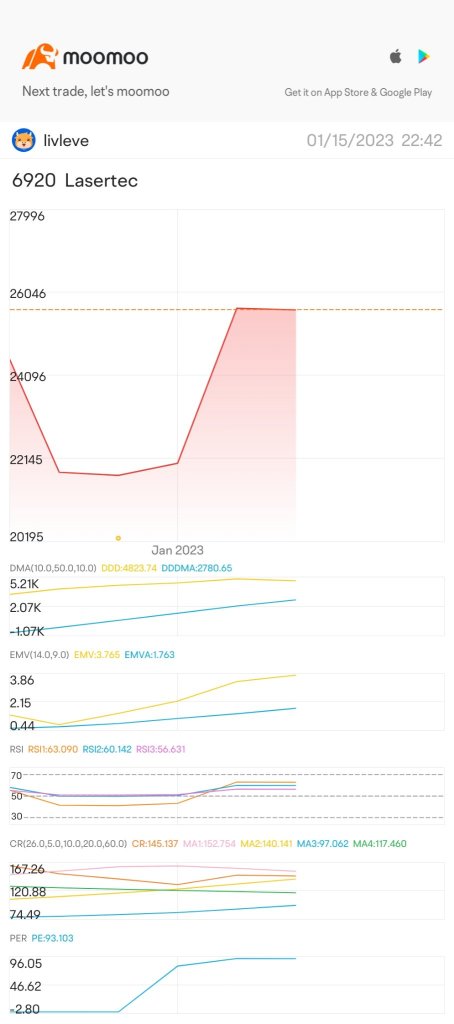

JP Stock MarketDetailed Quotes

6920 Lasertec

- 15825.0

- 0.00.00%

20min DelayMarket to Open Dec 10 15:30 JST

1.49TMarket Cap24.18P/E (Static)

0.0High0.0Low0Volume0.0Open15825.0Pre Close0.00Turnover45500.052wk High0.00%Turnover Ratio94.29MShares15575.052wk Low668.1EPS TTM1.22TFloat Cap45500.0Historical High24.18P/E (Static)77.30MShs Float85.6Historical Low654.49EPS LYR0.00%Amplitude230.00Dividend TTM9.43P/B100Lot Size1.45%Div YieldTTM

Lasertec Stock Forum

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

40

5

US Market Key Charts (S&P, US Dollar, Gold)

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are mixed, with MACD advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support could open next drop towa...

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ *]We maintain a bullish directional bias as price continues to hold above 5810 support level. We expect prices to push towards 5940 resistance level. Technical indicators are mixed, with MACD advocating for a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5810 support could open next drop towa...

6

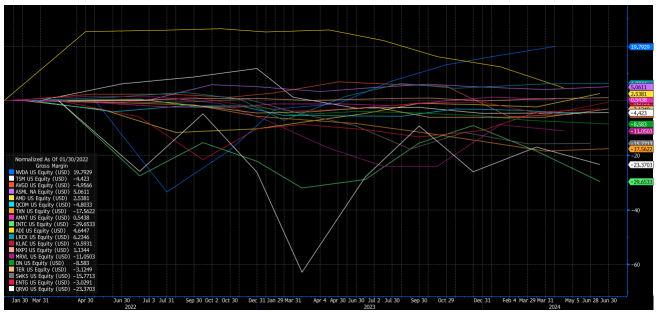

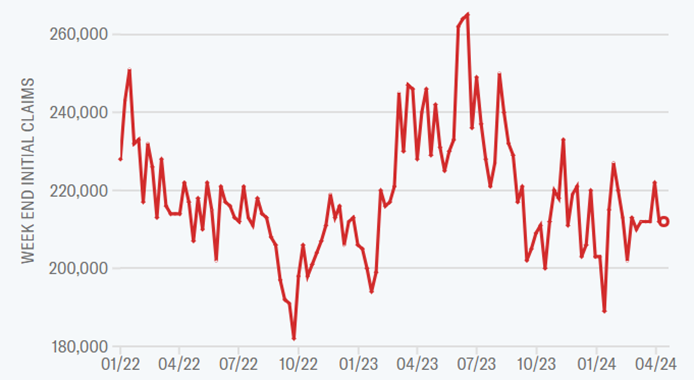

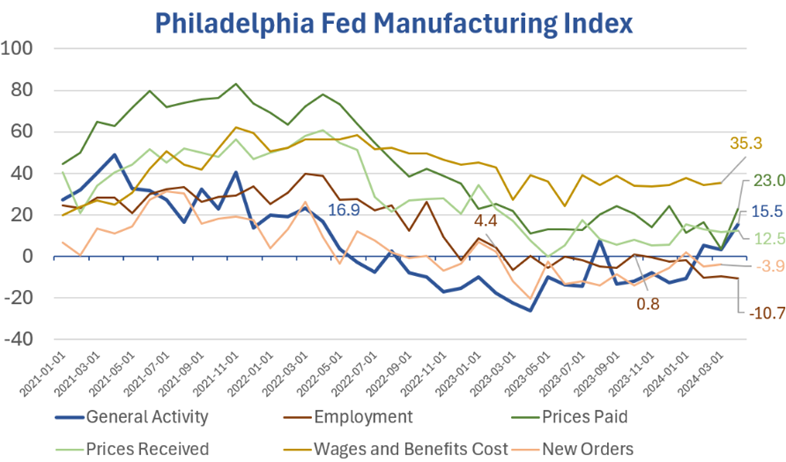

Thursday's release of multiple economic data points all showed poor performance, reigniting fears of a recession due to deteriorating macro demand expectations and weak employment figures. This led the market to experience a significant decline. Simultaneously, leading chip design giant Arm's projected growth rate for patent licensing fees, which benefit from the AI-enabled smartphone trend, fell below previous expe...

+3

57

13

126

The market continued to be affected by geopolitical conflicts and weakness in technology stocks heading into the weekend.

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.6...

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.6...

34

20

No comment yet

Heat List

Overall

Symbol

Price

% Chg

No Data

Cui Nyonya Kueh :

SS5GG Cui Nyonya Kueh : How did this emoji come about?

Diamond kuku bird ❤ :

Cui Nyonya Kueh Diamond kuku bird ❤ :

172727077 :