No Data

6902 Denso

- 2205.0

- +34.5+1.59%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock rankings - mixed highs and lows, Chicago is up 210 yen from Osaka at 39,700 yen.

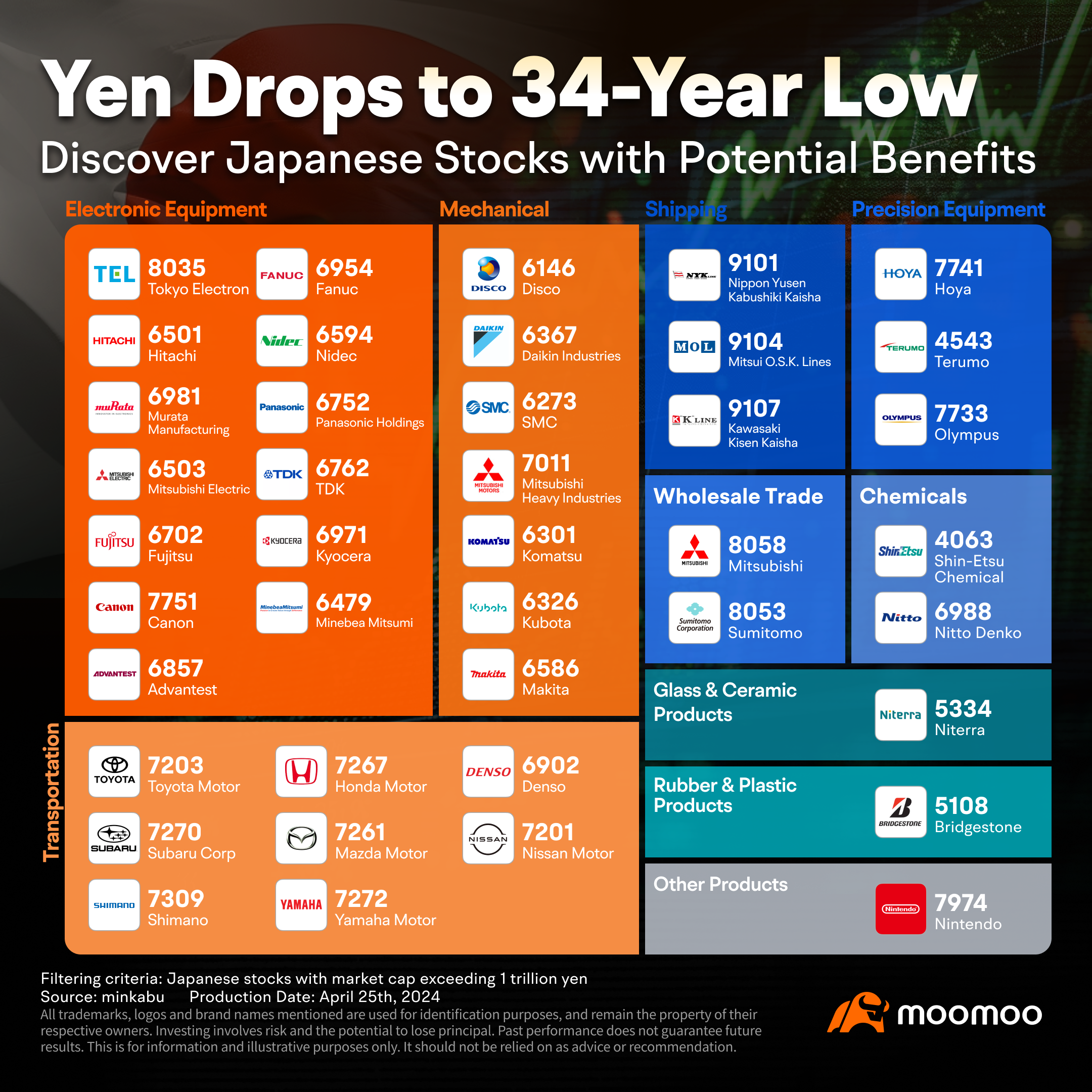

Japanese stocks of ADR (American Depositary Receipt), in comparison with the Tokyo Stock Exchange (calculated at 1 dollar = 157.88 yen), saw increases in Japan Post Holdings <6178>, Toyota Motor <6201>, Mitsubishi UFJ Financial Group <8306>, Tokyo Electron <8035>, Mitsubishi Corporation <8058>, Denso <6902>, etc. while Japan Post Bank <7182>, JAPAN TOBACCO INC <2914>, Nidec <6594>, Toyota Motor <7203>, Bridgestone Corporation Unsponsored ADR <5108>, Honda Motor Co., Ltd <7267>, etc. declined.

The U.S. stock market is mixed, with little movement after the holiday (26th).

