No Data

7741 Hoya

- 19375.0

- -95.0-0.49%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

ADR Japanese stock rankings - overall buying dominance including Orient Land, Chicago at 38,230 yen, 190 yen higher than Osaka.

Japanese stocks of ADR (american depositary receipt) compared to the Tokyo Stock Exchange (calculated at 154.51 yen per dollar), such as Orion Land <4661>, Mitsubishi Corporation <8058>, komatsu <6301>, Disco <6146>, Tokyo Electron <8035>, SoftBank Group <9984>, Mizuho Financial Group <8411>, have risen, with buying pressure prevailing overall. The settlement price of the Chicago Nikkei 225 futures is 38,230 yen, which is 190 yen higher than during the Osaka day session. The US stock market has risen, with the dow inc gaining 461.88 dollars.

Nikkei Average Contribution Ranking (Pre-Close) ~ The Nikkei Average continued to decline, with Fast Retailing lowering it by about 113 yen for one stock.

As of the close on the 21st, the number of rising and falling stocks in the Nikkei average was 88 up, 133 down, and 4 unchanged. The Nikkei average continued to decline, finishing the morning trade at 38,033.22 yen, down 319.12 yen (-0.83%) from the previous day (with an estimated volume of 0.8 billion 30 million shares). On the 20th, the U.S. stock market was mixed. The dow inc was up 139.53 points at 43,408.47 dollars, while the nasdaq ended down 21.33 points at 18,966.14. Ukraine.

Idemitsu Kosan, Sumitomo Osaka Cement, etc. (additional) Rating

Upgraded - bullish code stock name brokerage firm previous changed after----------------------------------------------------------<9468>KADOKAWA Macquarie "Neutral" "Outperform" <5233> Taiheiyo Cement Daiwa "2" "1" target stock price change code stock name brokerage firm previous changed after----------------------------------------------

Three points to watch in the latter half of the market - semiconductor stocks fell, briefly dropping below 38,000 yen.

In the afternoon trading on the 21st, three points should be noted. • The Nikkei Average continues to decline, falling below 38,000 yen temporarily due to the drop in semiconductor stocks. • The dollar-yen exchange rate hesitates to drop, resurging near 155 yen. • The top contributor to the decline is Fast Retailing <9983>, and the second is Advantest <6857>. ■ The Nikkei Average continues to decline, falling below 38,000 yen temporarily due to the drop in semiconductor stocks. The Nikkei Average is down 319.12 yen (−0.83%) from the previous day at 38,033.22 yen (estimated volume of 0.8 billion 30 million shares).

Nikkei Average continues to decline, temporarily falling below 38,000 yen due to the drop in semiconductor stocks.

The Nikkei average continues to decline, ending the morning session at 38,033.22 yen, down 319.12 yen (−0.83%) compared to the previous day (estimated volume of 0.8 billion 30 million shares). The US stock market on the 20th was mixed. The dow inc rose by 139.53 dollars to 43,408.47 dollars, while the nasdaq fell by 21.33 points to 18,966.14. Reports that Ukraine launched British-made long-range missiles into Russian territory raised concerns about the persistence of geopolitical risks, leading to a decline after the opening.

The Nikkei average starts 0.53 yen higher, with companies like Furukawa Electric and MS&AD rising.

[Nikkei Average Stock Price・TOPIX (Table)] Nikkei Average; 38352.87; +0.53 TOPIX; 2700.14; +1.85 [Opening Overview] On the 21st, the Nikkei Average started trading up 0.53 yen at 38352.87 yen. The previous day, on the 20th, the U.S. stock market was mixed. The dow inc rose by 139.53 dollars to 43408.47 dollars, while the nasdaq closed down 21.33 points at 18966.14. Ukraine has provided British-made long-range missiles to Russia.

