No Data

8766 Tokio Marine Holdings

- 5651.0

- +68.0+1.22%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Nikkei Average Contribution Ranking (before the close) ~ The Nikkei Average slightly fell, with Konami G decreasing by about 8 yen for one stock.

As of the close 25 days ago, the number of rising and falling stocks in the Nikkei 225 was 36 stocks up, 185 stocks down, and 4 stocks unchanged. The Nikkei 225 continued to decline, finishing the morning session at 38,990.56 yen, down 46.29 yen (-0.12%) from the previous day, with an estimated Volume of 0.9 billion shares. On the 24th, the US stock market continued to rise. The Dow Inc rose by 390.08 dollars, closing at 43,297.03 dollars, and the Nasdaq rose by 266.25 points, ending at 20,031.13. There are concerns about the rise in long-term interest rates.

List of cloud-breaking stocks [Ichimoku Kinko Hyo - List of cloud-breaking stocks]

○ List of stocks that broke through the clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <2157> Koshidaka Holdings 1165 1161.25 1083 <3031> Raccoon HD 766743.25 686 <3475> Goodcom A 855844.75 844 <3546> Alenza HD 10971084.5 1088 <3632> Gree 460442.75 447.5 <3741> Sec.

Nikkei Average Contribution Rank (closing) - The Nikkei Average has fallen for three consecutive days, with Advantest and Root Inc pushing it down by about 255 yen with two stocks.

As of the close on the 17th, the number of stocks in the Nikkei average that rose was 71, those that fell was 153, and those that remained unchanged was 1. The U.S. stock market on the 16th was mixed. Dow Inc closed down by 110.58 points at 43,717.48, while Nasdaq ended up by 247.17 points at 20,173.89. Following expectations for additional rate cuts at the Federal Open Market Committee (FOMC) meeting in the middle of the week, stocks rose slightly after the opening. The December services PMI was at a high level not seen in about three years.

Before the central bank events in Japan and the United States, after a round of buying, there is a stalemate.

The Nikkei average declined for three consecutive trading days, ending at 39,364.68 yen, down 92.81 yen (estimated Volume 1.8 billion 90 million shares). Reflecting the flow of tech stocks being bought in the previous day's USA market, buying led the way, primarily focused on Semiconductors-related stocks. The Nikkei average began to rebound and extended upwards to 39,796.22 yen shortly after the start. However, ahead of events from the USA and Japan central banks, including the Federal Open Market Committee (FOMC), momentum for aggressive upward movement was limited, and after the buying activity settled, there were adjustments in holdings leading to Sell.

The Nikkei Average has fallen for three consecutive days, with significant declines in Advantest weighing on it.

On the 16th, the US Stocks market was mixed. The Dow Inc average closed down by $110.58 at $43,717.48, while the Nasdaq finished up by 247.17 points at $20,173.89. Following the expectation of additional rate cuts at the Federal Open Market Committee (FOMC) meeting midweek, the market opened slightly higher. The December services PMI showed a near three-year high and indicated an acceleration in the pace of expansion, which helped to widen the gains, but the Dow Inc average continued to face resistance, resulting in a slight decline.

The Nikkei average fell by 21 points, with attention on U.S. economic Indicators.

The Nikkei average is down 21 yen (as of 2:50 PM). In terms of contribution to the Nikkei average, Advantest <6857>, Recruit HD <6098>, and Tokio Marine <8766> are among the top negative contributors, while SoftBank Group <9984>, Fast Retailing <9983>, and Chugai Pharmaceutical <4519> are among the top positive contributors. In the Sector, Securities Futures, Oil & Coal Products, Banking, Nonferrous Metals, and Insurance are among the top decliners, with Other Products, Information & Communications, and Precision also noted.

Comments

$E-mini S&P 500 Futures(MAR5) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We maintain neutral with a slight bullish bias as price is currently hovering around 5955 resistance level. A 4 hour candlestick closing above 5955 resistance level would open push towards 6035 resistance level. Technical indicators are mixed for now, with price holding above 21-EMA.

Alternatively: A 4 hour candlestick closing below 5880 support level...

