No Data

6954 Fanuc

- 3935.0

- -38.0-0.96%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The willingness to buy on dips is strong when prices fall below 38,000 yen.

The Nikkei average rebounded for the first time in three days. It closed at 38,349.06 yen, up 214.09 yen (volume approx. 1.68 billion shares) at the end of trading. Selling pressure dominated from the beginning due to the previous day's decline in US stocks, causing the index to drop to 37,801.62 yen shortly after the start of trading. Subsequently, moves to buy back tech shares intensified, especially triggered by reports from US media that "US semiconductor regulations on China will not be stricter than before", leading to a turnaround in the market and an expansion of gains towards the afternoon session.

Nikkei average is up 299 yen, the US market will be closed tonight.

The Nikkei index is up by 299 points (as of 14:50). In terms of contribution to the Nikkei average, Tokyo Electron <8035>, Fast Retailing <9983>, and TDK <6762> are among the top positive contributors, while Advantest <6857>, fanuc corp <6954>, and Recruit HD <6098> are among the top negative contributors. In the sectors, fishery and agriculture, other products, food, other finance, and mining have the highest increases, while precision instruments and services are decreasing.

The Nikkei average is up 300 yen, and the dow inc futures are stable, providing a sense of security.

The Nikkei average is up 300 yen (as of 1:50 PM). In terms of contribution to the Nikkei average, Tokyo Electron <8035>, TDK <6762>, kddi corporation <9433>, etc., are among the top positive contributors, while Advantest <6857>, fanuc corp <6954>, and Nitori HD <9843>, etc., are among the top negative contributors. In the sector, qitabankuai, agriculture and forestry, other financials, mining, and iron & steel are at the top of the increase rate, while precision instruments are declining. The Nikkei average is performing steadily.

Nikkei average contribution ranking (pre-closing) ~ Nikkei average rebounds for the first time in three days, with To-Electric pushing up about 141 yen per share.

As of the close on the 28th, the number of advancing and declining stocks in the Nikkei average was 151 up, 72 down, and 2 unchanged. The Nikkei average rebounded for the first time in three days, closing at 38,295.13 yen, up 160.16 yen (+0.42%) from the previous day, with a trading volume estimate of 0.8 billion 40 million shares. On the 27th, the U.S. stock market fell. The dow inc ended down 138.25 dollars at 44,722.06 dollars, while the nasdaq closed down 115.10 points at 19,060.48.

ADR Japanese stock rankings - Selling pressure predominant on SoftBank Group etc, Chicago down 290 yen compared to Osaka at 37,810 yen.

In comparison to the Tokyo Stock Exchange (converted at 1 dollar to 151.07 yen), Japanese stocks of American Depositary Receipts (ADR) such as Japan Post Bank <7182>, Japan Post <6178>, SoftBank Group <9984>, Renesas <6723>, Nidec <6594>, Advantest <6857>, and Mitsubishi Corporation <8058> have declined, indicating overall selling pressure. The clearing price of Chicago Nikkei 225 Futures is 37,810 yen, down 290 yen compared to daytime trading in Osaka. The US stock market has fallen back. The Dow Inc. average decreased by 138.25 dollars to 44,722.

Due to caution against Trump's tariffs, it temporarily fell below the milestone of 38,000 yen.

The Nikkei average continued to decline. It finished trading at 38,134.97 yen, down 307.03 yen (volume estimated at 1.8 billion 20 million shares). Today, risk-averse selling continued against the backdrop of concerns over the global economy due to the upcoming Trump administration's tariff increases. Additionally, the yen appreciated, reaching the low 152 yen range against the dollar, negatively impacting export-related stocks, which caused the Nikkei average to widen its decline towards the end of the afternoon session, pushing down to 37,988.99 yen and dipping below the psychological threshold of 38,000 yen.

Comments

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

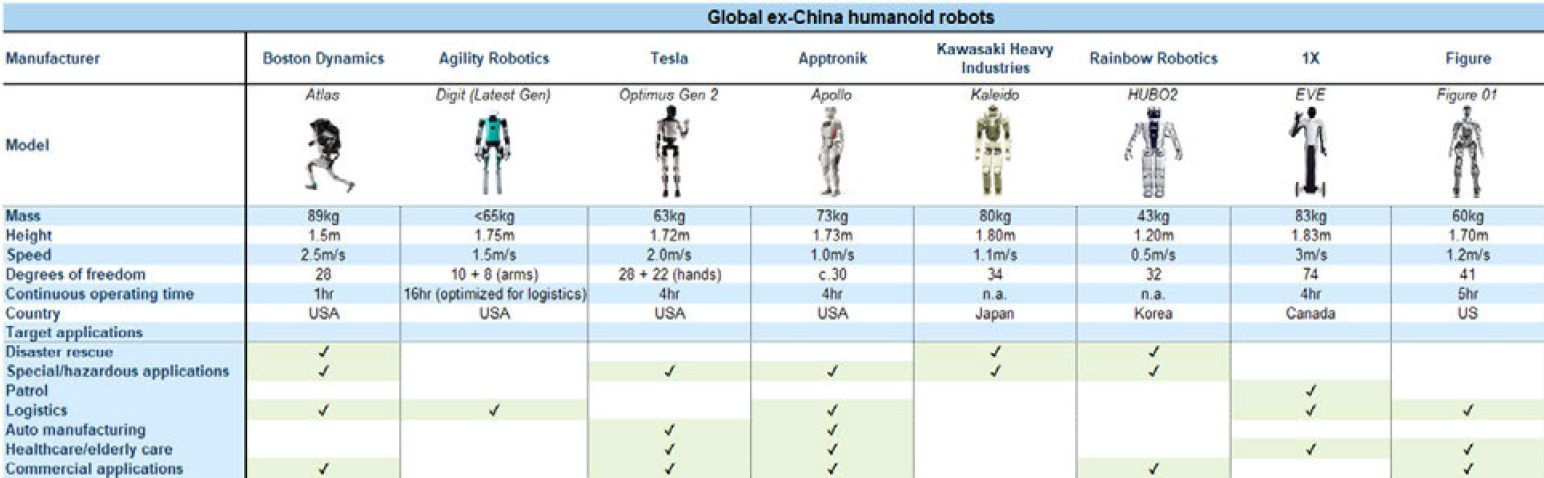

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

Analysis

Price Target

No Data

No Data

101550592 :