Comments

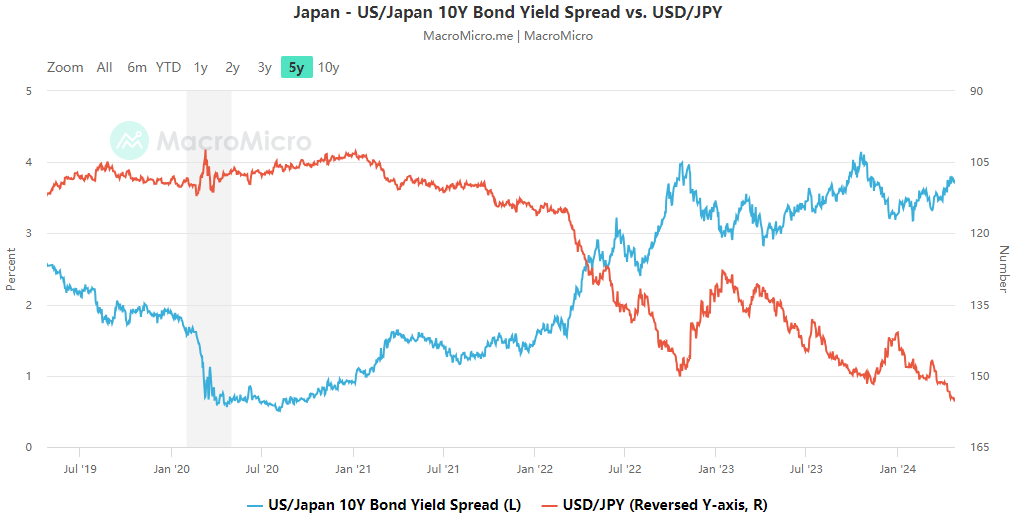

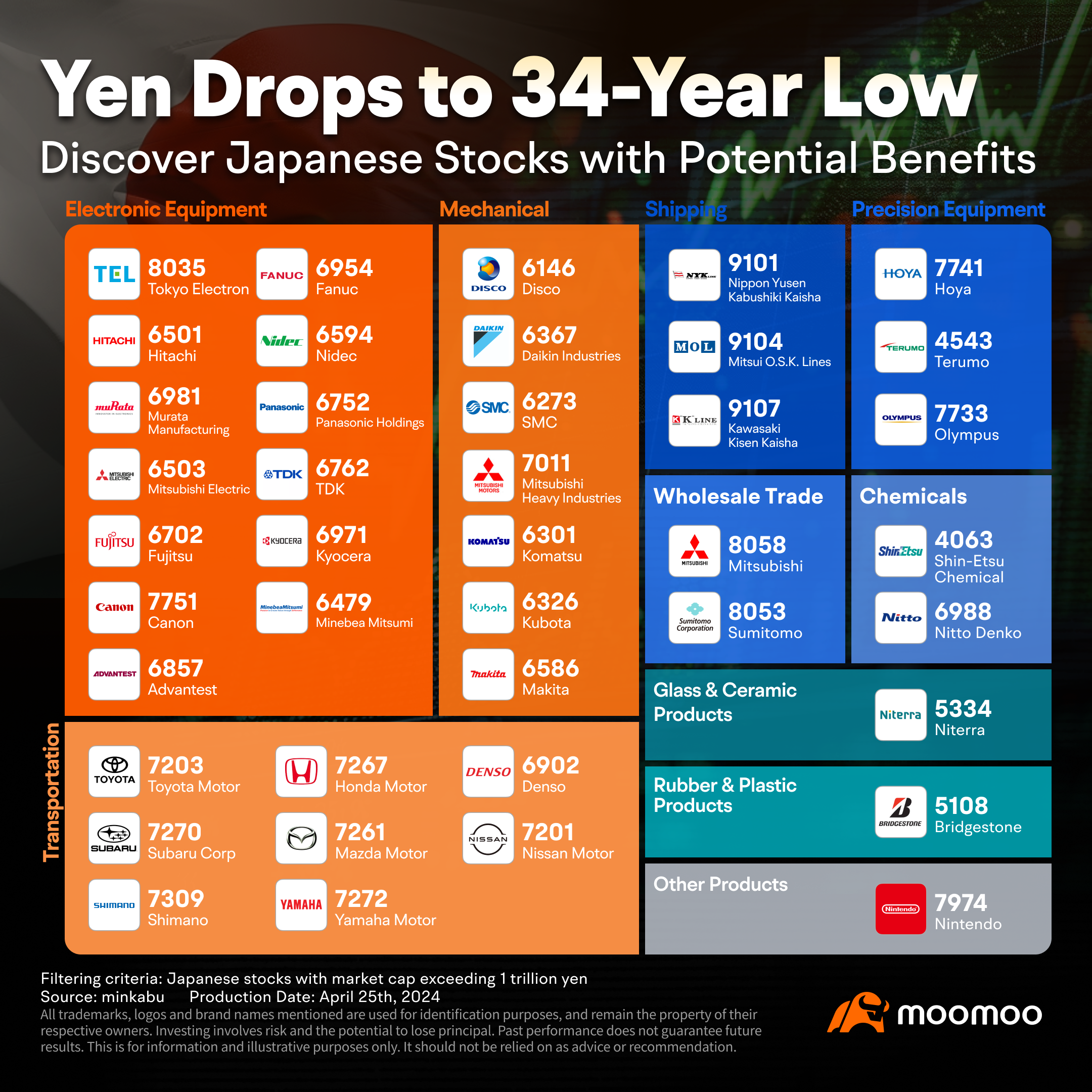

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

Analysis

Price Target

No Data

No Data