No Data

6JMAIN Japanese Yen Futures(DEC4)

- 0.0065230

- +0.0000150+0.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Will Trump's election stimulate the rapid depreciation of the yen and disrupt the Bank of japan's interest rate hike path?

①Kazuo Momma, former executive of the Bank of japan, stated that the outcome of the USA presidential election has increased the uncertainty for the Bank of japan; ②The rapid depreciation of the yen may become a catalyst for the Bank of japan to raise interest rates in the near future; ③The next policy meeting of the central bank will be held in mid-December, with over half of the observers expecting a rate hike next month, and more people expecting a rate hike in January next year.

The Japanese yen fell to a key level. Can the Bank of Japan make a move to counterattack? Expectations for a rate hike in December are rising!

On Thursday, November 7th, influenced by the results of the USA election, the dollar rebounded strongly, pushing the yen against the dollar exchange rates to continue to decline, reaching a three-month low of 154.71. Market attention once again focuses on the interest rate decision of the Bank of japan. Donald Trump, the newly elected President of the USA, has promised to implement a series of easing policies, including tax cuts and higher import tariffs. The expected implementation of these measures is boosting the strength of the dollar, but at the same time is also adding pressure on the Bank of japan to raise interest rates in response to the continuing weakness of the yen. Market background: The strong dollar is dragging down the yen, doubling the pressure on the Bank of japan to raise interest rates. With the rapid strengthening of the dollar, the decline of the yen has intensified, currently uncertain.

Former Bank of japan Director: Trump's victory may worsen the depreciation of the yen and force the central bank to raise interest rates ahead of schedule.

The yen may depreciate further due to Trump's election, which may prompt the Bank of Japan to raise interest rates early.

Trump Boosts BOJ's Risks as Yen May Spur Hike, Ex-Official Says

Japan's Kato: Important to Achieve Fiscal Health While We Strongly Push for Economic Recovery

The economy is still on the path of recovery with japan's basic wages seeing the largest increase in over 30 years.

The basic wages of Japanese workers have seen the largest increase in over 30 years, supporting the Bank of Japan's view that the economy is still on a path to recovery and providing reasons for potential interest rate hikes in the coming months.

Comments

Short-Term Rally in the Yen

The yen has been on a big rally for over a month now. This is mostly due to the expectation that the Fed will stop cutting interest rates. Ueda also hinted towards the idea of increasing interest rates in his previous comments. This would add strength to the yen. But I won't believe it until I actually see it.

Forex Machanics

There are a few variables that could affect the path of yen ...

$Japanese Yen Futures(DEC4) (6Jmain.US)$

$Japanese Yen Trust (FXY.US)$ $Proshares Ultra Yen (YCL.US)$

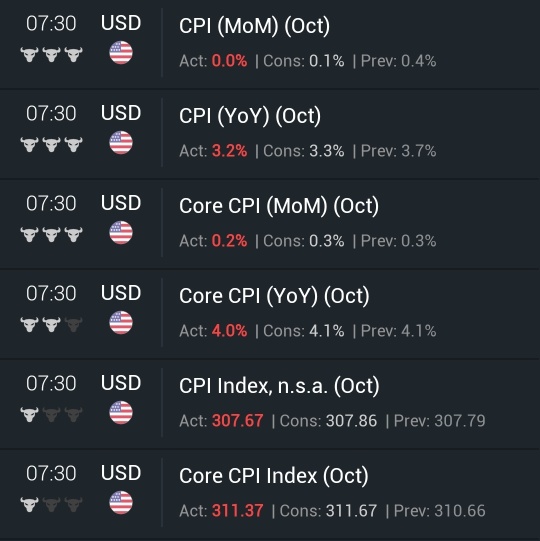

The CPI reading was the final push the market needed to fall back into a bull market. Yields are tanking with the dollar. This is bullish for equities in the "bad news is good news environment," equities are ripping, and gold is tagging along. I think it is safe to say that things are looking very bullish. Short premiums are crushed across the board.

I believe that most of the market was expecting this suppressed...