No Data

7267 Honda Motor

- 1229.5

- +9.5+0.78%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

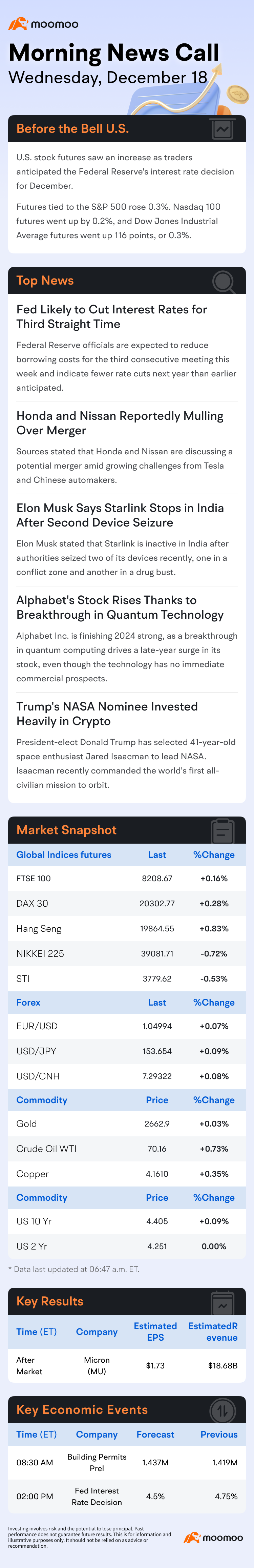

The decline, awareness of the slowdown in the pace of Fed rate cuts is growing.

Overview of last week, from December 16 to December 20. Nikkei average high: 39,796.22 yen, low: 38,355.52 yen, closing price: 38,701.9 yen, compared to the previous week: -1.95% ↓ decline, with increasing awareness of the slowdown in the pace of interest rate cuts in the USA. Ahead of financial events, there was heavy movement on the upside from the beginning of the week, but after the Federal Open Market Committee (FOMC) meeting, the slowdown in the pace of interest rate cuts in the USA for 2025 became strongly conscious, leading to further widening of the decline. The Bank of Japan's decision to refrain from additional rate hikes provided some support.

A pullback, in a market environment where interest in large Main Board stocks is high.

