No Data

6EMAIN Euro Futures(MAR5)

- 1.05110

- -0.00050-0.05%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

ECB's Muller: Temporary Ups and Downs on Inflation Are Inevitable

ECB's Villeroy: There Will Be Further Rate Cuts

Short-End of Curve Expected to Pull Eurozone Bond Yields Lower in 2025 -- Market Talk

German Annual Wholesale Prices Slip 0.6% in November

German Trade Surplus Declines in October

Pimco and Fidelity believe that the economic outlook for Europe is weak, and the European Central Bank's rate cut may exceed market expectations.

Investors such as Pimco and Fidelity International believe that the economic outlook for Europe is bleak, which could force decision-makers to lower interest rates more than the market expects. The latest market pricing indicates that the European Central Bank is expected to reduce the key interest rate to 1.75% next year. The bank has cut rates for the third consecutive time on Thursday, to 3%. However, Fidelity stated that borrowing costs could drop further to 1.5%, and Pimco also believes there is a risk of a larger rate cut. Further re-pricing could intensify the rise of European Bonds, and European Bonds have already outperformed the bond markets of the USA and the United Kingdom in 2024. A Bloomberg Index tracking euro-denominated government bond returns this year.

Comments

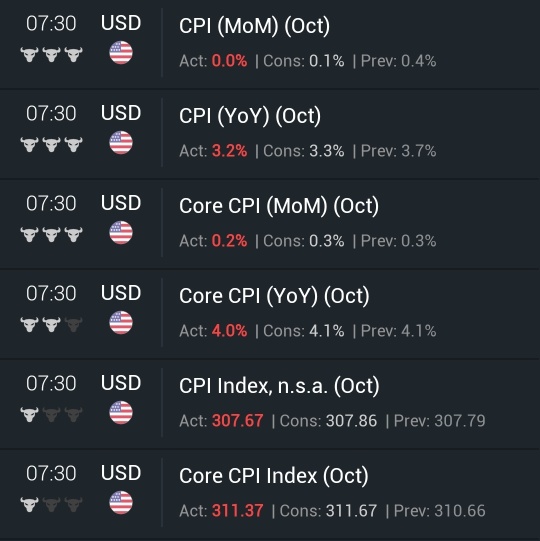

The CPI reading was the final push the market needed to fall back into a bull market. Yields are tanking with the dollar. This is bullish for equities in the "bad news is good news environment," equities are ripping, and gold is tagging along. I think it is safe to say that things are looking very bullish. Short premiums are crushed across the board.

I believe that most of the market was expecting this suppressed...

*A bear rally, no matter what starts it (chicken or the egg- doesn't matter there is a chicken that lays eggs) is money traders and sho...

���������...

razo2 : I think better keep eyes on data. Friday MM will not want to pay out the bulls.

SpyderCall OP razo2 : Of course those tricky MMs don't want to pay anybody. Especially on mid month expirations. Usually there is a little volatility around those expiration dates.

It is possible we might see a bit more volatility today, Wednesday, or Friday. Wednesday is the official monthly expiration but sometimes the rollover can happen before or after, like on a Friday.

But it is a possibility that investors might have already rotated their contracts. After a crazy rally like we have seen, it makes me think a lot of capital has already moved around. So then the volatility might be just like any normal day.

102905741 : stok data in market

102905741 : stok data in market..