No Data

7201 Nissan Motor

- 358.9

- -15.0-4.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

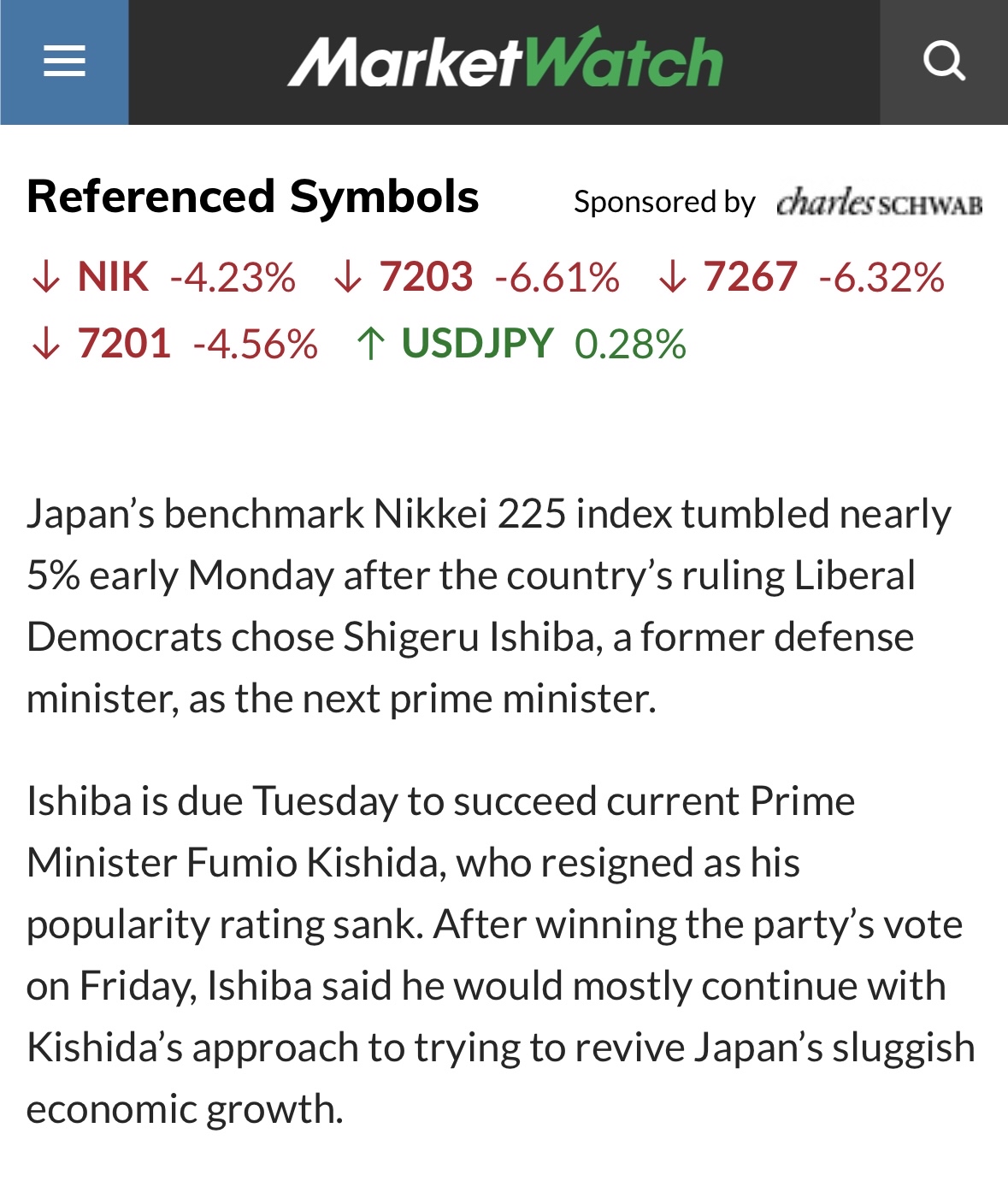

Japanese Stocks Decline 0.4%

JP Movers | The Chiba Bank Rose 4.21%, Leading Nikkei 225 Components, Disco Topped Turnover List

Market sentiment was stable today as Nikkei 225 components continued to trade sideways, with The Chiba Bank(8331.JP) being the top gainer today, rising 4.21% to close at 1250.5 yen. In addition, the top loser was Nissan Motor(7201.JP),falling 4.01% to end at 358.9 yen.

