No Data

6954 Fanuc

- 3871.0

- -64.0-1.63%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei average in the afternoon session started down by 127 yen, with Nissan and Mitsui E&S among the stocks that declined.

Nikkei average 38,221.16 -127.90 TOPIX 2,681.30 -5.98 [Afternoon opening overview] The Nikkei average in the afternoon started with a slightly smaller drop from the previous day, down 127.90 yen to 38,221.16 yen, compared to the pre-closing price (38,193.01 yen). During lunchtime, the Nikkei 225 futures traded in the range of 38,160 yen to 38,260 yen, with a strong upward pressure. The dollar-yen exchange rate has been around 150.30-40 yen per dollar since around 9 a.m., with the yen strengthening by about 60 cents and the dollar weakening. Asia

Nikkei Average Contribution Ranking (before the close) ~ The Nikkei Average fell back, with Tokyo Electron lowering it by about 27 yen from a single stock.

At the closing time on the 29th, the number of rising stocks in the Nikkei average constituent stocks was 73, the number of falling stocks was 149, and the number of unchanged stocks was 3. The Nikkei average fell. It ended the morning session of trading at 38,193.01 yen, down 156.05 yen (-0.41%) from the previous day, with an estimated volume of 750 million shares. The US market was closed for Thanksgiving holiday last night. In the foreign exchange market, trading of major currencies remained sluggish. The dollar-yen pair struggled to rise. After briefly being bought up to 151.77 yen, it dropped to 151.41 yen.

Three points to focus on in the afternoon session: Concerns about the progress of yen appreciation lead to a temporary breach of the 38,000 yen level.

In the afternoon trade on the 29th, attention should be paid to the following three points. ・The Nikkei average fell back, affected by the advance of the yen, briefly dropping below the 38,000 yen level. ・The dollar-yen exchange rate significantly declined, briefly falling below 150 yen. ・The top contributor to the decline was tokyo electron ltd. unsponsored adr <8035>, and the second was fanuc corp <6954>. ■The Nikkei average fell back, affected by the advance of the yen, briefly dropping below the 38,000 yen level. The Nikkei average fell back by 156.05 yen compared to the previous day (-0.41%), at 38,193.01 yen (approximate volume 0.7 billion).

Hot stocks Digest (morning): Unichika, Headwater, World, etc.

Noritake Steel Corporation <7744>: 4,605 yen (+280 yen) significantly continues to rise. The previous day, an upward revision of the performance for the fiscal year ending December 2024 was announced. Operating profit was raised from the previous financial estimates of 18 billion yen to 18.7 billion yen, a 30.0% increase compared to the previous period. It seems to reflect the resumption of shipments for some products that were halted due to defects at AlphaTheta. This comes just after an upward revision from 16.8 billion yen to 18 billion yen during the third-quarter earnings report, resulting in consecutive upward revisions.

Volume change rate ranking (10 AM) - Fanuc Corp, Sailor Advertising etc are ranked.

In the volume change rate ranking, you can understand the interest of market participants, such as trends in speculative buying, by comparing the average volume of the last 5 days with the volume on the delivery date. Top Volume Change Rates [As of 10:32 on November 29th] (Comparison of average volume over the last 5 days) Stock Code Stock Name Volume 5-Day Average Volume Volume Change Rate Price Change Rate <2156> Sailor Ads 472,500 49,729.64 214.8% 0.122% <2934> JF

Fanuc Corp ranks in, cautious about some reports related to EMC malpractice.

Fanuc Corp <6954> ranks in (as of 10:32). Significantly continues to decline. Some broadcasting reports indicate that EMC irregularities have been revealed, which are considered quite malicious among the previous quality irregularities, becoming a matter of concern. It seems that they have been shipping products that do not comply with the essential EMC directive for the European market. However, the company has set up a special investigation committee in April, and there is a possibility that the tests conducted on November 21 may not have been in compliance with the standards.

Comments

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

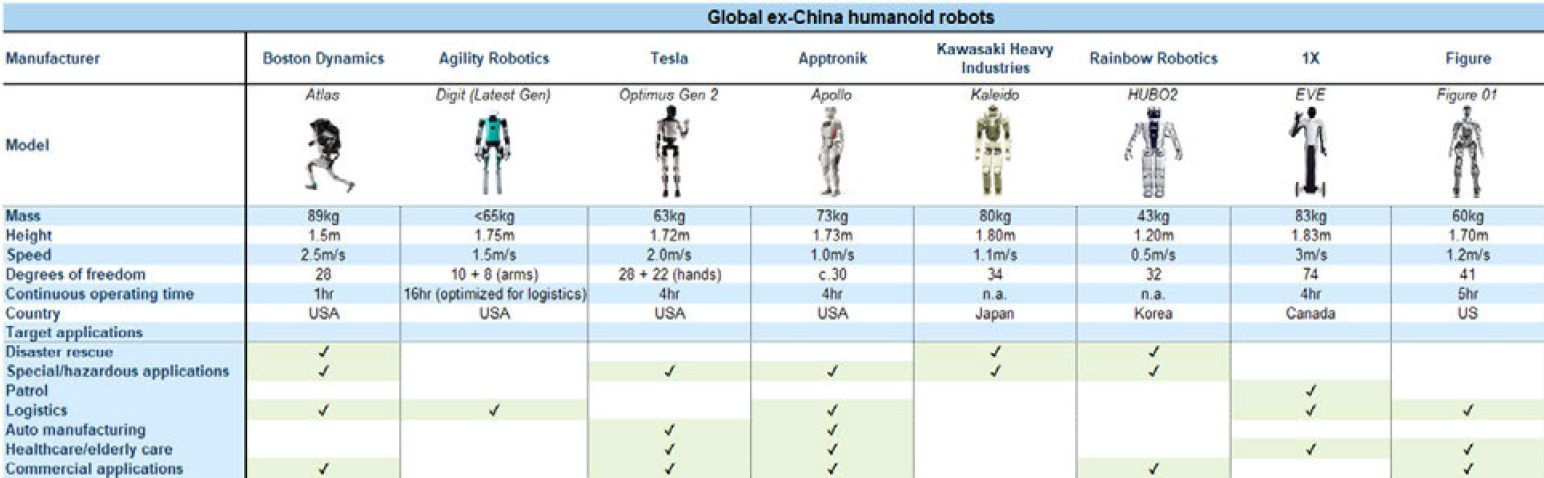

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

Analysis

Price Target

No Data

No Data

101550592 :