HK Stock MarketDetailed Quotes

800700 Hang Seng TECH Index

- 4307.400

- -47.400-1.09%

Not Open Jan 8 16:00 CST

4371.320High4252.040Low

4351.860Open4354.800Pre Close68.53BTurnover5451.53052wk High9Rise2.74%Amplitude2984.90052wk Low21Fall4311.680Avg Price--Flatline

$HSI Futures(JAN5) (HSImain.HK)$Hong Kong stocks hit 6-week low, erasing most of 26% stimulus rally

The Hang Seng Index has surrendered most of the 26.5 per cent rally driven by Beijing’s stimulus blitz on November 24.

Hong Kong stocks fell for a third day to a six-week low on concerns a robust US labour market will restrain the Federal Reserve from more interest-rate cuts this year, while China struggles to end sticky deflation in the economy.The Hang Seng Index slipped 0.9 per cent to 19,279.8...

The Hang Seng Index has surrendered most of the 26.5 per cent rally driven by Beijing’s stimulus blitz on November 24.

Hong Kong stocks fell for a third day to a six-week low on concerns a robust US labour market will restrain the Federal Reserve from more interest-rate cuts this year, while China struggles to end sticky deflation in the economy.The Hang Seng Index slipped 0.9 per cent to 19,279.8...

2

1

$Hang Seng TECH Index (800700.HK)$Tencent shares plunge over 7pc in HK after US labels it a ‘Chinese military’ firm

from Malaysian source. not in sg currently.. later someone said I'm Malaysian. last time said I'm from India.![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() to me it's nothing, just see another colour of another saltish person

to me it's nothing, just see another colour of another saltish person ![]()

![]()

![]()

![]()

![]()

![]()

from Malaysian source. not in sg currently.. later someone said I'm Malaysian. last time said I'm from India.

1

$HSI Futures(JAN5) (HSImain.HK)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$

6

4

1

$Hang Seng TECH Index (800700.HK)$ Aldy touched lower BOLL lol

1

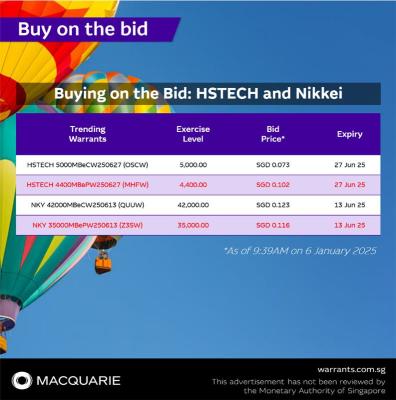

Click on the links below to be taken to the Live Matrix of each warrant, where you can see how the warrant moves alongside the underlying share/index during the day

🇸🇬Singapore stocks:

Keppel Call $KeppelMBeCW250630 (QIAW.SG)$ : https://warrants.com.sg/tools/livematrix/QIAW

SingTel Put $SingtelMBePW250630 (IJKW.SG)$ : https://warrants.com.sg/tools/livematrix/IJKW

🇭🇰Hong Kong stocks:

Alibaba Call $Alibaba MB eCW251003 (JBFW.SG)$ : ...

🇸🇬Singapore stocks:

Keppel Call $KeppelMBeCW250630 (QIAW.SG)$ : https://warrants.com.sg/tools/livematrix/QIAW

SingTel Put $SingtelMBePW250630 (IJKW.SG)$ : https://warrants.com.sg/tools/livematrix/IJKW

🇭🇰Hong Kong stocks:

Alibaba Call $Alibaba MB eCW251003 (JBFW.SG)$ : ...

5

Happy New Year! 55k views.. Did moomoo promo my ad? So many likes.You all buy happy new year to you I'm out. ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

$Hang Seng TECH Index (800700.HK)$

$Hang Seng TECH Index (800700.HK)$

2

1

$Hang Seng TECH Index (800700.HK)$

Key Points:

Nasdaq and S&P 500 drop as rising Treasury yields trigger profit-taking ahead of the year-end. BTC pullback adds pressure.

