No Data

6902 Denso

- 2154.0

- -61.0-2.75%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average fell by 375 yen and continued to decline, although it expanded its drop at one point, it began to recover towards the end of the Trade = September 9, afternoon session.

On the 9th, in the afternoon session, the Nikkei average fell by 375.97 yen to 39,605.09 yen, while the TOPIX (Tokyo Stock Price Index) dropped 34.08 points to 2,735.92 points, both continuing to decline. The weak conditions from the morning session persisted, and trading began with selling dominating the market. Continued weakened performance in Extended hours trading for US stock index Futures has also influenced the Nikkei average, which reached 39,385.05 yen, down 596.01 yen, at 1:05 PM.

Nikkei Average Contribution Ranking (Before Closing) ~ The Nikkei Average continues to decline, with Tokyo Electron pushing it down by about 41 yen with just one stock.

As of the closing on nine days ago, the number of rising and falling stocks in the Nikkei average was 44 rising, 181 falling, and 0 unchanged. The Nikkei average continued to decline, ending the morning session at 39,678.93 yen, down 302.13 yen (−0.76%) compared to the previous day, with an estimated Volume of 0.9 billion shares. On the 8th, the USA market showed mixed results. The Dow Inc rose by 106.84 dollars to 42,635.20 dollars, while the Nasdaq ended trading down 10.80 points at 19,478.88. Employment-related Indicators showed mixed strength.

DENSO Announces Treasury Stock Repurchase Status

The Nikkei average is down about 230 yen, showing weakness even after a sell-off in the early session.

As of 10:05 AM on the 9th, the Nikkei average stock price is trading around 39,750 yen, down about 230 yen from the previous day. At 9:38 AM, it reached 39,716.82 yen, down 264.24 yen. On the 8th in the United States, while the Dow Inc rebounded, the Nasdaq Composite Index declined, showing mixed results. With few clues, the US stock market will also be closed on the 9th due to the passing of former President Carter, leading to an early trend toward selling. There seems to be a tendency to refrain from active trading.

The U.S. Stocks market is mixed, waiting for the employment statistics (8th).

"Chicago Nikkei Average Futures (CME)" (8th) MAR24 O 39870 (denominated in dollars) H 40205 L 39800 C 40020 compared to the Osaka Exchange +60 (compared to the evening +70) Vol 6353 MAR24 O 39775 (denominated in yen) H 40120 L 39715 C 39935 compared to the Osaka Exchange -25 (compared to the evening -15) Vol 19641 "American Depositary Receipt Overview (ADR)" (8th) In the ADR market, when compared to the Tokyo Stock Exchange (calculated at 1 dollar = 158.39 yen),...

On the 8th, the ADR trends showed a nearly overall decline in yen conversion values, with Nidec Corporation Sponsored ADR, Denso, Rohm, ETC being lower.

On the 8th, the ADRs (American Depositary Receipts) were almost all lower compared to the Tokyo closing prices when converted to yen. In yen terms, Nidec Corporation Sponsored ADR <6594.T>, Denso <6902.T>, Rohm <6963.T>, Nissan <7201.T>, Mitsubishi Corporation <8058.T>, etc., decreased in value. INPEX <1605.T>, LINE Yahoo <4689.T>, Toyota <7203.T>, Honda <7267.T>, Softbank Group <9984.T>, etc., were also soft. Provided by Wealth Advisors.

