yen higher than Osaka.

Japanese stocks of ADR (american depositary receipt) compared to the Tokyo Stock Exchange (calculated at 154.51 yen per dollar), such as Orion Land <4661>, Mitsubishi Corporation <8058>, komatsu <6301>, Disco <6146>, Tokyo Electron <8035>, SoftBank Group <9984>, Mizuho Financial Group <8411>, have risen, with buying pressure prevailing overall. The settlement price of the Chicago Nikkei 225 futures is 38,230 yen, which is 190 yen higher than during the Osaka day session. The US stock market has risen, with the dow inc gaining 461.88 dollars.

Comments

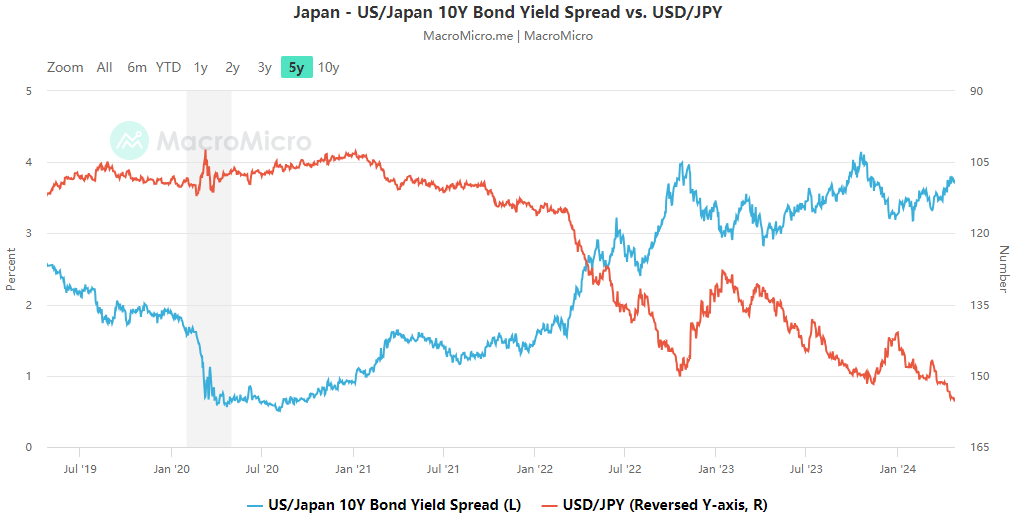

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

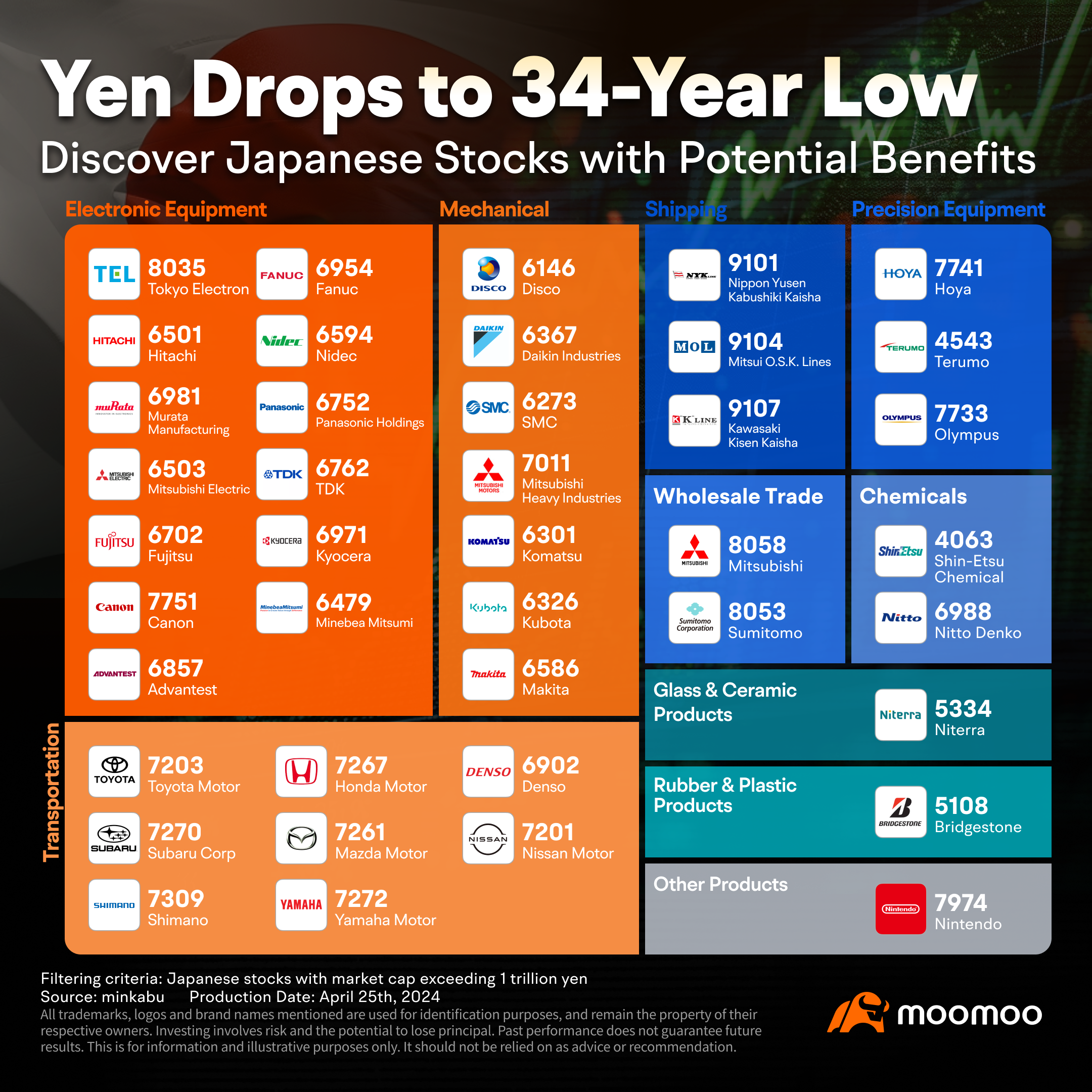

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...

Analysis

Price Target

No Data

No Data