The Nikkei average in the afternoon session started down by 127 yen, with Nissan and Mitsui E&S among the stocks that declined.

Nikkei average 38,221.16 -127.90 TOPIX 2,681.30 -5.98 [Afternoon opening overview] The Nikkei average in the afternoon started with a slightly smaller drop from the previous day, down 127.90 yen to 38,221.16 yen, compared to the pre-closing price (38,193.01 yen). During lunchtime, the Nikkei 225 futures traded in the range of 38,160 yen to 38,260 yen, with a strong upward pressure. The dollar-yen exchange rate has been around 150.30-40 yen per dollar since around 9 a.m., with the yen strengthening by about 60 cents and the dollar weakening. Asia

Nikkei Average Contribution Ranking (before the close) ~ The Nikkei Average fell back, with Tokyo Electron lowering it by about 27 yen from a single stock.

At the closing time on the 29th, the number of rising stocks in the Nikkei average constituent stocks was 73, the number of falling stocks was 149, and the number of unchanged stocks was 3. The Nikkei average fell. It ended the morning session of trading at 38,193.01 yen, down 156.05 yen (-0.41%) from the previous day, with an estimated volume of 750 million shares. The US market was closed for Thanksgiving holiday last night. In the foreign exchange market, trading of major currencies remained sluggish. The dollar-yen pair struggled to rise. After briefly being bought up to 151.77 yen, it dropped to 151.41 yen.

The Nikkei average fell, as the progress of yen appreciation triggered concerns, briefly falling below the 38,000 yen level.

The Nikkei average declined. It closed the morning trading at 38,193.01 yen, down 156.05 yen (-0.41%) from the previous day, with an estimated volume of 7,050 million shares. The US market was closed for the Thanksgiving holiday. In the currency market, trading of major currencies remained subdued. The dollar-yen pair struggled to rise, being bought up to 151.77 yen at one point, then falling to 151.41 yen before closing the trading at 151.50 yen. Despite the closure of the US market, the exchange rate experienced a stronger yen and a weaker dollar with the dollar trading at the 150-yen level.

In October, Nissan's global production decreased by 6% year-on-year, and sales fell by 3%.

Nissan Motor Corporation announced on Thursday that global production fell for the fifth consecutive month in October, with most of its manufacturing centers experiencing a decline except for Mexico. The company's global sales have also dropped for the seventh month in a row, but sales in its core market, the usa, saw an increase for the first time in three months. Earlier this month, Nissan announced plans to cut 9,000 jobs globally and reduce production capacity by 20% to cut costs. In October, global production fell by 6% year-on-year to 290,848 units. Production in the usa and china decreased by 15%, while production in the united kingdom and japan dropped by 23% and 4% respectively. One highlight

Comments

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[BULLISH↗ **]We maintain our bullish directional bias. Price is currently near 6055 resistance level. A 4 hour candlestick closing above 6055 resistance would open push towards 6120 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A 4 hour candlestick closing below 6055 resistance would...

🔸 Chinese Stocks Surge on Return from Holidays as Euphoria Extends. Chinese stocks listed onshore jumped as trading resumed following a week-long holiday, with encouraging home sales and consumption data giving fresh impetus to a rally sparked by Beijing’s stimulus blitz. The benchmark CSI 300 Index and SSEC Index climbed almost 11% in early trading before paring its advance. The measure h...

![Chinese Stocks Surge on Return from Holidays as Euphoria Extends [CSOP Global Market Morning Report]](https://ussnsimg.moomoo.com/sns_client_feed/71451441/20241008/1728367312428-c514003b5c.jpeg/thumb?area=999&is_public=true)

As strong as the U.S. economy, Japan Property is probably the best investment in 2023.

Why? Here are 4 reasons as follows:

Analysis

Price Target

No Data

No Data

104476495 : h