"Chicago Nikkei Average Futures (CME)" (26th) MAR24O 39340 (in USD) H 39830 L 39205 C 39800, compared to the Osaka Exchange +310 (evening comparison +100) Vol 2560 MAR24O 39250 (in JPY) H 39730 L 39110 C 39700, compared to the Osaka Exchange +210 (evening comparison +0) Vol 10140 "Overview of American Depositary Receipts (ADR)" (26th) In the ADR market, compared to the Tokyo Stock Exchange (1 USD = 157.88 JPY).

The New York market on the 26th was mixed.

[NYDow・Nasdaq・CME (Table)] NYDOW; 43,325.80; +28.77 Nasdaq; 20,020.36; −10.77 CME225; 39,700; +210 (compared to Osaka Securities Exchange) [NY Market Data] The NY market on the 26th exhibited mixed results. The Dow Inc average closed up $28.77 at $43,325.80, while the Nasdaq finished down 10.77 points at $20,020.36. The unexpected decrease in unemployment Insurance claims led to selling due to aversion to rising long-term interest rates.

Nikkei Average Contribution Ranking (At Close) - The Nikkei Average continues to rise, with SoftBank Group and Toyota contributing approximately 66 yen in total.

As of the close on the 26th, the number of Nikkei average constituent stocks that rose and fell was 199 stocks increasing, 22 stocks decreasing, and 4 stocks unchanged. On the 25th, overseas markets were closed due to the Christmas holiday in major markets. The exchange rate moved slightly in the early 157 yen range against the dollar. In the absence of significant trading materials, the Tokyo market opened with small movements. The Nikkei average, starting at the previous day's closing level, was buoyed by the consecutive rise of Toyota Motor Co. [7203] and various observations of Buybacks in the Futures, increasing its margin.

Sanwa Technos Research Memo (2): For the interim period ending in March 2025, there will be a decrease in sales and profits, but each stage's profits will exceed the Financial Estimates.

For the second quarter of the fiscal year ending in March 2025, the consolidated performance showed a revenue of 69,426 million yen, which is a 21.9% decrease compared to the same period last year. Operating profit decreased by 52.1% to 1,650 million yen, ordinary profit decreased by 54.6% to 1,681 million yen, and the net profit attributable to shareholders of the parent company decreased by 58.7% to 1,271 million yen. Despite these decreases in revenue and profit, each profit stage exceeded the forecasted figures.

Hagiwara Electric HD Research Memo (1): A semiconductor trading company with the Toyota Group as a major customer.

■Summary: Hagiwara Electric Holdings <7467> is a trading company based in Nagoya specializing in Semiconductors, Electronic Components, and Electronic Equipment, as well as a manufacturer of its own products. About 89% of its revenue (for the fiscal year ending March 2024) is from Automotive-related companies, with major clients including DENSO <6902> and other members of the Toyota Group. In recent years, there has been a focus on the solution business. 1. Performance for the second quarter of the fiscal year ending March 2025: The consolidated performance for the second quarter of the fiscal year ending March 2025 shows that revenue was 131,

Comments

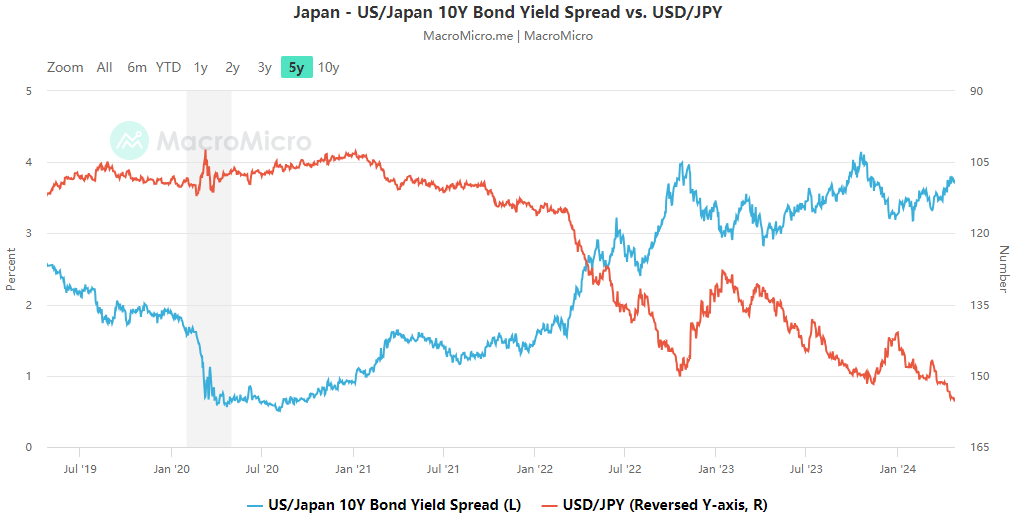

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...

No Data