No Data

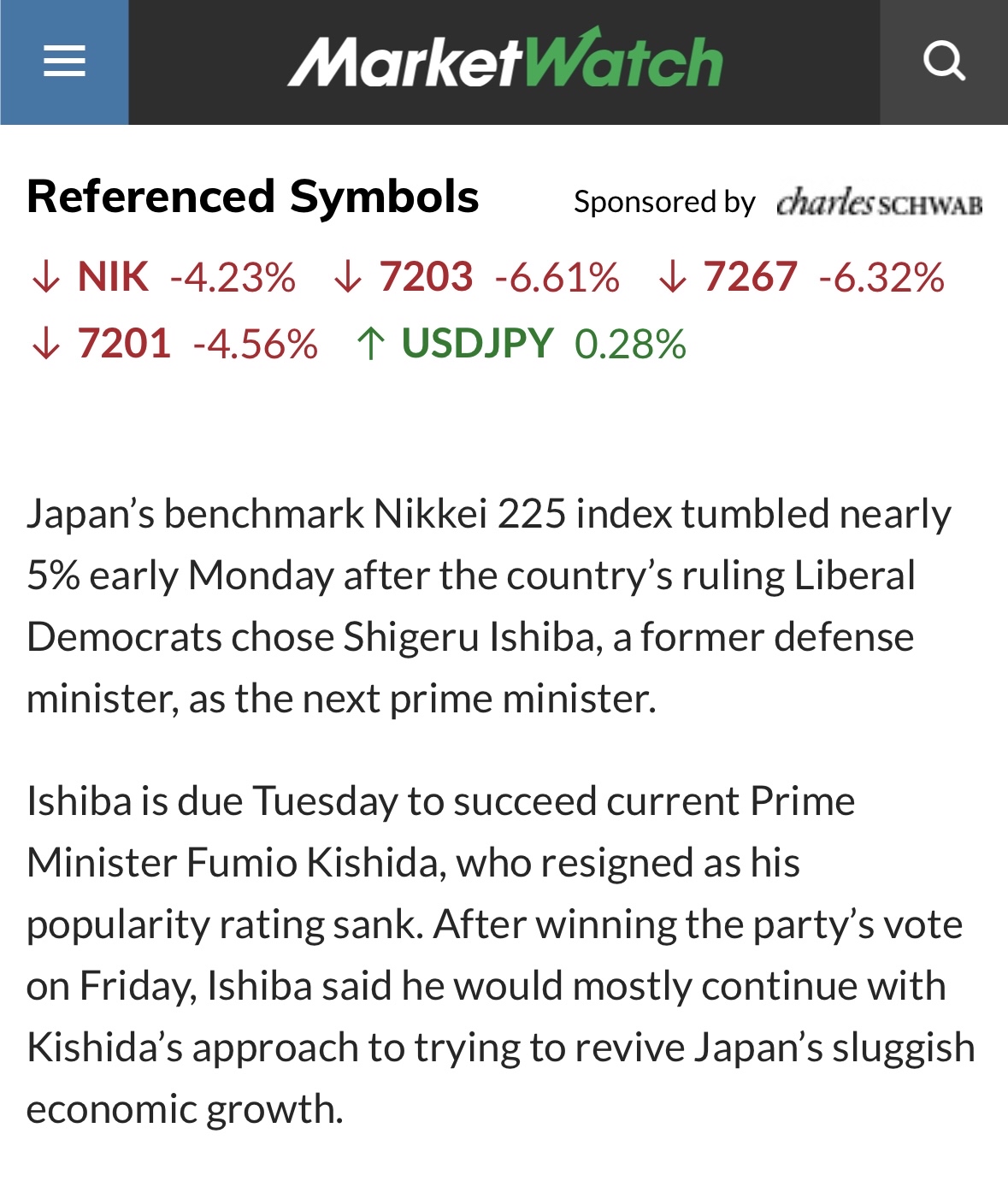

7201 Nissan Motor

- 373.5

- 0.00.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

No Data

Trade Overview

Capital Trend

No Data

News

Fitch Revises Nissan Motor's Outlook to Negative as North America Ops Weaken

Today's flows: 11/27 Kansai Electric Power saw an inflow of JPY¥ 3.59 billion, Toyota Motor saw an outflow of JPY¥ 7.07 billion

On November 27th, the TSE Main Market saw an inflow of JPY¥ 760.76 billion and an outflow of JPY¥ 886.52 billion.$Kansai Electric Power(9503.JP)$, $SoftBank Group(9984.JP)$ and $Fujikura(5803.JP)$

Active and newly listed stocks during the morning session.