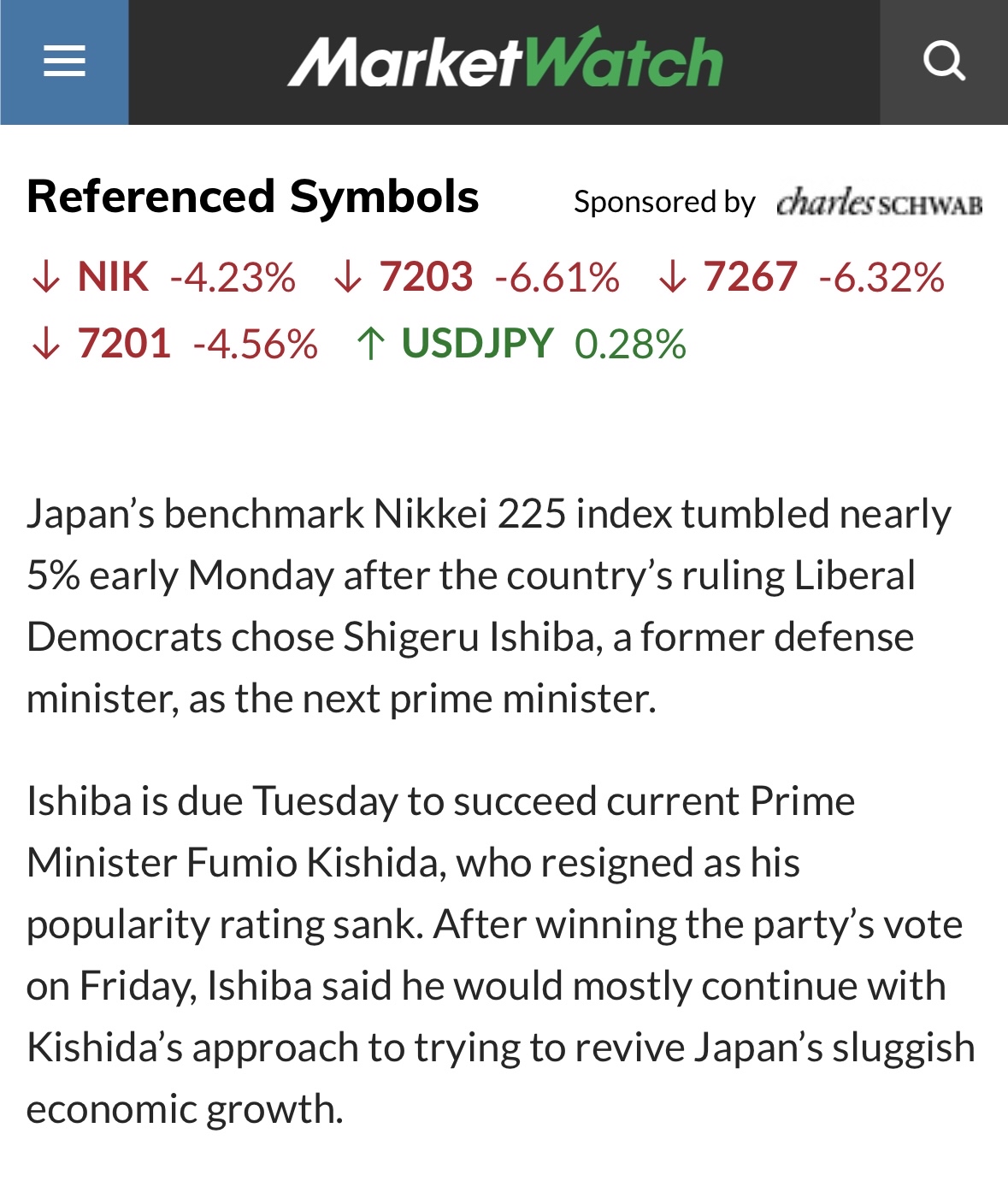

Overview for last week, from December 16 to December 20: Tokyo Stock Exchange Growth Index high: 643.49, low: 624.65, closing: 624.89, compared to the previous week: -3.09% ↓ declined, amidst a high interest in Large Cap on the Main Board. With attention turning to the central bank meetings of Japan and the U.S., there was also news considered material about discussions on a management integration between NISSAN MOTOR CO <7201> and Honda <7267>, leading to a high interest in Large Cap on the Main Board. After the financial policy events, the focus remains on Large Cap stocks in the Main market.

Short Sellers Targeting Major Auto Stocks, Growing Their Positions - S3 Partners

Honda, Nissan to Considering Producing Vehicles at Each Other's Factories: Report

Three points to watch in next week's market: Governor Ueda's speech at the Bank of Japan, key opinions in the December Bank of Japan meeting, and the US Consumer Confidence Index.

■Financial Estimates for Stock Market Outlook Range: Upper limit 39,500 yen - Lower limit 38,000 yen. On the 20th, the U.S. stock market rose. The Dow Inc. average closed at 42,840.26 dollars, up 498.02 dollars from the previous day, and the Nasdaq finished trading at 19,572.60, up 199.83 points. The Osaka Night Session's Nikkei 225 Futures ended trading at 38,880 yen, up 170 yen from the day session closing price. In the foreign exchange market, the dollar-yen exchange rate was trading around 156.40 yen per dollar. The last major event of the year is the Japan-U.S. central bank meetings.

Domestic Stocks market outlook: After the important events in Japan and the United States, the market is expected to be centered around individual investors.

The Nikkei average fell by 768.54 yen (-1.95%) to 38,701.90 yen this week, influenced by a sharp drop in U.S. stocks caused by a "hawkish" rate cut. Amid a strong mood to gauge the results of the Federal Open Market Committee (FOMC) meeting held by the U.S. Federal Reserve on the 17th and 18th, and the monetary policy meeting by the Bank of Japan on the 18th and 19th, Japanese stocks also experienced a slight decline in response to the steep drop in U.S. stocks. The FOMC cut rates by 0.25% as expected.

Comments

Polaris, Honda, Kawasaki, CanAm, etc. Pinnacle off-road toy makers.

they won't build affordable electric ATVs because they are scared of the Tesla ATV, e-bike companies, e- scooter companies doing it better, so they instead turn to OVER PRICED UTVs

E- bike, scooter, Tesla, etc won't build one !

why?

They are scared that the Pinnacle off-road toy companies w...

A federal judge ruled Google holds an illegal monopoly in the search and text advertising markets. The decision focused on Google’s exclusive search arrangements on Android and Apple devices, which the court said reinforced its dominance.

“Google is a monopolist, and it has acted as one to maintain its monopoly,” Judge Amit Mehta wrote in the decision. The ruling stems from combined antitrust suits filed by the Department of Justice and several states...

Nikkei 225 plunged more than 12% on Mon as investors worried that the U.S. economy may be in worse shape than had been expected dumped a wide range of shares.

The Nikkei index shed 4,451.28 to 31,458.42. It dropped 5.8% on Fri and has now logged its worst two-day decline ever, dropping 18.2% in the last two trading sessions.

At its lowest the Nikkei plunged ...

James 101542649 : good

104088143 : How is it?

105742796 Learner : Interesting news