China's PBoC signals possible rate cuts, aiming to bolster the economy through lower borrowing costs and fiscal support.

Hang Seng Index declines as US Treasury yields rise; Mainland China stocks gain on policy optimism despite US tariffs.

Hang Seng and Nikkei: US Sell-Off and Rising Yields Set Risk-Off Tone in Asia

$Hang Seng Index (800000.HK)$ $HSI Futures(JAN5) (HSImain.HK)$

Key Points:

Nasdaq and S&P 500 drop as rising Treasury yields trigger profit-taking ahead of the year-end. BTC pullback adds pressure.

China's PBoC signals possible rate cuts, aiming to bolster the economy through lower borrowing costs and fiscal support.

Hang Seng Index declines as US Treasury yields rise; Mainland China stocks gain on policy optimism despite US tariffs.

Hang Seng and Nikkei: US Sell-Off and Rising Yields Set Risk-Off Tone in Asia

$Hang Seng Index (800000.HK)$ $HSI Futures(JAN5) (HSImain.HK)$

3

$Hang Seng TECH Index (800700.HK)$

China's January to November industrial profit fell by 4.7% y/y to 6.67 trillion yuan.-NBS

Nov. profit fell by 7.3% y/y vs. fell by 10.0% in Sept.

For January-November:

China's state-holding enterprises' profit dropped by 8.4% y/y to 2.039 trillion yuan

Joint-equity's profit down by 5.7% to 5.014 trillion yuan

Foreign ventures+🇭🇰+🇲🇴+TW -0.8% to 1.606 trillion yuan

Private enterprises -1.0% to 1.965 trillion yuan

China's January to November industrial profit fell ...

China's January to November industrial profit fell by 4.7% y/y to 6.67 trillion yuan.-NBS

Nov. profit fell by 7.3% y/y vs. fell by 10.0% in Sept.

For January-November:

China's state-holding enterprises' profit dropped by 8.4% y/y to 2.039 trillion yuan

Joint-equity's profit down by 5.7% to 5.014 trillion yuan

Foreign ventures+🇭🇰+🇲🇴+TW -0.8% to 1.606 trillion yuan

Private enterprises -1.0% to 1.965 trillion yuan

China's January to November industrial profit fell ...

1

4

$HSI Futures(JAN5) (HSImain.HK)$ 来了 来了 ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

CHINA'S STATS BUREAU:

AT END-2023, LEGAL ENTITIES IN SECONDARY AND TERTIARY INDUSTRIES AT 33.27 MILLION, UP 52.7% FROM END-2018

AT END-2023, THERE WERE 428.98 MILLION PEOPLE EMPLOYED IN THE SECONDARY AND TERTIARY INDUSTRIES, UP 11.9% FROM END-2018

TOP THREE LARGEST SECTORS WERE WHOLESALE AND RETAIL TRADE, LEASING AND BUSINESS SERVICES, AND MANUFACTURING

TOP THREE SECTORS IN TERMS OF EMPLOYMENT WERE MANUFACTURING, WHOLESALE AND RETAIL TRADE, AND C...

CHINA'S STATS BUREAU:

AT END-2023, LEGAL ENTITIES IN SECONDARY AND TERTIARY INDUSTRIES AT 33.27 MILLION, UP 52.7% FROM END-2018

AT END-2023, THERE WERE 428.98 MILLION PEOPLE EMPLOYED IN THE SECONDARY AND TERTIARY INDUSTRIES, UP 11.9% FROM END-2018

TOP THREE LARGEST SECTORS WERE WHOLESALE AND RETAIL TRADE, LEASING AND BUSINESS SERVICES, AND MANUFACTURING

TOP THREE SECTORS IN TERMS OF EMPLOYMENT WERE MANUFACTURING, WHOLESALE AND RETAIL TRADE, AND C...

2

11

No comment yet

Cui Nyonya Kueh OP : 1. Tariffs

2. US sell off

3. Tencent conspiracy

4. Trump inauguration on 20 Jan (I think that is the date TBC)