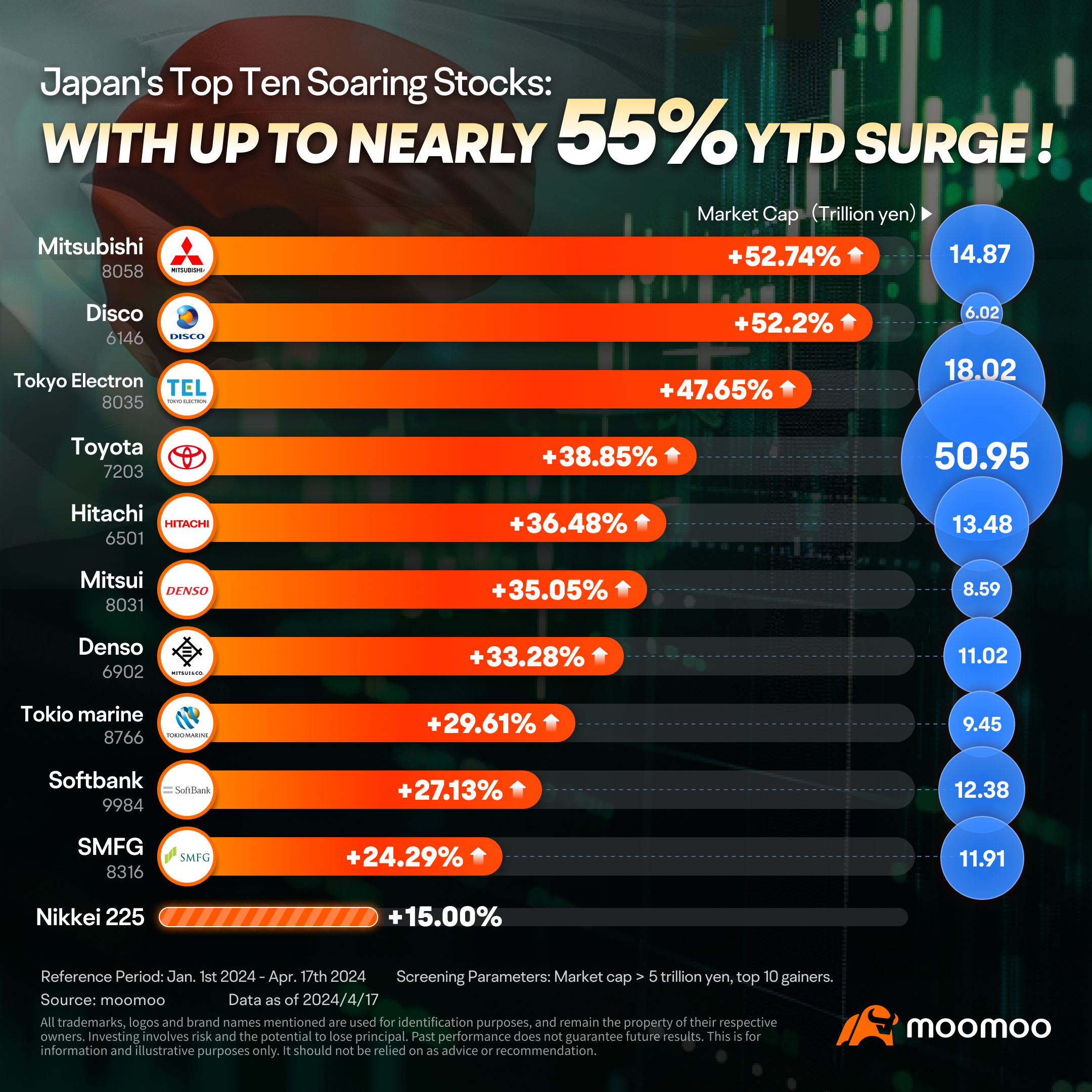

Alongside Buffett, Wall Street giants like Goldman Sachs Asset Management are eyeing Japan, favorin...

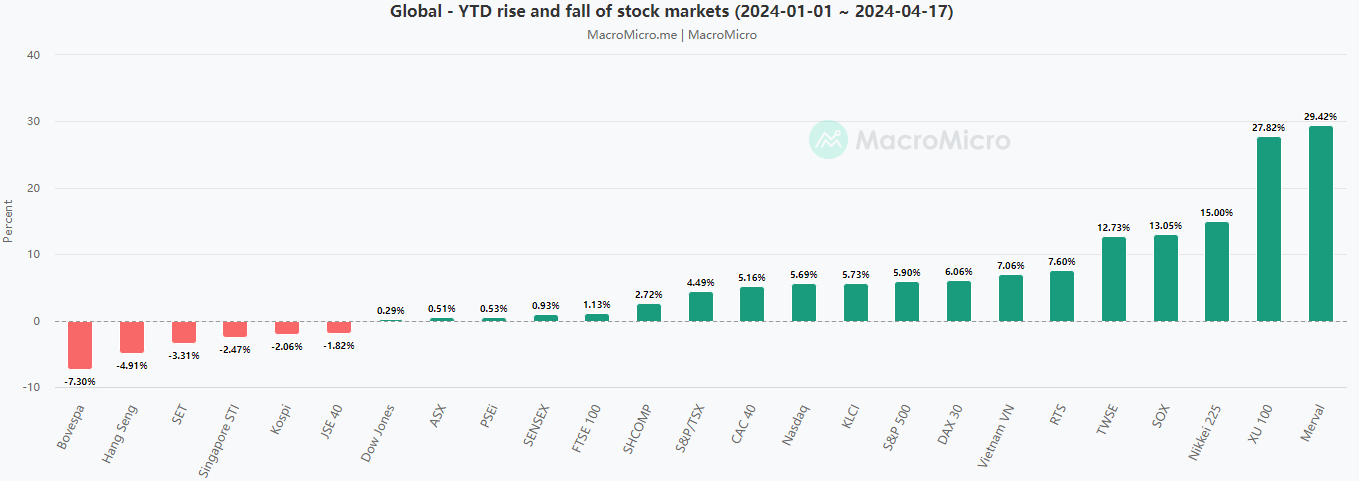

As mentioned in my earlier posts, Japan now is facing a booming economy that is witnessed by its upward trending stock market (*1) and cheap big houses (*2).

Many Mooers would like to take this opportunity to ride the upward ride and huat big big.

���������...

No Data

103677010 : notes