*Dai-Doo Group HD <2590> 3240 +326 The cumulative operating profit for the third quarter has turned into an increase. *Janome <6445> 1187 +82 The upward trend in stock prices continues, and buybacks are becoming more active. *Keisei Electric Railway <9009> 4662 +243 Viewed as a material for the sale of shares in OLC shareholding. *Resonac <4004> 4170 +178 Interest as a related company to perovskite solar cells. *Oriental Land Co., Ltd. Unsponsored ADR <4661> 3585 +150 Responding to the sale of shares in Keisei Electric Railway.

The Nikkei average in the afternoon session started 291 yen lower, with companies like Furukawa Electric and Tokyu experiencing declines.

[Nikkei Stock Average・TOPIX (Table)] Nikkei Average; 38150.61; -291.39 TOPIX; 2665.72; -23.83 [Afternoon Market Overview] The afternoon Nikkei average started slightly lower at 38,150.61 yen, down 291.39 yen from the previous day's close (38,165.85 yen). During lunchtime, the Nikkei 225 futures traded in a range of 38,130-38,180 yen. The USDJPY exchange rate was around 152.40-152.50 yen per dollar from around 9 a.m., down 40 pips.

Three points to focus on in the morning session~Movement centered on short-term range trading opportunities~

In the trading session before the market closed on the 27th, focus should be on the following three points: ■ The main movement is aimed at short-term price fluctuations. ■ DyDo's operating profit for Q3 increased by 10.8% to 6.416 billion yen. ■ Materials of interest before the market: Sato HD visualizes industrial waste and recycling, developing a history management system. ■ The main movement is aimed at short-term price fluctuations. The Japanese stock market on the 27th is expected to start with selling pressure and then develop into a strong consolidation. On the 26th, the US market saw the Dow Jones Industrial Average rise by 123 points and the Nasdaq increase by 120 points.

Sato HD, Rohm, etc. [List of brand materials from the newspaper]

*Sato HD <6287> Visualization of industrial waste to recycling, history management system development (Nikkan Kogyo Front Page) - ○ *Mitsui Chemicals <4183> Operating profit for the fiscal year ending March 2029 expected to increase by 90%, urgent reconstruction of petrochemical related businesses (Nikkan Kogyo Page 3) - ○ *Nissan Motor <7201> Continues production cut at 2 US plants for inventory rationalization, until March next year (Nikkan Kogyo Page 3) - ○ *Daikin Industries, Ltd. Unsponsored ADR <6367> Establishment of joint venture with American company, test sales of air conditioning components (Nikkan Kogyo Page 3) - ○ *Shikoku Electric Power <9507> With Sumitomo Corporation, collaborate with two South Korean companies in power generation in Qatar

Comments

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

🔸 Chinese Stocks Surge on Return from Holidays as Euphoria Extends. Chinese stocks listed onshore jumped as trading resumed following a week-long holiday, with encouraging home sales and consumption data giving fresh impetus to a rally sparked by Beijing’s stimulus blitz. The benchmark CSI 300 Index and SSEC Index climbed almost 11% in early trading before paring its advance. The measure h...

![Chinese Stocks Surge on Return from Holidays as Euphoria Extends [CSOP Global Market Morning Report]](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20241008/1728367312428-c514003b5c.jpeg/thumb?area=999&is_public=true)

As strong as the U.S. economy, Japan Property is probably the best investment in 2023.

Why? Here are 4 reasons as follows:

Analysis

Price Target

No Data

No Data

104476495 : h