Comments

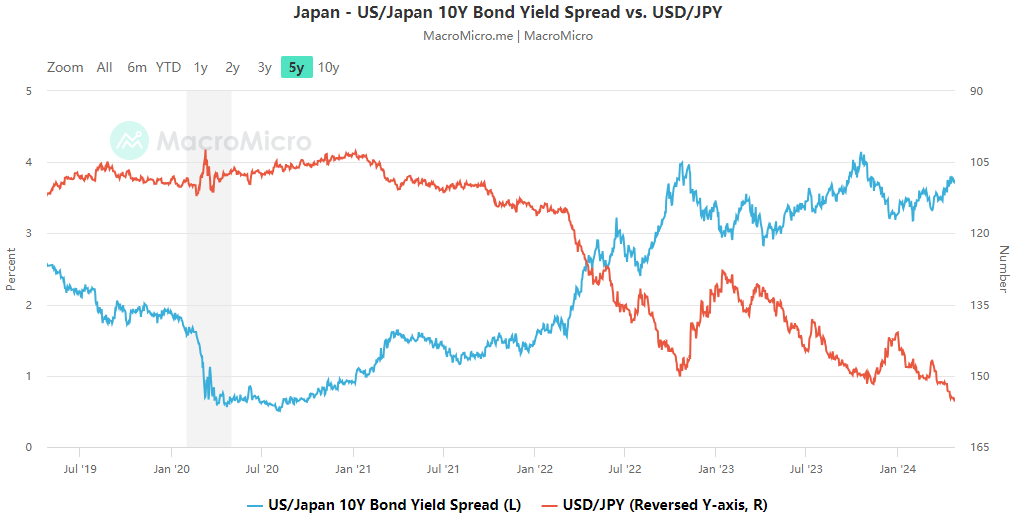

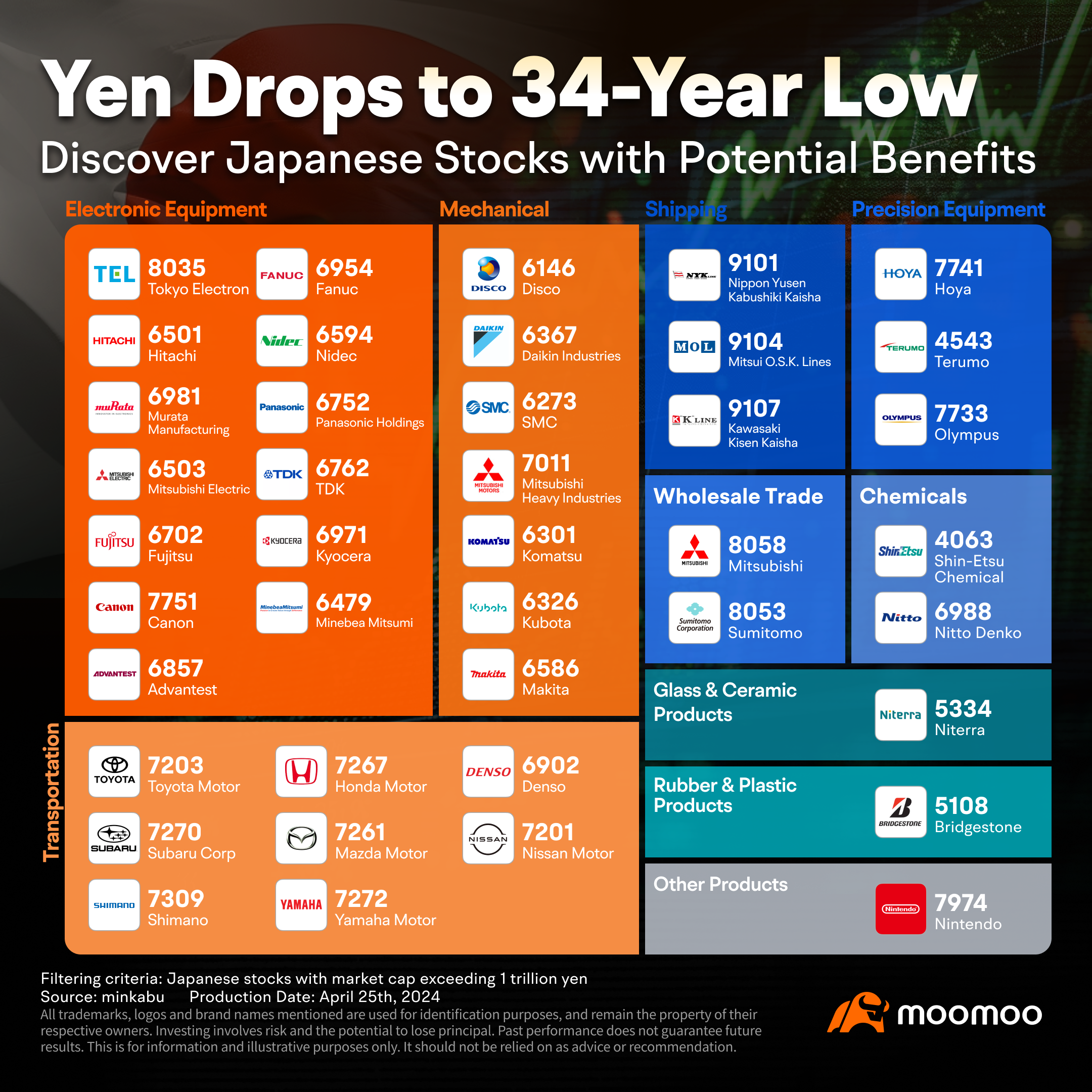

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...

No Data